The Department of Housing and Urban Development (HUD) has released its Q1 Federal Housing Administration (FHA) Mutual Mortgage Insurance (MMI) Fund Programs report to Congress, which details that the Home Equity Conversion Mortgage (HECM) program is exhibiting a trend of overall budget positivity as volume has fallen relative to Q4 2020.

Industry response to the report appears to be one of encouragement, according to input RMD sought from the National Reverse Mortgage Lenders Association (NRMLA). The overall performance of the MMI Fund was also recently spoken about by incumbent HUD Secretary Marcia Fudge, who released a statement saying that there are no “near-term plans” to change the pricing of FHA’s mortgage insurance premium. This is according to a statement released Tuesday morning by HUD.

HECM performance

According to the report, HECM endorsement volume for Q1 2021 sits at $4.71 billion, marking a loss of 6.81% when directly compared to the endorsement volume seen in Q4 2020. HECM endorsements by count endured a very slightly smaller reduction, dropping 6.51%. On the front of HECM program claims, total claims went down from 11,872 loans in Q4 2020 to 9,263 loans in Q1 2021, which the Department attributes to a lower number of claims being assigned to HUD.

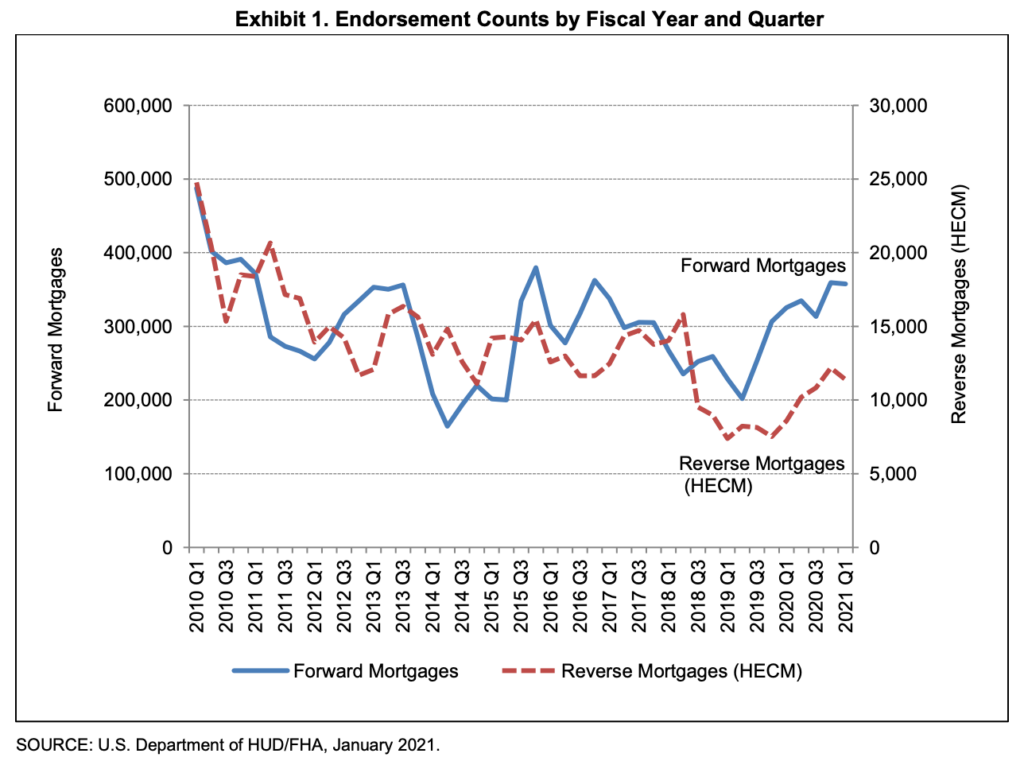

According to a visualization of HECM endorsement volume data going back to Q1 2010, HECM endorsements recovered significantly by Q3 2020 from an all-time low seen in Q1 2019, however that recovery only barely matched figures seen in Q4 2016 which at that time had been considered a near all-time low when looking at the prior six years of data.

