Homeownership backlash is starting now that we’re far into an economic expansion and close to an election.

Does homeownership undermine growth, fairness and public faith in capitalism as The Economist suggested this week? Or is it still the stuff of stable American dreams? Let’s debate a few points.

Socialist Millennials Must Wake Up To Housing Reality

Baby Boomers with a median age of 35 in 1990 owned one-third of America’s real estate by value. In 2019, Millennials with a median age of 31 own just 4%. The Economist said this helps explain why Millennials are embracing socialism.

Yes, the stat is stark, but would-be socialists may already have what they’re embracing.

Socialism is when the government controls companies, and we’ve had an increasing degree of this for decades in American housing as the government has tried to help us.

- In 1934, the government created the Federal Housing Administration to standardize and insure loan approvals, and improve homebuilding standards.

- In 1938, the government created Fannie Mae to buy FHA insured loans and encourage banks and lenders to lend more by buying their loans.

- In 1949, the government set a goal to fund private companies to build 810,000 housing units to improve living conditions for Americans.

- In 1968, the government deepened its commitment to “a decent home and a suitable living environment for every American family” by setting a goal to construct or rehabilitate 26 million housing units.

- In 1970, Freddie Mac was created to assist Fannie Mae in providing market liquidity so banks and lenders could lend more.

- In 2008, the government straight up took control of U.S. housing by taking over Fannie Mae and Freddie Mac to ensure housing stability during the worst financial crisis since the Great Depression.

- Since 2008, government-controlled Fannie Mae and Freddie Mac have approved loans well beyond what post-crisis regulations allow.

Did the government and private companies hit their 1949 and 1968 homebuilding goals? No.

Are there still endless deliberations about the fate of government-controlled Fannie and Freddie? Yes.

But increasing government housing assistance for decades demonstrates a clear goal of helping people achieve the American Dream of homeownership.

So if fairness is the perceived problem in homeownership today, financial and housing literacy is the solution.

Rent vs. Buy Math For 8 U.S. Markets In 2020

There’s a counterargument for every headline stat like the one above about boomers eroding Millennial homeownership confidence.

Today I counter that with this: U.S. renters paid $4.5 trillion in rent in the 2010s, and $512 billion in 2019 alone.

But headline sparring doesn’t matter in housing where everything is a local ground game.

