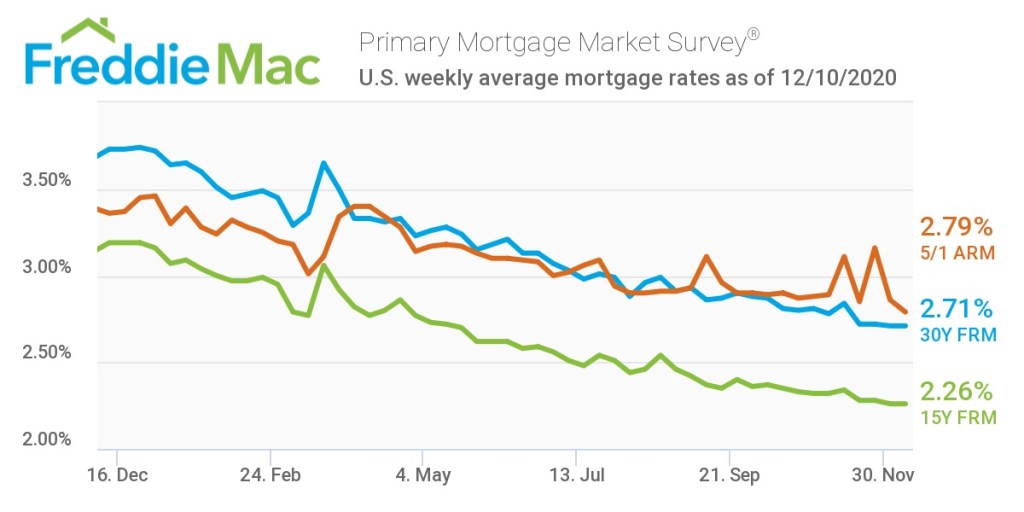

Despite slightly higher Treasury yields, mortgage rates held steady at record lows this week, according to a survey by Freddie Mac. Rates remained at last week’s level of 2.71% for the 30-year fixed rate mortgage, according to Freddie Mac’s Primary Mortgage Market Survey.

“Mortgage rates remain at record lows, resisting their typical correlation to Treasury yields, which have recently been moving higher,” Freddie Mac Chief Economist Sam Khater said. “Mortgage spreads – the difference between mortgage rates and the 10-year Treasury rate – are declining from their elevated levels earlier this year.”

“Although today’s mortgage spread is about 1.8% and still has some room to move down if the 10-year Treasury continues to rise, it’s encouraging to see that the spread is almost back to normal levels,” Khater said.

The 15-year fixed mortgage also remained unchanged from last week at 2.26%, but down from last year’s 3.19%.

The five-year Treasury-indexed hybrid ARM mortgage ticked down slightly from 2.86% last week to 2.79% this week. That is also down from 3.36% last year.

Leveraging eClosings to Effectively Manage Increased Loan Volumes

With no end in sight to record low rates and the increased loan volume, lenders must streamline workflows and accelerate closing times. Download this white paper to explore the current state of the market and the efficiency gains lenders can achieve with eClosing.

Presented by: SimpleNexus

And these low rates aren’t likely to go away anytime soon. CoreLogic recently released its final three-year housing and mortgage outlook report for the year, and if numbers hold up, the data company predicts 2021 will maintain its unprecedented home sales and record low rates as the economy continues to recover.

“We may actually see rates below 3%, perhaps for the entire year of 2021,” CoreLogic Chief Economist Frank Nothaft said. “And I wouldn’t be surprised if this low rate environment continues even beyond 2021, not necessarily at 2.7% or 2.8% once we get out to 2022, but we are expecting mortgage rates over the next three years to be far less than they’ve been in the last decade.”

The Mortgage Bankers Association, however, is predicting slightly higher rates over the next couple years.

“I expect that mortgage rates will start to slowly rise, with the 30-year fixed-rate expected to end 2020 at 3%, before increasing to 3.3% by the end of 2021,” MBA Chief Economist Mike Fratantoni wrote in an op-ed.