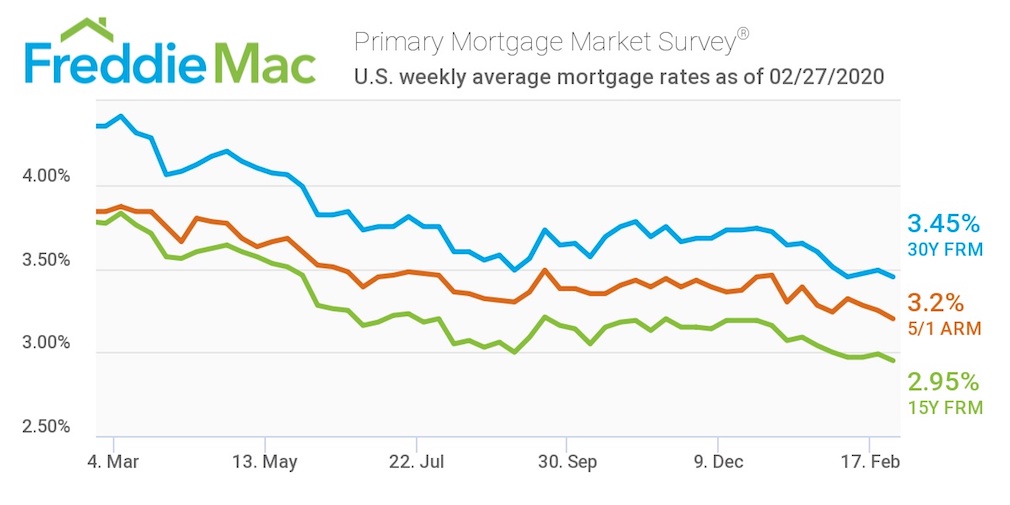

The average U.S. fixed rate for a 30-year mortgage fell to 3.45% this week, matching the three-year low set three weeks ago.

The rate declined as global money managers spooked by the coronavirus named Covid-19 piled into the U.S. bond markets, boosting competition for securities back by home loans.

Although the rate is only four basis points below the previous week’s level, it’s almost a percentage point below the 4.35% of the same week a year ago, according to Freddie Mac.

“Given the recent volatility of the ten-year Treasury yield, it’s not surprising that mortgage rates again have dropped,” said Sam Khater, Freddie Mac’s Chief Economist. “These low rates combined with high consumer confidence continue to drive home sales upward, a trend that is likely to endure as we enter spring.”

According to the survey, the 15-year FRM averaged 2.95% this week, down from last week’s rate of 2.99%. This time last year, the 15-year FRM came in at 3.77%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.2% this week, down from last week’s rate of 3.25%. Last year, the 5-year ARM averaged 3.84%.

The image below highlights this week’s changes: