First, let’s set the record straight. Homeownership is critical to wealth creation, especially for establishing intergenerational wealth in America. When looking at net worth, even considering the fact that there can be periods of volatility, the ability for Americans to own a home has proven to be the best method for establishing a financial reserve for passing onto the next generation and to tap into for other financial needs.

The debate that has occurred over the decades about renting vs. owning is answered with data. But it is true, not all should own or perhaps are able to own. But if you are able own a home, can qualify and commit to ownership, there is a strong argument to support doing so.

One of the conundrums of homeownership is that it is limited to certain individuals meeting the necessary criteria. Unfortunately, in the U.S., these limits often reflect the ethnic divides that make up the nation. Today, white non-Hispanic homeownership rates are above 70%, while Hispanic and Black rates sit in the sub 50% levels. For Black homeownership in particular, there has been little improvement in the homeownership rate at all.

I would argue that public policy has actually eroded the strength of forceful leadership needed to make any dent in this area.

An effort to address this gap is once again being discussed by the new administration. President Biden, in fact, had a plank in his campaign calling for a $15,000 first-time homebuyer tax credit. The proposal has been met with resistance in a variety of policy arenas where the debate over the lack of single-family inventory for sale raises concerns that a tax credit would simply exacerbate the already challenging environment that some argue is artificially inflating home values.

This leaves people asking: Why is there a need to focus on this gap and can anything substantive actually be done? But we need to be asking this: As long as we have a society that, whether intentional or not, disenfranchises a portion of its citizens from the most basic opportunity to build wealth and shift a generations-long paradox for the better, can we ever move the needle on the color boundary in homeownership?

Why this matter is basic to our nation

As the National Association of Homebuilders pointed out in their February 2021 Eye on Housing, “For 2019, the median net worth of homeowners was $255,000 and the median net worth of renters was lower ($6,300).”

With homeownership rates significantly lower for minorities, the net effect is that wealth creation is an impairment to providing opportunity for the long run. In fact, the ability to own a home for all Americans is where the most important asset is created.

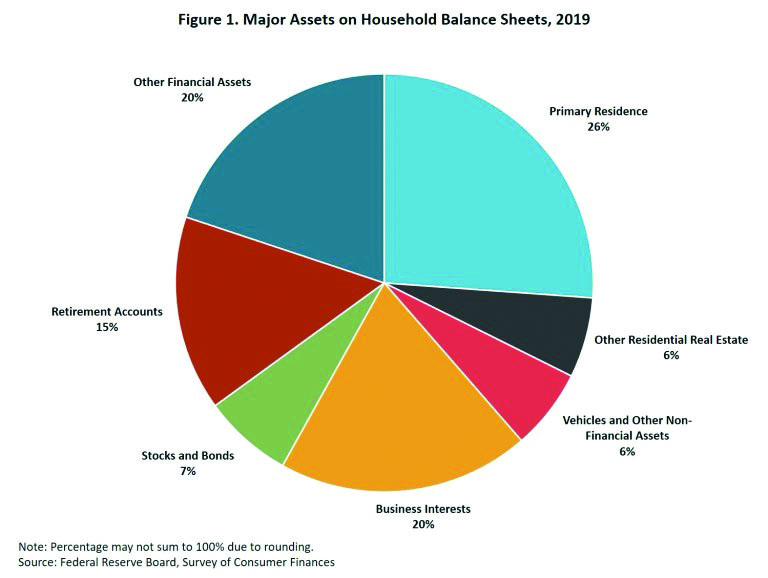

The Federal Reserve’s survey of consumer statistics reflects that the primary residence is the single-greatest asset held by Americans. Yet with less than half of minorities versus two thirds of white non-Hispanics getting access, the long-term implications are important to consider. Homeownership, however, is even more critical to wealth building for minorities.

In fact, as the NAHB article shows, “Household wealth for these groups (Black/African American, Hispanic/Latino, and other ethnic groups) heavily relied on the value of primary residence.”

