We are in a unique moment in the history of housing. With a rapid spike in interest rates, inventory at historic lows, home prices rising at unprecedented levels above income, and a purchase market that is both highly anxious and digitally reliant, mortgage and real estate professionals must be strategic to capture the market opportunity today.

We interviewed more than 25 mortgage industry experts to gather the best insights, strategies, and recommendations to pivot and win in today’s market. We have partnered with HousingWire to release a few excerpts from the report. To view the complete research, click here.

2022 State of the Mortgage Industry: Affordability and Inventory

It was no surprise that affordability hit the top of the list in every interview. Black Knight reported that May was the least affordable housing market in 16 years. Inventory has increased slightly with rising rates, but economists agree that the progress is nowhere near enough to bring us out of the current inventory crisis. Lead Analyst for HousingWire, Logan Mohtashami, calls it “a savagely unhealthy market.”

Inventory rising, historically low. Let’s start with the good news. For the first time in three years, we have seen an increase in homes on the market and price reductions. In Portland, Oregon, for example, one loan officer noted that new listings doubled in the second half of May from 800 to 1,900 new listings. In Seattle, Dan Keller reported 47% of all listings had price reductions.

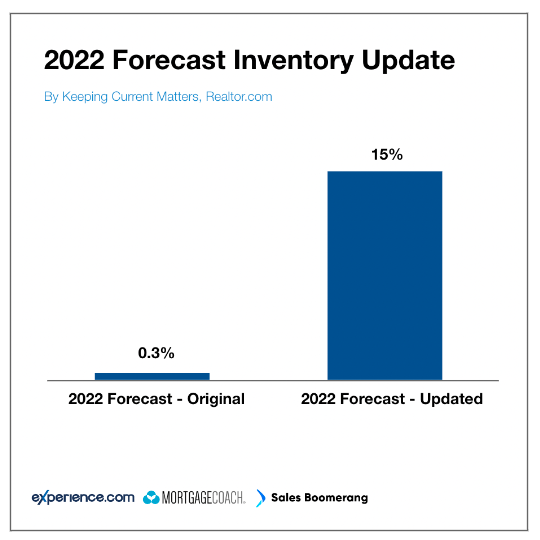

Inventory is projected to increase significantly higher than originally forecasted for the year.

However, looking at the data over the span of history, we are still at record all-time lows. According to Mohtashami, we should be at a range of 1.52 to 1.93 million homes on the market, and we are currently at around 1.0. According to Black Knight, active listings remain 67% below pre-pandemic levels with 820,000 fewer listings than would be expected at this time of year.

As for price reductions, while these have increased to an average of 22%, this number would be closer to 30% in a traditional market. Lastly, homes are listed today for an average of 13 to 16 days, depending on the market, but we should see that closer to 30 to 45 days.

Growth rate of income vs. home prices. Affordability challenges have been driven by more than just low inventory. Again, looking at the market over the past 40 years, debt and income have not kept up with rises in housing costs. Median home prices have risen by 60% since 1980, while median family income has only risen by 25%.

Slow construction and restrictive zoning laws. One of the major causes of low inventory has been due to slowed construction. Builders and contractors across the country have experienced challenges in getting basic materials and labor, which has created significant delays.

After the housing crisis of 2008, many homebuilders went out of business, and for years following the recovery, building did not pick up to the level needed to accommodate demand. Worker shortages and supply chain issues in the pandemic further widened the inventory gap. In an interview with NPR, one builder stated, “If I had twice as many guys, I would still not have enough… And my subcontractors, they’re all hurting for people.”

In addition to labor and materials, builders have struggled to meet the increasing demand for multifamily units due to restrictive zoning laws. Delayed household formation has increased the demand for multifamily units, designed for one or two-person households (Urban Institute). However, many neighborhoods restrict the building of multifamily units or ADUs.

Institutional Investors. In 2021, we saw the highest rate of investor-purchased properties than ever before. Austin Niemic, executive vice president at Rocket Pro TPO, stated one of the reasons that affordability is a challenge in their markets has been due to “institutional buyers getting in and buying homes at scale.”

New data published in Business Insider found that investors bought 33% of U.S. homes on the market in January, the highest percentage in over a decade. In recent months, investors have more heavily leveraged real estate to hedge against inflation, pushing more first-time homebuyers out of the market.

For more trends and strategies aggregated from more than 25 of the mortgage industry’s leading experts, click here and view the full report.