According to the report’s updated projection of the annual subsidy rates, the budget execution subsidy for the reverse mortgage program sits at -2.39%, which shows that the program is actively generating a small amount of revenue for the federal government. The budget subsidy for the forward mortgage program also currently sits at -3.36%.

“A negative rate means that the present value of premium revenues is expected to be greater than the present value of net claim expenses over the life of the insurance, i.e., a negative subsidy. Mortgages with negative credit subsidies are expected to produce receipts for the federal budget,” the report specifies.

As a point of comparison, traditional forward mortgage volume sat in Q1 2021 at $84.66 billion, an increase of 0.86%.

HUD Secretary on status of MMI Fund

Taking stock of the state of the MMI Fund one year into the COVID-19 coronavirus pandemic, HUD Secretary Marcia Fudge said that the MMI Fund has managed to maintain a positive level of performance even under the stresses of the current crisis.

“The health of FHA’s Mutual Mortgage Insurance Fund has remained resilient despite the financial challenges faced by homeowners with FHA-insured mortgages in 2020,” Fudge said. “The fund stands at more than $80 billion and remains well above the 2% minimum capital reserve required. Through the pandemic, the FHA portfolio has experienced increased levels of seriously delinquent loans and a heightened level of loans in forbearance. We continue to monitor mortgage performance trends within our portfolio, particularly related to those homeowners who are struggling financially because of the pandemic.”

While the secretary made no specific mention of the HECM program – which some industry advocates may take as a good sign in and of itself – she did mention the most specific provision of the recently-passed American Rescue Plan Act that has specific relevance to borrowers of reverse mortgages.

“The American Rescue Plan recently signed into law by President Biden includes crucial and unprecedented resources for housing, including nearly $10 Billion Homeowner Assistance Fund, to help homeowners behind on their mortgage and utility payments and avoid foreclosure and eviction,” Fudge said. “The actions we are taking now will help position the FHA program to continue to fulfill its critical mission in the future.”

Biden administration officials previously detailed for RMD that the Homeowner Assistance Fund in the American Rescue Plan would be available to HECM borrowers who require assistance in paying taxes, fees and other associated costs necessary to keep their loan in good standing.

Additionally, Secretary Fudge addressed the FHA mortgage insurance premium (MIP), saying that changes to it are not currently being discussed.

“Given the current FHA delinquency crisis and our duty to manage risks and the overall health of the fund, we have no near-term plans to change FHA’s mortgage insurance premium pricing,” she said. “We will continue to rigorously evaluate our strategy and work transparently with Congress. Our number one priority is helping families keep their homes and remain safe as we work toward an equitable recovery.”

Industry response

The report as released this week is a generally positive sign for the HECM program on the basis of the projected receipts it is expected to provide to the federal government, and is an encouraging look at the health of the program. This is according to Steve Irwin, president of the National Reverse Mortgage Lenders Association (NRMLA).

“The FHA-Insured HECM program’s performance in the MMI Fund continues to improve,” Irwin said in an email to RMD. “While certain macroeconomic changes may impact future quarterly reporting, we are pleased to see the programmatic changes implemented by HUD are continuing to bolster the HECM’s performance.”

Previously, analysts at New View Advisors predicted that based on trends outlined in FHA’s annual report to Congress last November and an accompanying actuarial report submitted to FHA. At the time, FHA contended that the forward mortgage book of business was subsidizing the HECM book, which New View disagreed with as they reiterated to RMD this week.

“[A] subsidy would mean outsized realized HECM losses, and a compelling case that this will continue,” New View explained at the time. “This is not demonstrated in the report. In fact, given current trends, a reversal of fortune is possible, in which the HECM program returns to surplus and forward mortgage enters a deficit.”

Read the Q1 2021 MMI report at HUD.