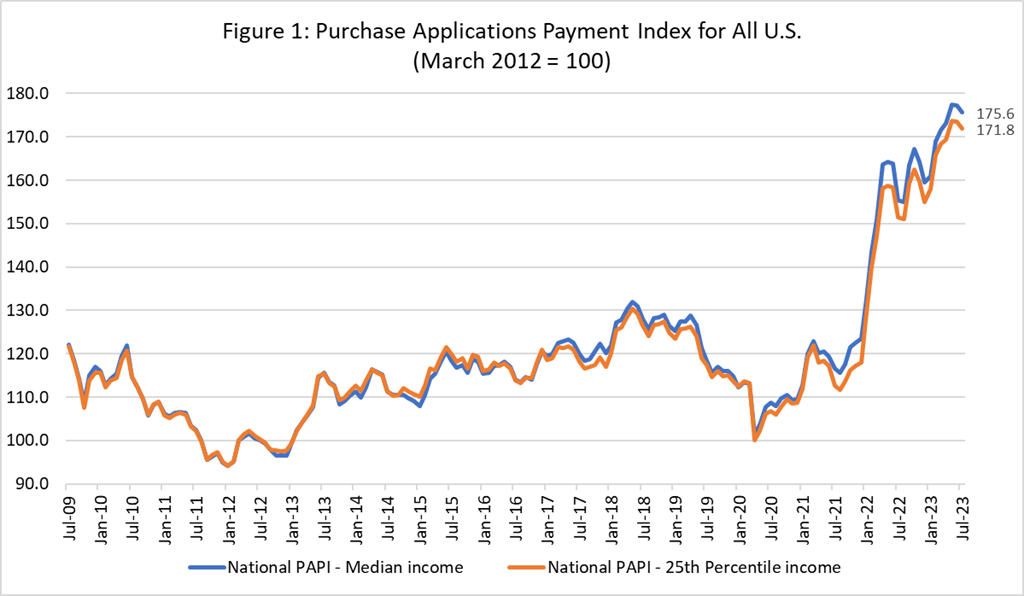

Homebuyer affordability remained unchanged in July from June, according to Mortgage Bankers Association‘s (MBA) Purchase Applications Payment Index (PAPI). The index measures how new monthly mortgage payments vary across time, relative to income, drawing from data from MBA’s weekly applications survey.

The national median payment applied for by purchase applicants was $2,162 in July, up $318 from a year prior but unchanged from June. Median earnings were up 3.7% compared to one year ago, but payments increased by 17.2%.

The national median mortgage payment for FHA loan applicants was $1,854 in July, up from $1,824 in June and up from $1,461 in July 2022. The national median mortgage payment for conventional loan applicants was $2,197, down from $2,205 in June and up from $1,892 in July 2022.

“Prospective homebuyers continued to face challenging conditions in July, with elevated and volatile mortgage rates and low housing inventory serving as a formidable one-two punch that suppressed mortgage applications and sales activity,” Edward Seiler, an economist at the MBA, said in a statement.

Considering that mortgage rates will most likely remain elevated until the end of the year, “affordability will remain a hurdle for many households looking to buy a home,” he added.

An increase in MBA’s PAPI speaks to declining borrower affordability conditions. It means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

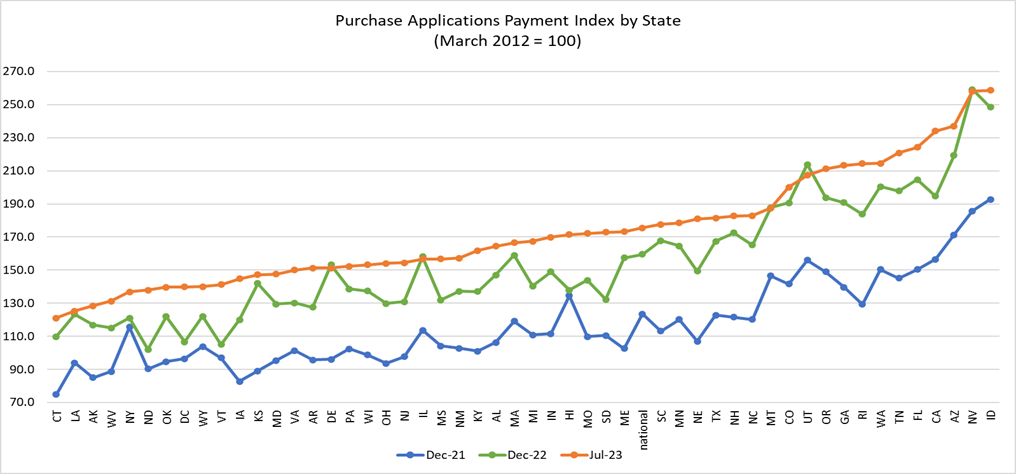

The top five states with the highest PAPI were Idaho, Nevada, Arizona, California, and Florida. The top five states with the lowest PAPI were Connecticut, Louisiana, Alaska, West Virginia, and New York.