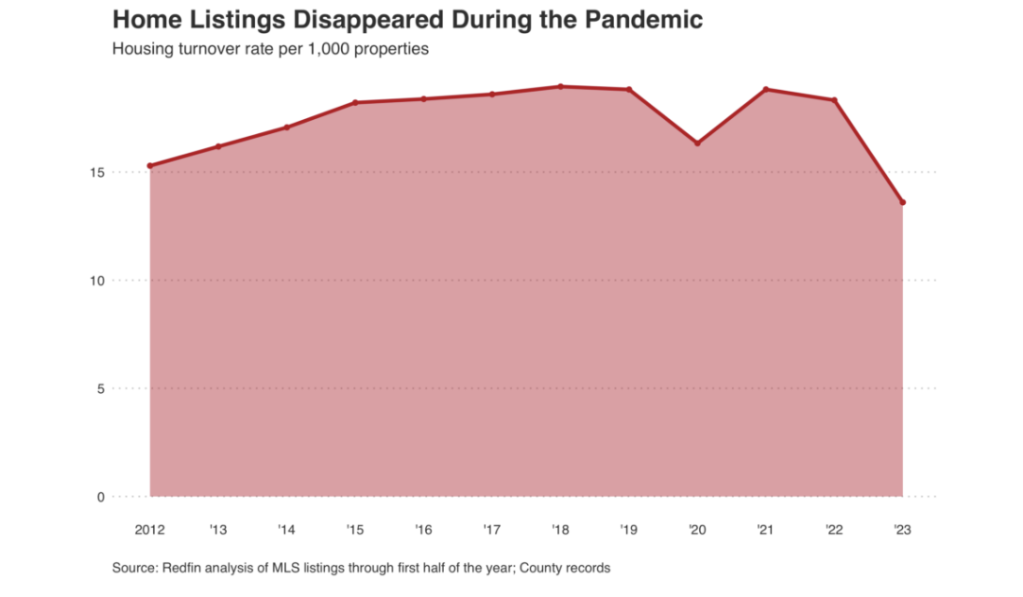

High mortgage rates and depleted housing inventory have exacerbated an already existing housing availability crisis. In the first six months of 2023, roughly 14 of every 1,000 U.S. homes changed hands according to a report released by Redfin. That’s down from 19 of every 1,000 during the same period in 2019. It’s the lowest turnover rate seen in at least a decade.

In other words, prospective homebuyers have 28% fewer homes to choose from than they did before the pandemic.

Redfin’s analysis, which uses turnover as a measure of housing availability, includes overall for-sale housing turnover and breakdowns based on neighborhood type and home type.

As a frame of reference, a 20/1,000 turnover rate is a fairly typical for the modern housing market. A more active market would have a rate closer to 40 or 50 for every 1,000 homes.

The ‘lock-in effect,’ in which homeowners are disincentivized to list their homes for sale because of the cost/difficulty in finding a new home, is seriously inhibiting the supply of existing homes available for sale. The supply of homes for sale is now at a record low, and millions of new homes need to be built to meet demand.

“The quick increase in mortgage rates created an uphill battle for many Americans who want to buy a home by locking up inventory and making the homes that do hit the market too expensive. The typical home is selling for about 40% more than before the pandemic,” said Redfin Deputy Chief Economist Taylor Marr. “Mortgage rates dropping closer to 5% would make the biggest dent in the affordability crisis by freeing up some inventory and bringing monthly payments down. But there are a few other things that would boost turnover and help make homes more affordable. Building more housing is imperative, and federal and local governments can help by reforming zoning and making the building process easier. Financial incentives, like reducing transfer taxes for home sellers and subsidizing major moves with tax breaks, would also add to supply.”