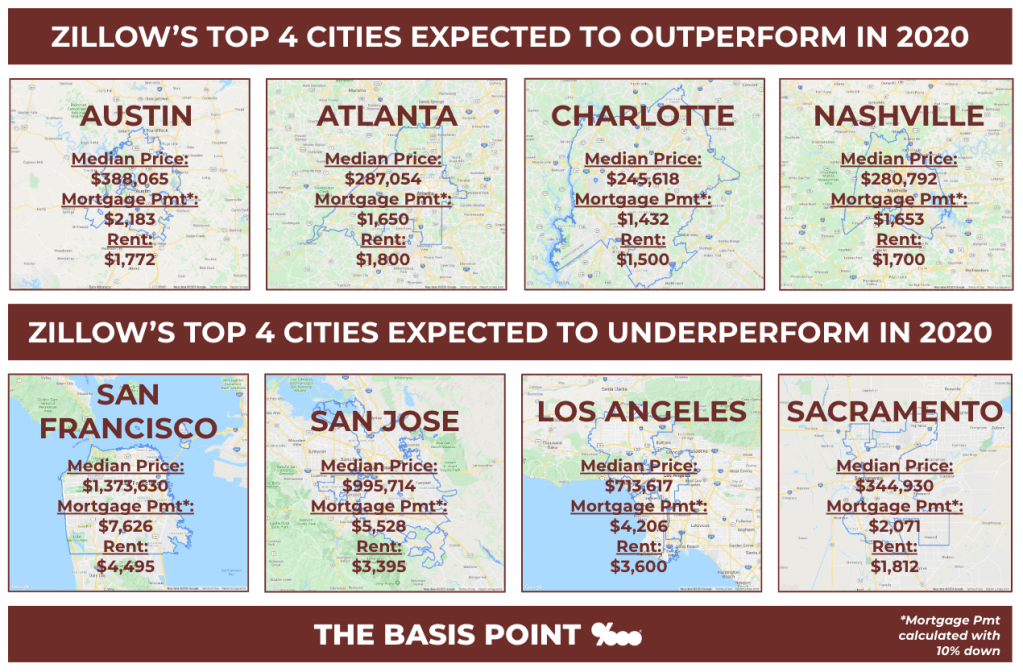

I recently analyzed mortgage vs. rent payments in Zillow’s four hottest and coldest cities for 2020. The hot/cold rankings are based on expectations of whether housing markets outperform or underperform in 2020.

The image below shows mortgage vs. rent payments are similar in five of these eight markets, and owning beats renting in three of America’s “hottest” four markets.

Note: I didn’t calculate any homeowner tax benefit into these scenarios.*

What Is Fairness In A Socialist-Capitalist Market?

But the down payment you used is too high!

Yep, heard that one. Heard them all.

Of the five markets where mortgage vs. rent payments are similar, the similarity holds using 5% down, except for Austin.

In Austin, the most expensive of today’s hot/affordable markets, a household with $600 of car, student loan, or other non-housing debt would need to make $80,000 per year to afford the median house with 5% down. Not insurmountable, especially in a job market that hot.

These scenarios are illustrative for debate, but scenario sparring also doesn’t matter in the local ground game of housing.

Only individual borrower and property profiles matter in home buying.

No matter what anyone thinks, 6-plus million people will buy existing or new homes this year as they build their personal and financial lives.

If people with less cash can’t put 5% down and must rent, that’s fine.

And it’s a stretch to call it unfair, especially in a global political context where homeownership isn’t government-subsidized and 5% down isn’t even on the radar.

Bottom line: U.S. housing is socialized to consumers’ benefit.

‘The Sharing Economy’ In Housing Is Nonsense

We’ve tackled whether U.S. housing undermines fairness and faith in capitalism. Now let’s look at whether it undermines growth.

One tired political argument says homeowners don’t move for better jobs or start new businesses. This doesn’t hold in the mobile era. Technology and competition for talent will power the remote work trend ever faster. Increasingly, people can live where they want without risking opportunities or options.

Another argument says Millennials and Gen Z are sharing economy natives who are fine with housing being rented like music, TV and rides around town.

This is nonsense for three reasons:

- Even if someone is working on TikTok stardom in a collab house today, they’ll succeed and move or fail and move. Or they’re the lucky landlord for their crew.

- Shared appreciation or rent-to-own models cater to this demographic with “be flexible” marketing, but the underlying goal is still homeownership.

- All generations are the same. Millennials (ages 26-40) and Gen Z (ages 5-25) will want their own space as career and family plans mature.

Homeownership Shouldn’t Be Left To Landlords

I agree with The Economist’s housing commentary about restrictive local building policies holding back housing and pushing home prices too high in some areas.

They said if just three big cities – New York, San Francisco, and San Jose – relaxed planning rules, America’s GDP could be 4% higher.

I’ve been a housing professional in San Francisco for 17 years, and too often, we can’t get out of our own way on building rules.

Voters are either overly housing literate and protect their interests, or not literate enough and unknowingly vote against their interests.

Such is politics, and we’re certain to have plenty to comment on this election year.

But here’s another certainty: the American Dream of homeownership is inside us all, and homeownership shouldn’t be left to landlords.

*The “mortgage payment” in these scenarios uses 10% down, and is the actual total monthly ownership cost including principal, interest, taxes, insurance; plus mortgage insurance (MI)–except on jumbos where MI is less common so jumbo scenarios use a rate premium instead.

Interested in exclusive real estate news and commentary? Join HW’s free twice-weekly newsletter OpenHouse to stay informed. Sign up here!