Richard Green, director of the University of Southern California Lusk Center for Real Estate, created a research paper for the Department of Housing and Urban Development on why homeownership makes a difference. He started with a focus on family impact, pointing out that, unlike renting, owning brings longevity.

“This longevity indicates parents can assure that their children remain in a stable environment, and, more specifically, can remain in a school district that their parents find desirable,” Green states. While his conclusions pointed to shortfalls in rental protections for Americans and the need to consider long-term protected leases to keep families stable, the impact of a stable living environment is proven.

A piece by Habitat for Humanity references multiple research papers that show how homeownership produces better health outcomes, greater educational achievement, more security and safety in the living environment and creates a pathway out of poverty in the form of long-term wealth building.

In a piece I published in HousingWire following the pullback of HUD’s anti-discrimination rule (Affirmatively Furthering Fair Housing), I lamented former President Trump’s tweet that stated, “I am happy to inform all of the people living their Suburban Lifestyle Dream that you will no longer be bothered or financially hurt by having low-income housing built in your neighborhood.” He added: “Your housing prices will go up based on the market, and crime will go down. I have rescinded the Obama-Biden AFFH Rule. Enjoy!”

I lamented over this because the intent of the anti-discrimination rule was to require those in real estate to be accountable for the effect of their polices and not just the intent not to discriminate. The fact is that unless we can change the paradigm of disenfranchisement in economic opportunity in America, we risk the perpetuation of outcomes that produce societal divisions and prejudice along ethnic and color lines. To put it another way, by focusing on creating more opportunity to narrow the wealth opportunity gap, we can produce better overall outcomes for the nation as a whole.

Enter Tai Christensen and the story the Washington Post published last year titled, “One Home, a Lifetime of Impact.” It’s the story of her great grandmother Mary Pherribo and her husband George, who purchased their first home in 1936, changing the outcome for their family for generations to come. Christensen currently serves as the director of government affairs and diversity, equity and inclusion officer at CBC Mortgage Agency.

The Pherribos had been born to parents who were slaves. The simple fact is that their father, who became a chef after emancipation and upon his death in 1901 was able to leave a house for each of his eight children, began a waterfall of passing forward to future generations the value of homeownership and the ability to pull out of the spiral of poverty that grips far too many who never get the opportunity.

However, the author, Michelle Lerner, adds to the story of Christensen’s family, stating how this is the exception and not the rule to America’s story. Lerner states, “Unfortunately, that pattern of homeownership and generational wealth building is broken for many Black families. In the first quarter of 2020, 44% of Black families owned their home, compared with 73.7% of white families, according to the Census Bureau. The gap is wider in some cities, with just 25% of Black families owning a home in Minneapolis compared with 76% of whites, which is the widest gap in U.S. cities.”

Addressing the gap

The gap in access and opportunity is one that many lenders, Realtors and homebuilders would prefer to be left to academics and policy wonks. After all, why is this issue so important to them?

These are “for profit” entities who want to sell every home and every loan they can. The answer is simple, really: The fact is that the system is rigged against creating opportunity.

“The homeownership gap between Blacks and whites is larger today than it was in 1934, which is when the Federal Housing Administration was established,” says Donnell Williams, president of the National Association of Real Estate Brokers. The proof is in the pudding, and despite bold statements and all good intentions, little to no ground is being made here.

So, what are some of the challenges and potential solutions? None of this can be done without first addressing leadership and authority. Here is my short list.

1. HUD Secretary

This nation needs a centralized and authoritative housing policy leader. Today, housing policy is completely fragmented over multiple agencies with varying programs and levels of authority. It starts with the role of the HUD secretary. This role has been vastly watered down over the past decades. The secretary used to have authority over the FHA and the GSEs’ mission responsibilities, that is no longer the case. The secretary used to have authority over regulatory policy for all lenders under the office of regulatory affairs, where polices like RESPA and the SAFE Act sat. But these have been moved to other agencies, mostly the Consumer Financial Protection Bureau.

Today, HUD Secretary Marcia Fudge has control over the FHA single family and multifamily programs, FHA manufactured housing, some health care and nursing home financing, and then the subsidy programs used for community development block grants, along with other efforts such has the rental housing subsidies provided through the budget.

