Mortgage borrowers who shopped around last week could’ve saved $47,768 on the life of a $300,000 loan, according to LendingTree’s Mortgage Rate Competition Index.

The index measures the spread in the APR of the best offers available on its website. LendingTree derives that savings claim by comparing the amount a borrower would payout of over the life of a loan at the lowest available interest rate on its site versus the highest available interest rate.

According to the company’s data, although the index slid to 1.01, the share of borrowers that received rates under 4% edged up for the week ending Nov. 17, 2019.

LendingTree indicates that for 30-year fixed-rate mortgages, 51.5% of purchase borrowers received offers under 4%, increasing from 48.2% the previous week.

This percentage remains significantly higher than the 2018 rate, when virtually no purchase offers were under 4%.

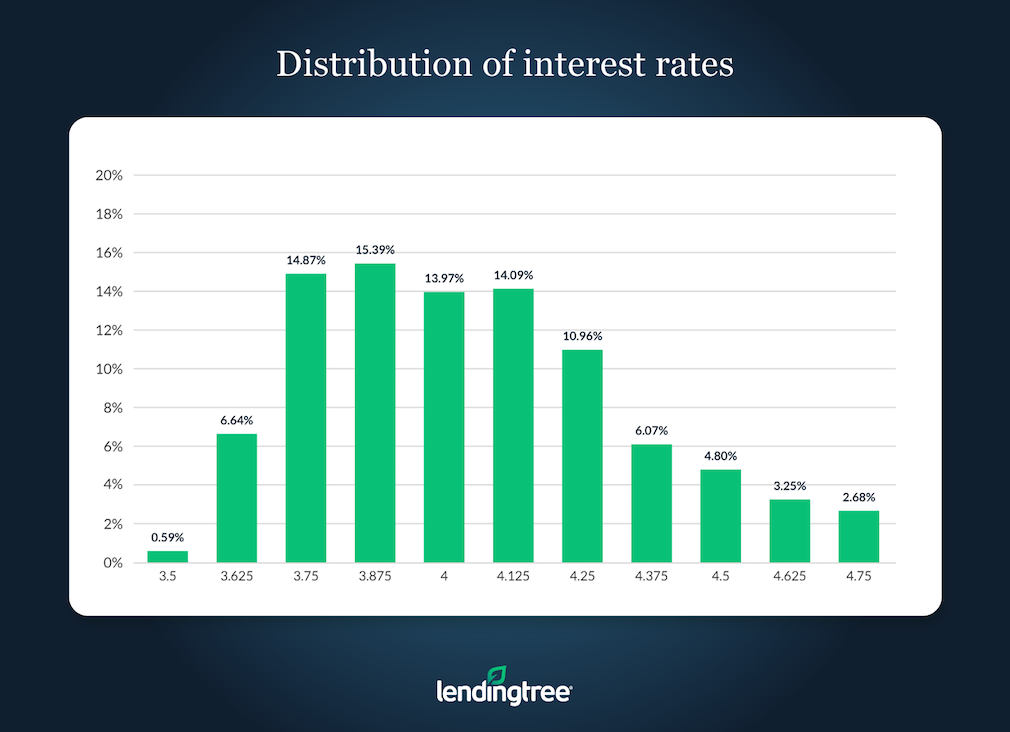

Notably, the report highlights that across all 30-year, fixed-rate purchase mortgage applications made on LendingTree’s site, 15.4% of borrowers were offered an interest rate of 3.875%, making it the most common interest rate.

When it comes to 30-year fixed-rate refinance borrowers, 50.7% received offers under 4%, climbing from 48.6% one week prior. In 2018, no refinance offers were under 4%.

This means with a wider refinance market index of 1.22, the typical refinance borrowers could have saved $58,190 by shopping around for the lowest rate.

According to the report, across all 30-year, fixed-rate refinance applications, the most common interest rate was 3.875%. This rate was offered to about 15.7% of borrowers.

This image highlights the distribution of mortgage fees: