Large institutional investors like Invitation Homes, American Homes 4 Rent and Amherst are poised to pounce on distressed property purchase opportunities in the aftermath of the coronavirus-induced economic downturn, according to a recent Wall Street Journal article.

But those mammoth institutional investors may be outflanked by an army of individual real estate investors willing to buy earlier in the cycle at prices closer to full market value.

“We have had twice the number of new members in March and April than we had in prior months. Our sales have not slowed down. Prices have not come down,” said Kathy Fettke, Co-CEO at Real Wealth Network, a company that connects passive individual investors — most holding full time day jobs — with turnkey rental properties. “Our teams do not have enough inventory to meet demand.”

In the decade since the last downturn, Real Wealth Network and other companies like it have armed individual real estate investors with direct access to nationwide inventory along with services such as tenant placement, property management and maintenance.

“I see no reason to stop investing, and I think most investors out there, the majority of those people still feel bullish,” said Marco Santarelli, founder of Norada Real Estate Investments, another provider of turnkey investment properties to passive individual investors.

Santarelli noted that his buyers aren’t holding out for deep discounts.

“Nobody is asking us, waiting for or expecting big discounts because of what is going on,” he said. “That expectation is not there. Nobody is talking about housing prices crashing. All our product is turnkey and newly renovated and new construction. We’re not after distressed properties.”

Santarelli noted that the property providers he relies on for turnkey investment inventory are often purchasing distressed properties at foreclosure auction and then rehabbing those properties into rent-ready condition. He believes the strong demand from individual turnkey buyers will ripple out to those distressed property buyers as well.

Rebounding distressed demand

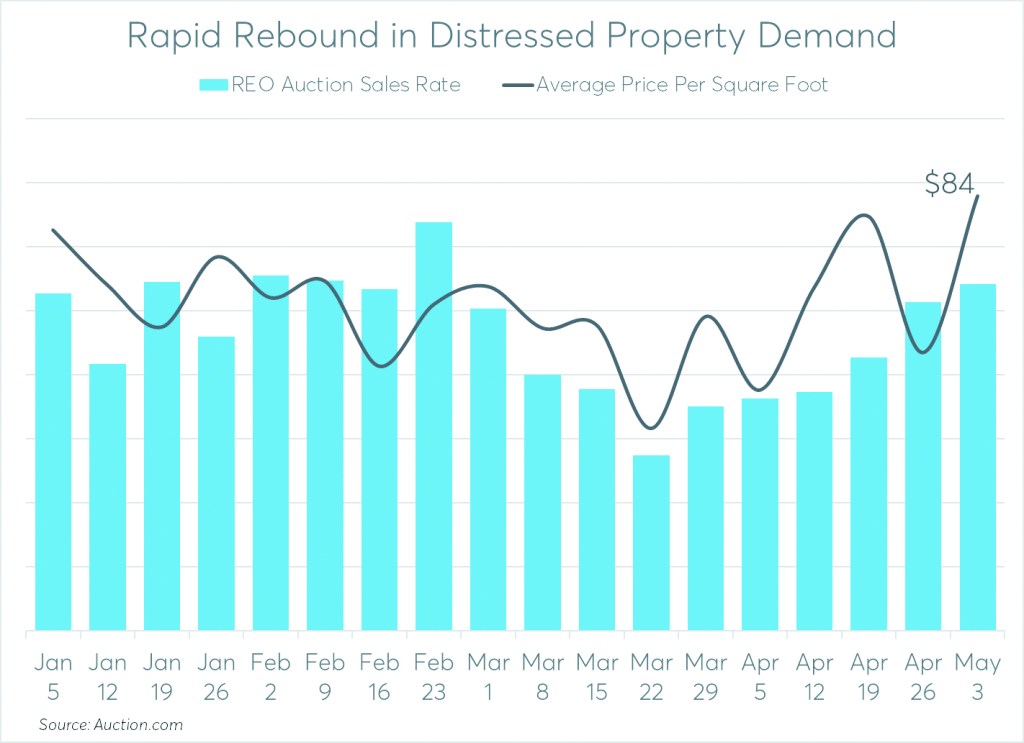

Demand from distressed property buyers quickly rebounded in April after dipping in late March immediately following the pandemic and national emergency declarations, according to data from the Auction.com online marketplace.

The sales rate for real estate-owned properties sold via online auction dropped to a year-to-date low in the week starting March 22. The sales rate represents the percentage of available REO auction inventory that sold in a given week. The average price per square foot for REOs sold via online auction also dropped to a year-to-date low in the week of March 22.

But beginning in the week of March 29, the REO sales rate increased for six consecutive weeks, reaching a 10-week high in the week of May 3. The average price per square foot for REOs sold via online auction hit a new year-to-date high that same week, according to the Auction.com data.

“(The pandemic) hasn’t stopped me,” said one distressed property investor who said he had already purchased more than 75 properties through Auction.com in 2020 as of mid-May. “I’ve been buying and buying and buying. I’m probably doing more than I did last year, and I had a big year last year.”

Smaller-volume investors more confident

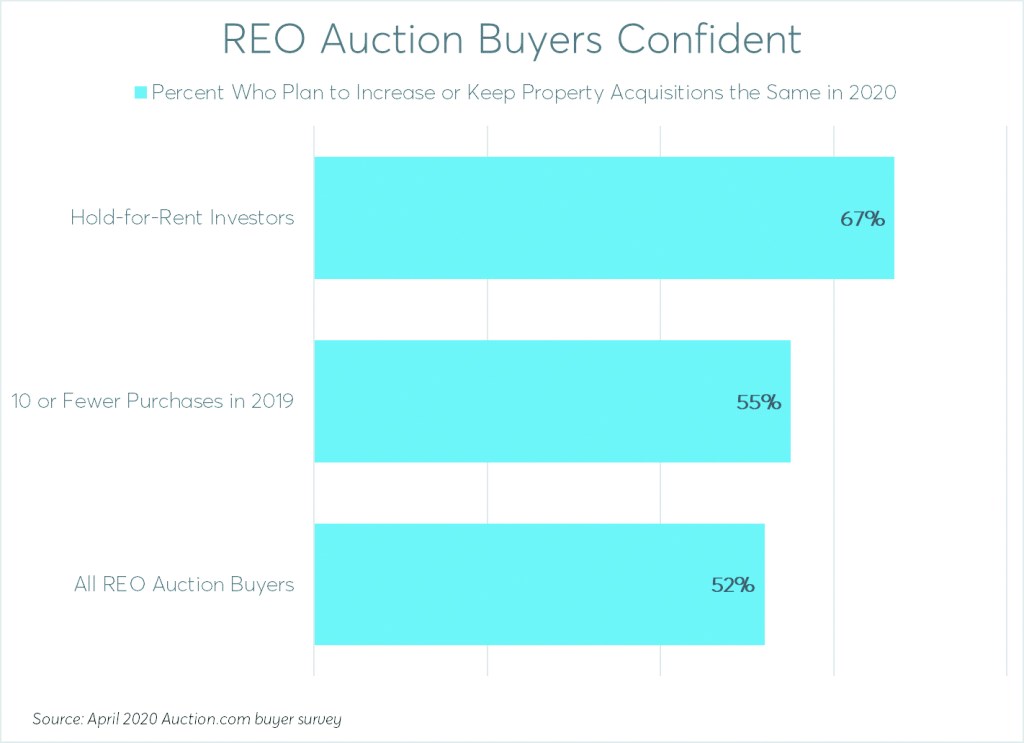

That sentiment aligns with more than half of all investors purchasing via online REO auction, according to an Auction.com survey of more than 400 buyers conducted between April 3 and April 10.

Among buyers whose preferred acquisition method was online REO auction, 52% said they plan to increase or keep the same their volume of property acquisitions despite the coronavirus crisis.

Smaller-volume REO auction buyers were more likely to express confidence in the post-crisis market, with 55% of those who purchased 10 or fewer properties in 2019 saying they planned to increase or keep their property acquisitions the same in 2020.

Hold-for-rent investors purchasing via online REO auction were even more confident, with 67% saying they planned to increase or keep property acquisitions the same in 2020.

“We have seen rents hold better than we thought, thanks to my managers,” said a Portland, Oregon-based investor who noted that he and his wife have gradually built up a portfolio of about 30 rental properties in the Portland, Albuquerque and Las Vegas markets over the last decade.

“The people I know are optimistic but cautious. … For us accumulating and those flipping, I see the demand picking up once the virus is seriously subsiding,” he said.

Larger-volume buyers more cautious

Larger-volume investors purchasing at least 10 properties a year scooped up a high share of distressed property sales during the last downturn, according to an analysis of public record data from ATTOM Data Solutions.

Those 10-plus property investors accounted for 61% of all third-party sales at foreclosure auction in 2008 and 2009.

Since 2009, the percentage of foreclosure auction sales to these larger-volume investors has gradually decreased, dropping to a 20-year low of 19% in 2019.

Investors purchasing 10-plus properties a year accounted for 14% of all REO sales — including both online auctions and REOs sold via the Multiple Listing Service in 2013, but the share had dropped to 9% by 2019, according to the ATTOM data.

While many higher-volume investors, including mammoth institutional investors like Invitation Homes, American Homes 4 Rent and Amherst, are preparing for a large-scale buying opportunity in the aftermath of the coronavirus-induced economic downturn, those buyers will most likely wait for a downturn in home prices before dramatically scaling up their acquisitions.

“It’s an artificial high right now,” said Lee Kearney, CEO of Spin Companies, a group of real estate investing businesses that has completed more than 6,000 real estate transactions since 2008. “In the background the next wave is coming. I’m definitely in wait-and-see mode.”

“Real estate is not the stock market… real estate moves in quarters,” Kearney said. “We may actually have another quarter where prices rise in certain markets… but at some point, it’s going to slip the other way.”

Kearney continues to acquire properties for his investing business, but with conservative exit pricing, maximum rehab cost estimates and higher profit targets in order to convert to more conservative purchase prices.

“Those three variables give me an increased margin of error,” he said, noting that if he does start buying at higher volume, it will be outside of the large institutional investors’ buy box. “The biggest opportunity is going to be where the institutions won’t buy.”

Will deferred foreclosure inventory hurt or help?

The strength of the market since the pandemic declaration has been surprising, according to a spokesman for a New York-based institutional buyer that renovates and resells 1,500 to 2,000 distressed homes a year, mostly reselling to owner-occupants.

“We didn’t want to go out there, guns a-blazing,” he said, referring to his company’s acquisition strategy in the aftermath of the pandemic declaration. “We took a step back to see how the market would shake out. And the market hasn’t shaken out. Which is somewhat disconcerting.”

This institutional buyer has continued to acquire properties, but more cautiously given the uncertainty of when pent-up distressed inventory caused by the foreclosure moratoriums and mortgage forbearance programs will hit the market.

But Santarelli, with Norada Real Estate, views any influx of deferred foreclosure inventory as providing welcome relief for his individual investors in a supply-constrained market.

“It will help with the tight supply in these markets … because the providers we work with are going to see more distressed inventory they can pick up at a discount, whether at auction or wherever, and turn into a turnkey product,” he said.

“We’re still in a seller’s market,” Santarelli continued. “The sustained demand for property, whether homes or rentals, has not waned a lot. It has paused a bit, but people are coming back.”

To read the July issue of HousingWire Magazine, click here.