Mortgage applications for new home purchases fell 9% month-over-month in May at a seasonally unadjusted pace ― the second consecutive month sales of new homes have dropped, according to data released Thursday by the Mortgage Bankers Association. Compared to May of last year, MBA’s Builder Application Survey (BAS) revealed purchases are down 5.9%.

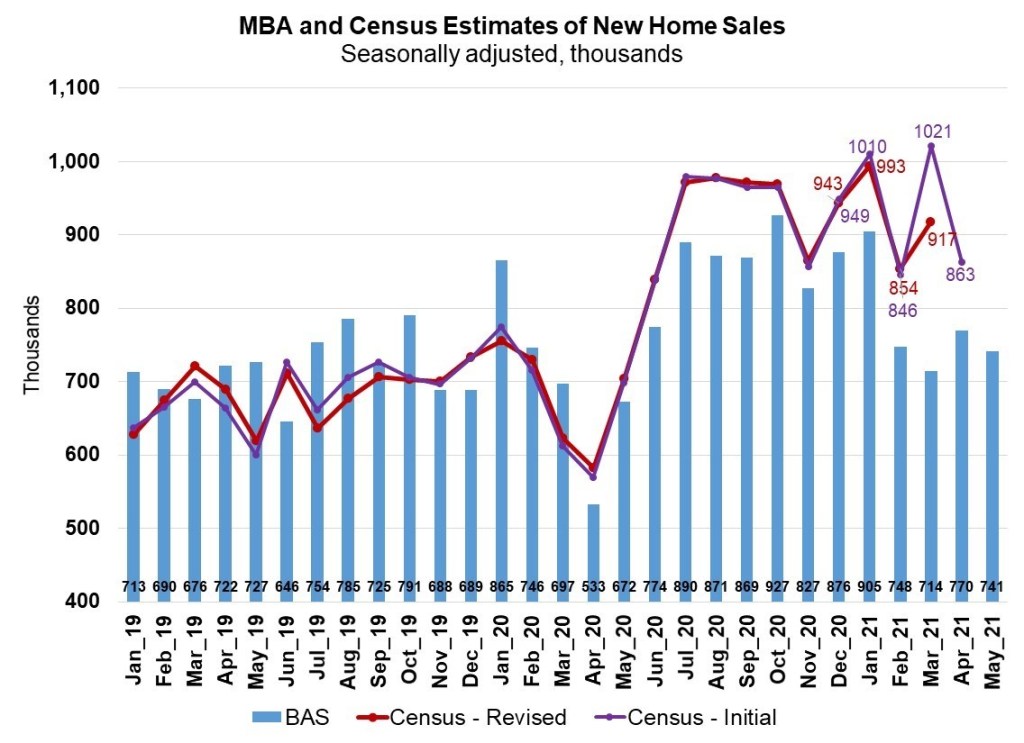

On a seasonally adjusted basis, the MBA also estimates new home sales fell at an annualized pace of 4% in May, said Joel Kan, MBA’s associate vice president of economic and industry forecasting. Overall, the MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 741,000 units in May 2021.

“Since reaching a survey-high 927,000 units in October 2020, the annual pace of new home sales has now fallen around 20 percent, weighed down by low housing inventory and rising prices,” said Kan

Lack of inventory and sweltering home prices have become a market norm for much of the industry, and May’s loan size data reported the trend has yet to abate. According to the BAS, the average loan size rose from $377,434 in April to $384,000 in May ―the fourth consecutive month of rising loan sizes and a new survey high.

By product type, conventional loans made up 743.9% of loan applications, FHA loans composed 14.8%, RHS/USDA loans cam in around 0.9% and VA loans provided 10.4%.

How community lenders can grow millennial homeownership

HW+ Managing Editor Brena Nath spoke with Maxwell CEO John Paasonen about how community lenders can help millennials and underserved demographics become homeowners.

Presented by: Maxwell

“Loan balances continue to rise because of a larger share of sales in the higher end of the market, as well as increased sales prices from strong demand and elevated building material costs,” said Kan.

Roughly 54% of homes sold in America during May closed at over listing price, according to data from Redfin, a record.

Housing starts data from the U.S. Census Bureau on Wednesday painted a more hopeful picture of builders catching up to meet new home sales demand. According to the data, housing starts increased 3.6% in May to a rate of 1.57 million. That’s more than 50% above above the May 2020 rate — when the COVID-19 pandemic was at its height in the country — of 1.05 million.

However, construction is still facing headwinds given permits for new developments by homebuilders dropped 3%, largely because lumber and building material costs kept prices high.

“Permits for new construction are typically a forward-looking indicator of new starts, and the homebuilding industry continues to grapple with increasing materials costs and delayed deliveries from suppliers,” said Kan.

MBA’s BAS uses data from builders’ application volume and estimates the sales ahead of the official new home sales the U.S. Censes Bureau releases each month. In that data, new home sales are recorded at contract signing, which typically occurs with the mortgage application. The official May home sales report is scheduled to release Wednesday, June 23.