Multifamily rent growth remained positive in October, a new report from YardiMatrix said.

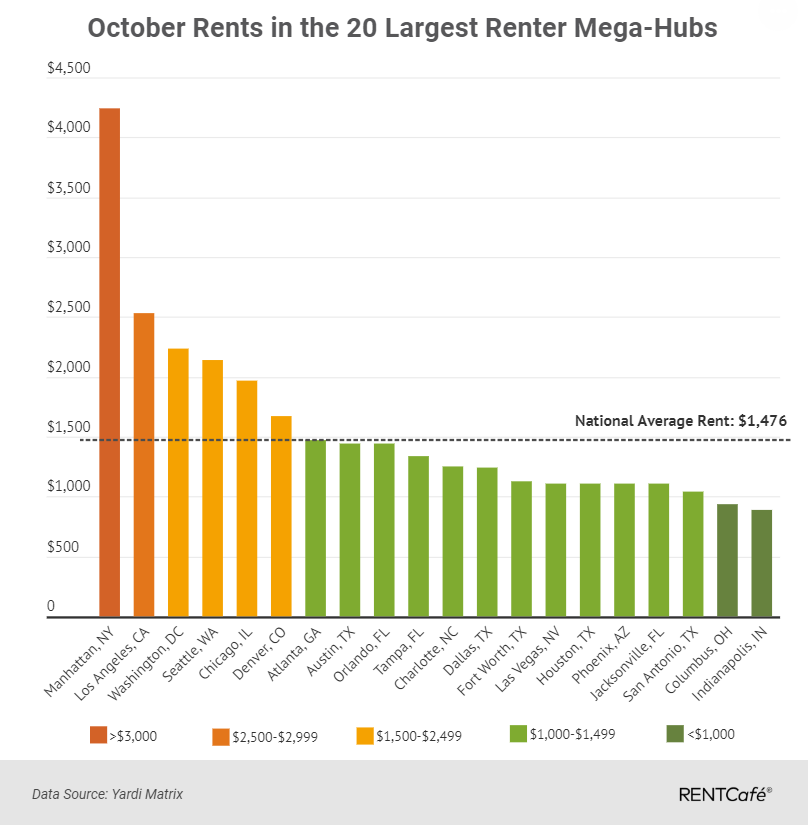

Multifamily rent increased by just $1, to $1,476. Year over year rent growth remained at 3.2%.

Of the 30 major markets covered in the report, 17 saw year-over-year rent growth of at least 3.3%. San Jose and Houston remained below the 2.5% long-term average.

Although the multifamily market boasts positive results, three states had bills passed to limit rent growth.

Rent control affects the multifamily sector because it puts a chill on development during a period of low housing stock, YardiMatrix said.

Although rent has topped historical growth levels, occupancy rates still remain strong.

According to RealPage, this year was the second-highest apartment leasing season ever, with 281,800 units rented. The highest leasing season was in 1997 during the tech boom.

In the third quarter this year, multifamily vacancies fell to 3.6%.

RentCafe found that in the 260 large cities it analyzed, 1% of them experienced a decrease in apartment rates since last month and 4% have seen increases, while monthly rents generally flatlined in the remaining 95%.

Essentially, renting in 65% of the cities are below the national average, while the remaining 35% are above $1,476, RentCafe said.