This article is part of our HousingWire 2022 forecast series. After the series wraps early next year, join us on February 8 for the HW+ Virtual 2022 Forecast Event. Bringing together some of the top economists and researchers in housing, the event will provide an in-depth look at the predictions for next year, along with a roundtable discussion on how these insights apply to your business. The event is exclusively for HW+ members, and you can go here to register.

The last two years have been a wild ride. We’ve had the sharpest and yet also the shortest recession in history, record-low mortgage rates leading to record origination volumes, and record home prices as housing demand far outstripped supply. Let’s not forget the substantial fiscal and monetary policy that provided extraordinary levels of support for households, businesses, and markets here and abroad.

The latest news regarding the Omicron variant has many cautious about whether the recovery that began in the second half of 2020 and blossomed in 2021 can continue. Odds are that this turn in the pandemic will likely be just a temporary setback. Public health officials note that we have many more tools to address this latest — and likely not the last — challenge.

Nevertheless, while we view the trends described below as the most likely path for the economy and mortgage market in 2022, this news highlights the elevated level of uncertainty we’ve all been living with the past few years. The pandemic, as well as policymakers, continue to have the ability to send shocks through the system.

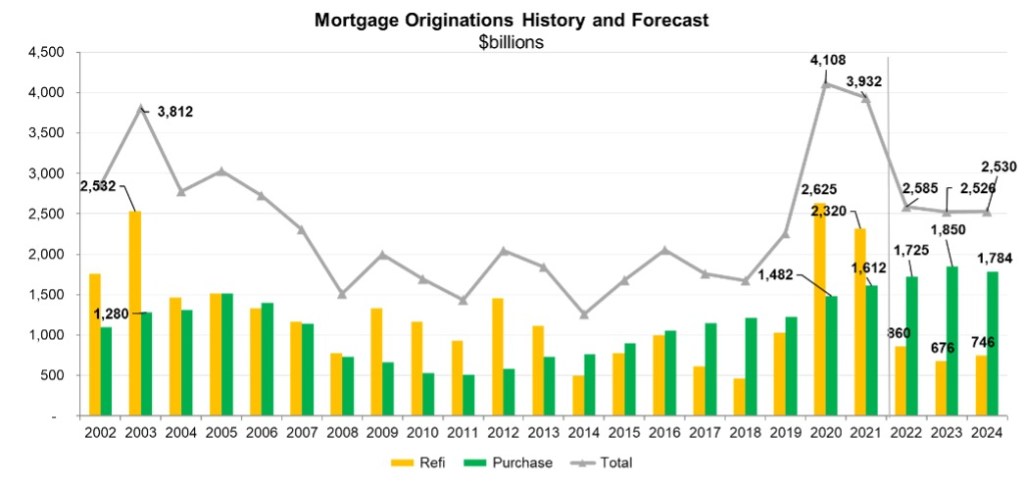

The main takeaway from Mortgage Bankers Association forecast is that we see 2022 as a transition year, moving from a refinance market to a purchase market. Industry veterans know that past similar transitions have posed challenges as the industry works to match origination capacity to the new level of demand. A silver lining is that we are expecting both 2022 and 2023 to be record years for purchase originations.

In thinking about the year ahead, I am going to frame my comments around five questions I often hear from lenders.

How will the Federal Reserve respond to economic developments in 2022, and what will be the impact on mortgage rates?

The Federal Reserve aims to meet three goals: reach full employment, keep inflation low and maintain a stable financial system. More specifically, that means targeting an unemployment rate close to 4%, inflation close to 2%, and using regulatory tools to prevent unsound lending or other financial imbalances.

In response to the pandemic, the Fed brought short-term rates to zero while also more than doubling the size of their balance sheet, adding trillions of dollars in Treasuries and MBS to their holdings.

When this article was published, the unemployment rate is at 4.2%, inflation is above 6%, and both stock market and housing market values are elevated. MBA forecasts that the unemployment rate will dip below 4% next year, ending the year at 3.5%. Businesses across the country have more than 11 million job openings and are raising wages to try to fill them.

The only outstanding question is to what extent individuals who have dropped out of the labor force will be pulled back in as employers continue to push up their offers. Given that the decline in labor force participation has been largest for older workers, some of whom may have retired, at least temporarily, it may take more than a small raise to draw them back into the job market.

The improving job market is all to the positive. However, inflation running much higher than the Fed’s target is troubling, as higher inflation expectations are getting baked into consumer and business decision-making. The Fed and other central banks around the world are already responding to this trend with their words and are beginning to change their actions. The Fed began to taper their asset purchases in November, and at their December meeting announced that they would double the speed of their taper beginning in January, which means they will no longer be adding to their MBS holdings after March.

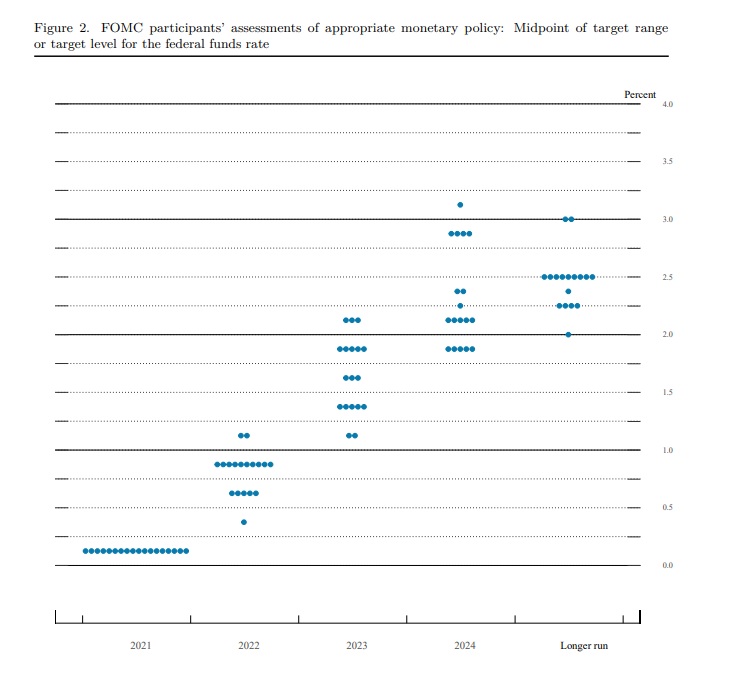

Also at the December meeting, the median FOMC (Federal Open Market Committee) member indicated three rate hikes in 2022, although this is dependent upon a forecast of still strong growth and elevated inflation. Lenders should expect a much faster pace of hikes over the next few years than what was experienced following the 2009 recession.

A more hawkish Fed, a strongly recovering economy, and large federal budget deficits are all likely to put upward pressure on longer-term rates, including mortgage rates. MBA forecasts that 30-year mortgage rates, averaging about 3.3% today, will reach 4% by the end of 2022.

Will home price growth slow in 2022? (What if it doesn’t?)

While the market has struggled with a lack of inventory in 2021 and builders have reported ongoing supply chain challenges, there are more than 700,000 homes under construction right now, and a growing inventory of new homes for sale. The inventory of existing homes remains quite tight at less than 2.5 months, but the addition of new homes to the mix should lead to more choices for potential buyers in 2022, including many who had hesitated to list their homes in 2021. This should lead to an increase in the number of existing homes listed.

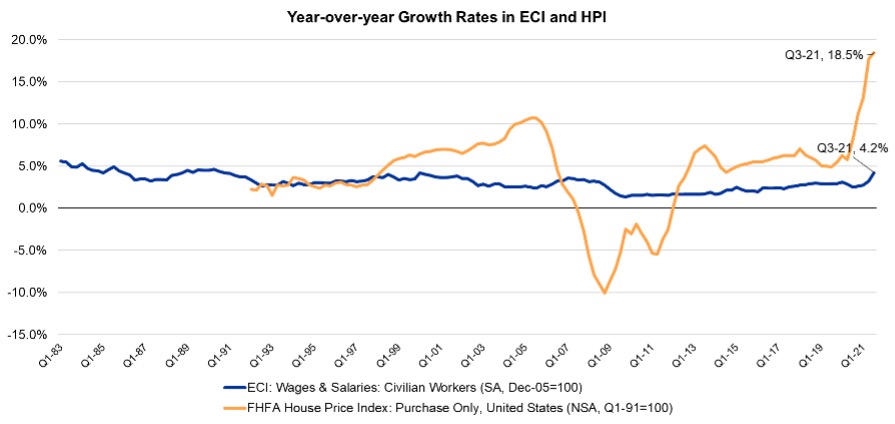

This additional inventory is sorely needed. In the most recent readings, home prices nationally have been increasing at about an 18% rate compared to last year, with double-digit growth in almost every part of the country, and growth even faster in parts of the Mountain West. Per the chart below, this rate of growth is more than four times the pace of income growth. That’s clearly not sustainable, particularly for potential first-time homebuyers.

While existing homeowners can cash in their equity gains and use that gain toward a down payment for their next home, first-time buyers are seeing their chance to buy decrease, or at least are having to re-think the types and locations of properties that they might be able to afford.

The encouraging news? MBA’s forecast for an increase in housing starts and home sales, coupled with our expectation of somewhat higher mortgage rates, should together lead to deceleration in home-price growth to around 5% in 2022. Note that this is a deceleration — a slowing in the rate of growth, not a decline in the level of home prices.

Could home prices actually decline next year? Yes, if we were to get a spike in mortgage rates or some other shock that leads to an abrupt drop in demand right when the new supply arrives. However, I am frankly less worried about that scenario, and more worried that for other reasons, perhaps ongoing supply-chain constraints impacting homebuilders, the additional supply does not arrive. In that case, there is certainly a chance that home prices could continue to rise at unsustainable levels, increasing the risk that the market could run into a wall at some point next year with respect to purchase demand, showing up as a sharp drop in purchase applications.

Will we really move into a purchase market next year?

Refinance volume will have totaled more than $5 trillion between 2020 and 2021, roughly half of mortgage debt outstanding, and representing 15 million refinance loans. Of course, that means that 15 million homeowners now have remarkably low mortgage rates. Will those who did not refinance when rates were below 3% be interested in doing so if rates rise to 4%? While there will be borrowers who will be interested in cash-out refinances given the rapid growth in home equity the past few years, MBA is forecasting a sharp drop in total refinance volume in 2022 and expects that volume to stay lower in 2023.

However, while total origination volume is forecast to drop from $3.9 trillion in 2021 to $2.6 trillion in 2022, perhaps the bigger shift is the transition from a refi to a purchase market. Purchase loans present different challenges and opportunities for lenders, both in respect to the mix of business and the need to maintain strong relationships with real estate agents, builders, and others in the housing market.

Given our outlook for home sales and housing starts outlined earlier, MBA forecasts a record year for purchase volume in 2022, driven by millennials reaching peak first-time homebuyer age, a strong job market, and continued increases in home prices.

Will there be an increase in foreclosures next year as the remaining borrowers in forbearance exit?

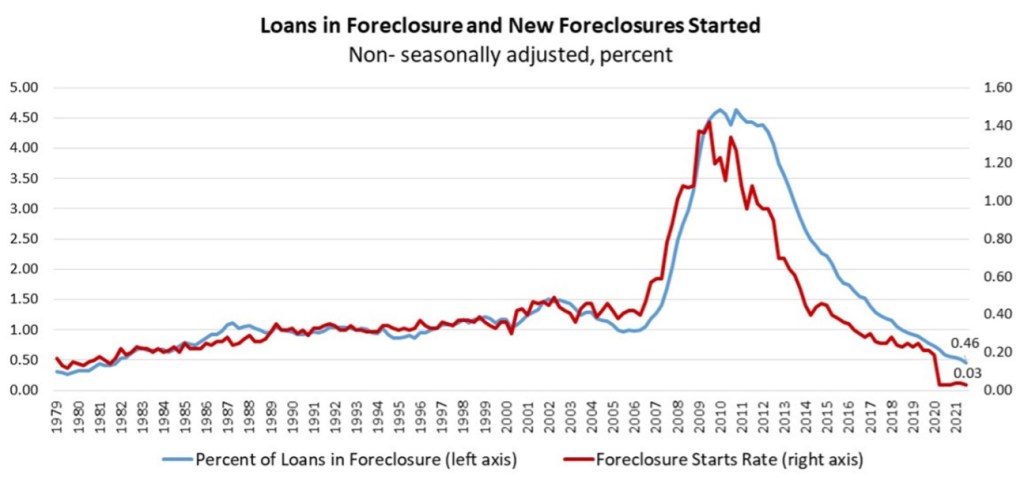

When the unemployment rate spiked to almost 15% last year as the economy was shut down to protect against the first wave of COVID-19, policymakers and servicers moved incredibly quickly to offer forbearance to millions of homeowners. In June 2020, more than 8.5% of all homeowners with a mortgage were in forbearance. While mortgage delinquency rates spiked in concert with the jump in the unemployment rate, these forbearance plans and foreclosure moratoria enabled homeowners impacted by the pandemic to weather the storm.