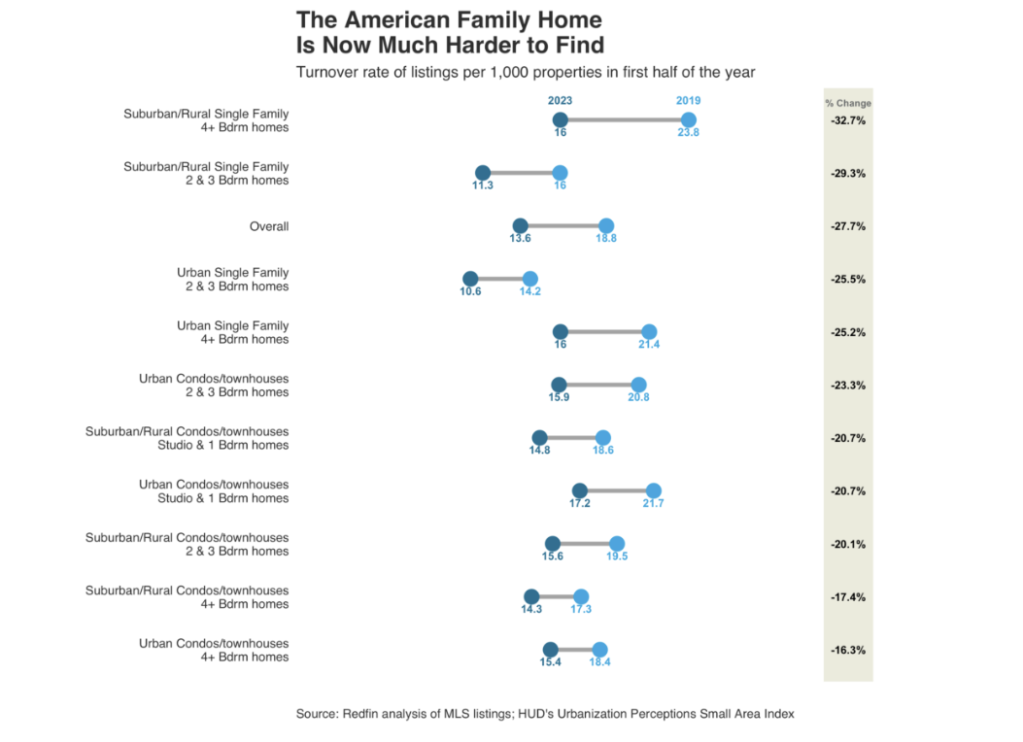

The turnover rate has shrunk most in the suburbs

The turnover rate was worse for large suburban houses: 16 of every 1,000 suburban homes with at least four bedrooms changed hands in 2023, down from 24 of every 1,000 in 2019, according to Redfin. Buyers of that home type had 33% fewer houses to choose from.

This shortage can be explained by the popularity of this type of homes during the pandemic. Then, remote workers flocked to the suburbs to purchase large properties with space for adults to work from home and children to attend school from home.

Condos and townhomes were not as impacted as they were not in such demand during the pandemic. Still, buyers are about 20% less likely to find that type of home than they were in 2019.

Modestly sized single-family homes in the city are hardest to find

Smaller houses in the city have the lowest turnover rate of all the home types in this analysis. Roughly 11 of every 1,000 two- and three-bedroom single-family homes in urban neighborhoods sold in the first six months of 2023, compared to 14 of every 1,000 during the same period in 2019. It was also hard in the suburbs, with 11 of every 1,000 changing hands this year, down from 16 of every 1,000 in 2019. Modestly sized single-family homes in all kinds of neighborhoods have long been hard for buyers to find. Builders don’t make many of them anymore, and homeowners tend not to sell.

Homebuyers have the fewest options in the Bay Area

Northern California has the lowest turnover rate in the U.S with 6 of every 1,000 homes in San Jose changing hands in the first half of 2023, the lowest rate of the 50 most populous U.S. metros. It’s followed closely by Oakland, San Diego, Los Angeles, Sacramento and Anaheim. In those places, the rate climbed to 8 for every 1,000 homes.

Newark, NJ, Nashville and Austin have better turnover rates, with more than 20 of every 1,000 homes in each of those metros selling this year. But don’t be deceived – Newark buyers still have fewer homes to choose from than they did pre-pandemic, with a 42% drop in turnover since 2019.

In terms of suburban single-family homes again, California still has the lowest turnover rate. Six of every 1,000 homes of that type have sold this year in San Jose (-40% since 2019), the lowest rate in the nation. Next come Oakland (7 of every 1,000; -43%), San Diego (8 of every 1,000; -51%), Sacramento (9 of every 1,000; -41%) and Anaheim (9 of every 1,000; -41%).

Historically, California’s tax laws have incentivized homeowners to stay put by limiting property-tax increases. This policy fed, over the years, into the housing inventory crisis.