For this to be a cabinet level position, one that sits at the same table as the U.S. Treasury Secretary, is alarming. This cabinet-level seat should be able to coordinate the vast resources focused on the government’s housing programs. For this or any other president to make a serious attempt at driving change, there needs to be a serious and substantial recognition in the “management by committee” implications of this morass of institutions, all with overlapping authorities and with no one truly in charge of producing change. President Biden could push for some steps to address this paradigm, and with his very seasoned team, many of whom dealt with these issues during the Obama administration, there is an opportunity to at least call this what it is — a policy conundrum with no clear leadership or authority.

2. Housing Supply

Housing supply needs federal leadership and state-level involvement. From land acquisition to occupancy, the timeline and cost has gotten so long that the marginal return on building entry-level housing has become uneconomic. Add to this the huge construction cost increases for supplies, and it’s no surprise that home building has been targeted to higher price points.

A larger and emboldened HUD secretary could lead this through an office of housing supply that would be tasked to work with states and homebuilder organizations and be tasked with devising incentives to meet the supply shortages of the nation.

The funds planned for the first-time homebuyer tax credit might have far better use in being targeted to home building for first-time and first-in-a-generation homebuyers using alternative mortgage instrument targets and more. Another consideration should be given to new ideas or re-generated ones from the past, like shared equity programs to advance ownership in resale housing stock.

The needs are enormous. Following World War II, William Levitt built seven large subdivisions for returning soldiers and their families with cheap loans provided by the Veterans Administration. It was huge and created a solution for many. But to highlight the dramatic historical failure of this approach and to highlight the history of systemic racism in opportunity, no people of color were allowed to buy one of these homes.

3. The credit evaluation system

The credit evaluation system is discriminatory in its effect. What is reported to Fair Isaac or other credit bureaus may not reflect the full credit profile, and thus, may skew a score lower or perhaps not provide one, furthering the homeownership gap.

In fact in a research paper published by Lisa Rice, vice president of the National Fair Housing Alliance, and Deidre Swesnik, director of public policy and communications at the National Fair Housing Alliance, the view was straightforward, “Our current credit-scoring systems have a disparate impact on people and communities of color. These systems are rooted in our long history of housing discrimination and the dual credit market that resulted from it.”

Rent payments, cell phone bills, utility payments, wifi, cable and more can all show a pattern of credit repayment, yet these are not included in any scoring model. For some families that are “under banked,” or may have come here from countries where credit is not trusted, or simply may believe that credit is a bad thing, our system needs to find a way to provide an opportunity to use those other forms of regular payment to approve a loan.

Decades ago, when we underwrote loans before scores existed, we looked at the actual report and allowed for borrowers to tell their story. No credit was not bad credit. The thin file borrower needs a real solution, not an exception, but a true underwriting policy that does not result in denial or extraordinary credit overlays.

4. Appraisals

Appraisal outcomes can be discriminatory. There is simply too much research that shows how home appraisal values can change simply because of the owner of the home, the homebuyer or the neighborhood, and its residents solely due to color.

Earlier this year, there were many stories published about discrimination in appraisals based on race, such as an article in the New York Times titled, “Black Homeowners Face Discrimination in Appraisals,” where these homeowners, a mixed-race couple, swapped out all the Black family photos for white family members only and hid the Black family member photos in order to get a better value on the second appraisal after being concerned with the low value on the first one.

The dependence on human judgement in appraisal can sometimes come with negative outcomes. The separation of the home on-site property review, measurements and photos, might be better served if separated from the individual doing the actual valuation so as to remove any color blinders in the process.