The foreclosure moratoria have now been lifted, and many homeowners are reaching the expiration of their forbearance terms. Most borrowers exiting forbearance to date have been able to resume making their original payments, while some borrowers have entered modifications, needing lowered payments for a time. MBA’s Weekly Forbearance and Call Volume Survey and new Monthly Loan Monitoring Survey track the performance of these workouts, which have been positive thus far.

Prior to the pandemic, foreclosure levels were extremely low. In 2021, with the moratoria in place, they dropped even lower, with foreclosure starts and foreclosure inventory rates at or near all-time lows. These levels are bound to increase to some extent, but given the success of forbearance exits thus far, we expect the levels to remain extremely low in 2022.

With the expected decline in origination volume next year, will margins tighten (further)?

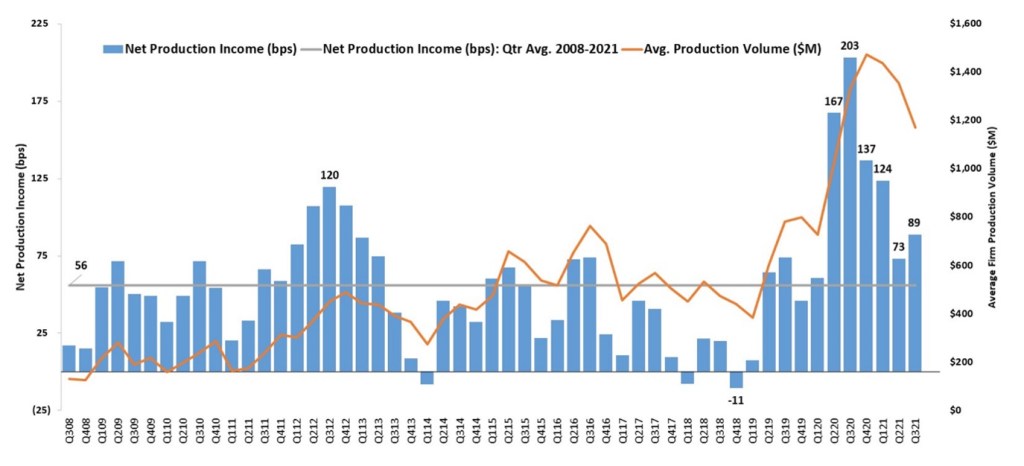

2020 was a record origination volume year and a profitable year for mortgage originators, as shown by the triple-digit margins in MBA’s Quarterly Performance Report data. As had been typical in prior refinance waves, when the industry is operating at or beyond capacity, margins increase, but this time, expenses were elevated as lenders moved to remote work and staffing shortages abounded across many roles.

In 2021, as refinance volume crested and began to wane, margins have trended downwards as well. The higher personnel and operational costs taken on to meet the record volume remain, but the industry now has some extra capacity, and that is showing up as a drop in margin. It is important to highlight that the third quarter of 2021 margin of 89 basis points is still above the historical average of 56 basis points, when looking at data going back to 2008.

Of course, purchase volumes display large seasonal swings, leading margins in the fourth and first quarters of each year to typically be much lower than those in the middle of the year.

While MBA does not forecast industry-level margins, it is reasonable to expect more tightening in the year ahead given our forecast of a move to a purchase market coupled with a sharp drop in refinances. We’ve already seen tightening to an even greater extent in third-party channels, as lenders lean more heavily there, perhaps to make up for lost volume through the retail channel. If we look back to 2018 or early 2019, there’s typically a time of below-average profitability as the industry right-sizes following a refinance wave.

2022 should be a year of higher mortgage rates, fewer refinances, more purchase volume, a more sustainable rate of home-price growth, an increased, but still low level of foreclosures, and tighter margins for originators. This part of the cycle is always a challenge for lenders, but mortgage bankers have been through this before.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Mike Fratantoni at mfratantoni@mba.org.

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com