The Consumer Financial Protection Bureau (CFPB) has released its updated review and analysis of data disclosed in 2019 by the Home Mortgage Disclosure Act (HMDA) in an effort to better understand the landscape of the mortgage market. The new analysis features extensive amounts of mortgage information disclosed by financial institutions, and features a lot of information specifically relevant to the reverse mortgage industry.

“These publications are intended to further the Bureau’s objective of providing an evidence-based perspective on consumer financial markets, consumer behavior, and regulations to inform the public discourse,” the CFPB says in its report.

Reverse mortgage LARs down in 2019, top 10 lenders

HMDA requires companies covered under its provisions to keep a Loan/Application Register (LAR), meaning that each time someone applies for a loan, the institution that is applied to must keep a record of the date the application took place; the type of loan being applied for; the property type it applies to; purpose of the loan; the amount; and a slew of specific demographic information of the applicant as well as the terms of the particular loan being applied for.

“In the 2019 HMDA data, 151 financial institutions reported approximately 75,500 reverse mortgage LARs, down from 168 reverse mortgage reporters with 90,300 LARs in 2018,” the report reads. “The total number of applications for reverse mortgages is about 55,100, including approximately 34,800 reverse mortgage originations […] up from about 33,000 reported reverse mortgage originations in 2018.”

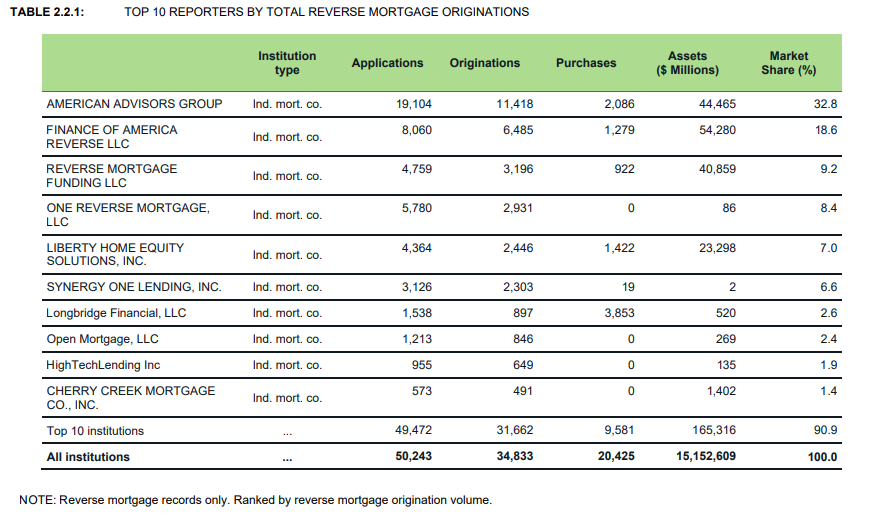

The data also includes a tabulation of the top 10 reverse mortgage lenders by origination volume in 2019, including breaking out the information related to applications vs. originations, purchases and total market share.

All told, the top 10 lenders increased their overall dominance in the reverse mortgage industry in 2019 according to the HMDA information.

“In total, the top 10 reverse mortgage lenders accounted for approximately 31,700 reverse mortgage originations, or 90.9% of all reverse mortgage originations reported under HMDA, up from 84.5% in 2018,” the report reads.

Reverse mortgage approval rate, demographics

The data also breaks down reverse mortgage records by how many loans are reported as purchased, and indicates that less than 1-in-5 reverse mortgage applications are denied.

“About 27.1% of the reverse mortgage records reported under HMDA are purchased loans, and none of the reverse mortgage records [indicate] a pre-approval request denied or pre-approval request approved but not accepted,” the report reads. “In total, there were about 34,800 reverse mortgage originations reported. The denial rate for reverse mortgage applications, excluding purchased loans, preapprovals, and applications that are withdrawn or closed for incompleteness, was about 17.3%.”

The data also features a demographic breakdown of reverse mortgage borrowers by race, indicating that non-Hispanic Whites make up the largest share of reverse mortgage borrowers, while lower-income reverse mortgage borrower levels are higher than for Home Equity Line of Credit (HELOC) borrowers.

“Non-Hispanic Whites make up a higher percentage of 2019 reverse mortgage borrowers (74.7%) than they do of closed-end [mortgage] or HELOC borrowers,” the report reads. “The share of reverse mortgages in low- or moderate-income tracts is higher than for closed-end and for HELOC borrowers. The rural share for reverse mortgages is slightly higher than for HELOCs but lower than for closed-end mortgages.”

Median income, loan amounts, H4P utilization

When compared directly with the median income of HELOC and jumbo borrowers, the median income of reverse mortgage borrowers presents a noticeable contrast, according to the data.

“The median income of HELOC borrowers is approximately $107,000 and their mean income is approximately $149,000,” the report reads. “In contrast, the median income of reverse mortgage borrowers is approximately $28,000, and the mean is approximately $32,000, which are the lowest among borrowers of all enhanced loan types, perhaps reflecting the unique design of reverse mortgages to help income-constrained seniors convert home equity into cash income.”

Additionally, the median loan amount for reverse mortgages in 2019 sat at $163,000, while the mean sat at $226,000. The data also includes purchase data, indicating that the instances of HECM for Purchase (H4P) utilization remained low last year.

“About 6.7% of reverse mortgage originations had [a] loan purpose reported as home purchase,” the report reads, specifying that these are indeed H4P loans in the report’s footnotes.

Borrower age, property values and interest rates

The report also details the typical age brackets for borrowers of many loan types, including reverse mortgages.

“Not surprisingly, the reverse mortgage borrowers are much older than borrowers with other loan types. The median age of reverse mortgage borrowers is 73, and the mean is 74.1,” the data indicates. “For reverse mortgage borrowers, 9.7% are between the ages of 55 and 64, 46% are between 65 and 74, and 44.4% are 75 or older.”

Interestingly, the amount of fixed-rate reverse mortgage originations has dropped by 10% when comparing the 2019 HMDA data with the same data from the prior year, according to the report. The 2019 divide indicates that 48% of reverse mortgages were fixed-rate versus 52% adjustable-rate, while in 2018 the fixed-rate figure sat at 58.2%.

Median property value for reverse mortgages was $351,000 in 2019, while reverse mortgage borrowers had a mean credit score of 729 and a median credit score of 749 in the same period.

The median interest rate for reverse mortgages in 2019 was 4.482%, down slightly from the 2018 level of 4.827%. Borrowers who reside in rural areas saw slightly higher interest rates in 2019 (4.716%) than their counterparts living in micropolitan areas (4.549%) by 16.7 basis points. Borrowers in metropolitan areas saw slightly lower interest rates (4.465%).

Read the full report at the CFPB.