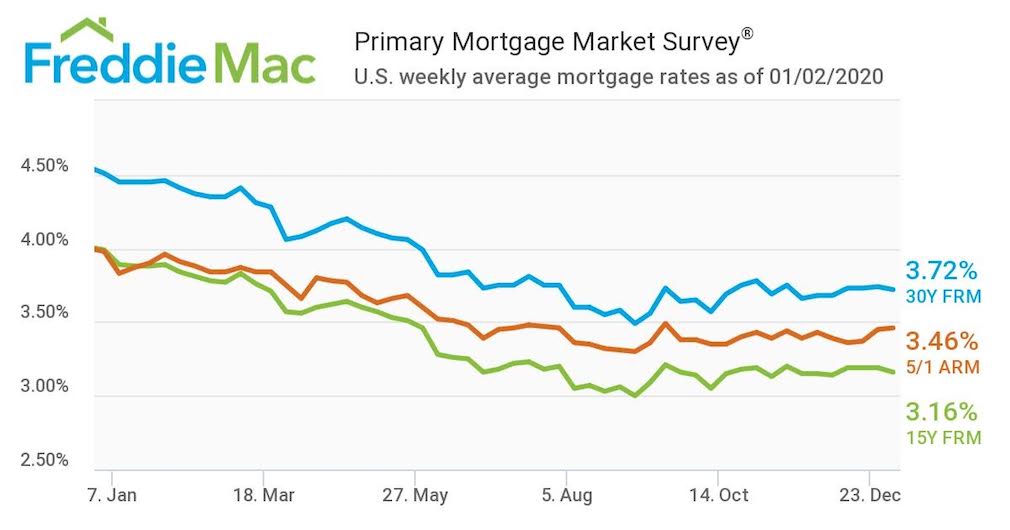

In the first week of the year, the average U.S. fixed rate for a 30-year mortgage averaged 3.72%.

Not only is this percentage below the previous week’s average, but it’s also nearly 80 basis points below the 4.51% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“As investors kept their eyes on the phase one of the U.S.-China trade deal, 10-year Treasury notes closed 2019 lower than a year ago,” said George Ratiu, Realtor.com’s chief economist. “The conventional 30-year loan slid 2 basis points to 3.72% in the first week of 2020. Rates remain about 80 basis points lower than the first week of 2019.”

With an economy expected to maintain a moderate growth trajectory this year, Ratiu said employment and wage gains will continue to fuel demand for housing.

“As mortgage rates remain favorable, buyers are likely to get a head start on the spring shopping season in the first couple of months of this year,” Ratiu said. “A stronger infusion of new homes in affordable price ranges would be a welcome gift for the New Year.”

According to the survey, the 15-year FRM averaged 3.16% this week, sliding from last week’s rate of 3.19%. This time last year, the 15-year FRM came in at 3.99%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.46% this week, inching forward from last week’s rate of 3.45%. Last year, the 5-year ARM averaged 3.98%.

Sam Khater, Freddie Mac’s chief economist said the combination of improved economic data and market sentiment has led to stability in mortgage rates, which have hovered around 3.7% for nearly the last two months.

“The stability is welcome news after the interest rate turbulence of the last year, which caused a slowdown in the housing market and other interest rate-sensitive sectors,” Khater said. “The low mortgage rate environment combined with the red-hot labor market is setting the stage for a continued rise in home sales and home prices.”

The image below highlights this week’s changes: