Mortgage credit availability increased by 1.4% in May – a sign that volume-hungry lenders continued to loosen credit standards in a highly competitive market, according to Thursday data from the Mortgage Bankers Association.

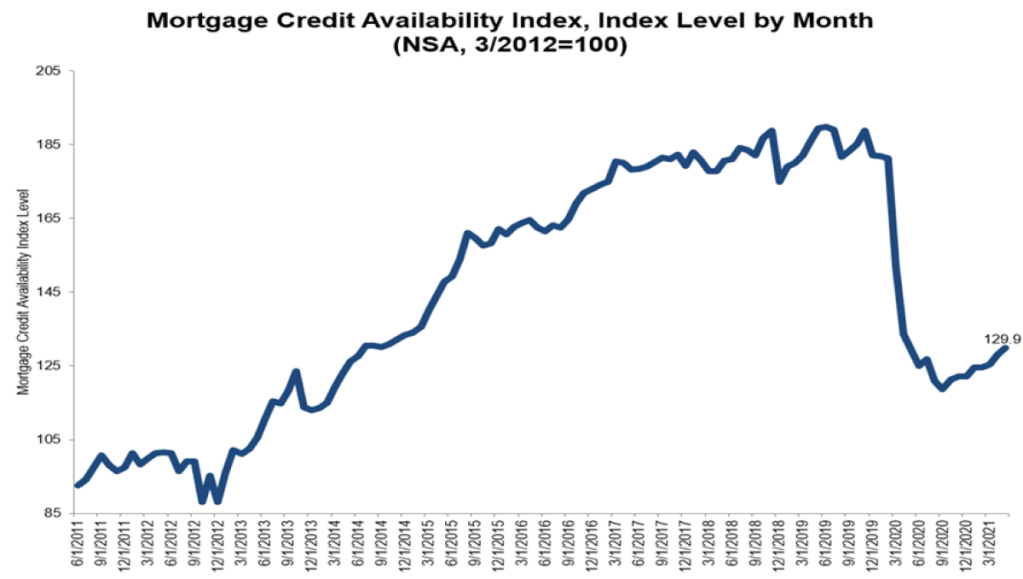

MBA’s Mortgage Credit Availability Index (MCAI) which uses 100 as a benchmark — increased to 129.9 in May. A decline in the MCAI suggests that lending standards are tightening while a higher number suggests loosening credit standards.

Lenders concerned over borrowers’ ability to pay their bills at the beginning of the economic shutdown resulted in an exponential tightening of credit. However, May’s credit availability inched to its highest level since the early days of the pandemic, but remained at 2014 levels.

The MCAI on conventional loans increased 3.5%, while MCAI on government loans increased by 0.3%. Of the two component indices of the conventional MCAI, the jumbo MCAI increased by 5.1%, and the conforming MCAI rose by 1.6%, the MBA said.

“The overall increases were driven by a 3% gain in the conventional segment of the market, with a rise in the supply of ARMs and cash-out refinances,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Why millions of prospective borrowers are stuck in ‘no man’s land’

Borrowers are “stuck in the middle” between the agencies’ minimum FICO requirements and the “FICO gates” imposed by lenders’ credit overlays. We have the tools to help them, we just need to use them.

Presented by: FormFree

According to Kan, this is consistent with the uptick in mortgage rates and a slowing refinance market, as well as MBA’s Weekly Applications Survey data showing increased interest in ARMs. Monday data from the MBA revealed mortgage applications dropped for the third consecutive week.

Compared to last year, fewer people are applying for purchase mortgages – a likely result of home prices continuing to rise and prospective buyers avoiding astronomical bidding wars.

However, housing demand is still far outpacing supply, Kan said. The average loan size on a purchase application edged down to $407,000, below the record $418,000 set in February — but still far above 2020’s average of $353,900, the MBA reported.

“The jumbo index also jumped 5% last month, but even with increases over the past two months, the index is still around half of where it was in February 2020,” Kan said. “A rapidly improving economy and job market has freed up jumbo credit, as banks have deposits to utilize. However, there is still plenty of restraint, as many sectors have not fully returned to pre-pandemic capacity, and there are around 2 million borrowers still in forbearance.”

At this time last year, the Jumbo loan index was 54% lower than it had been in February 2020. Securing a jumbo loan was the most difficult it had been in four years, according to MBA data. But a flourishing housing market gave way to jumbos from a host of lenders, including Rocket Mortgage and United Wholesale Mortgage.