5. Downpayment

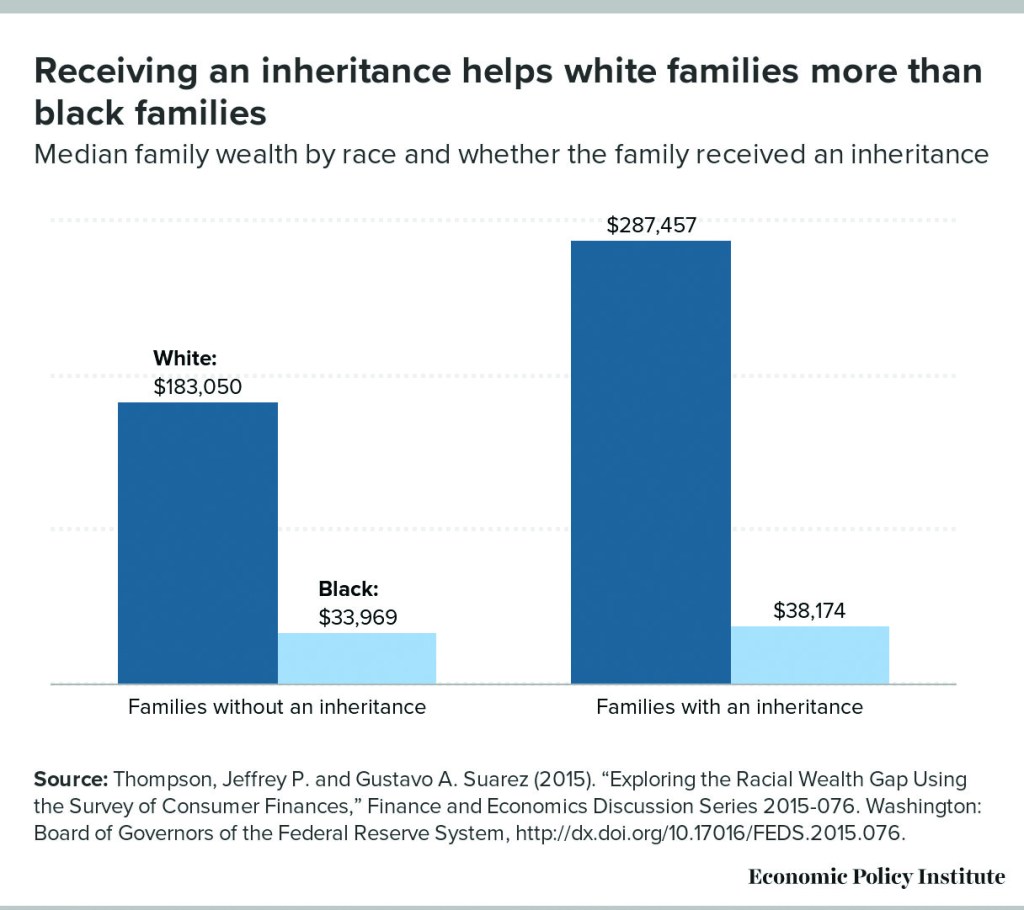

A down payment continues to be one of the single greatest barriers to entry in buying a home. As shown in the chart from the Economic Policy Institute, whites not only start off with more wealth regardless of inheritance, but when provided an inheritance, they, on average, benefit greatly.

Black families benefit very little in comparison. The lack of intergenerational wealth accumulation in this nation among minorities has a cumulative affect over generations by extending the opportunity gap. There have been many articles on the value of down payment assistance programs in eliminating this gap.

In fact, last year 40% of all FHA purchase transactions had some form of down payment assistance. The challenge in DPA programs generally is the inconsistency in application across the country. HUD could play a role here, as could FHFA, by establishing program requirements for DPA if used on one of their products.

This could include standards for underwriting, housing readiness education, loan terms, servicing standards, etc. If each of the many hundreds of housing finance agencies and governmental entities at the state, county, and municipal level all adhered to the same underwriting approaches, the ability of lenders to adapt their multi-state or national platforms to these programs might be improved.

Moving toward wealth creation

We are long past calls from presidential candidates for single solutions to bridge the gap in wealth creation in the country. Housing has proven to be, over the long term, the most meaningful asset a family can hold. It creates better health, education, and safety outcomes for a family.

The biggest gap we face is the force of leadership. If we are going to turn the page, it will need to be initiated by first making the leader of housing policy a role that has teeth. Instead of watering down the role of HUD secretary, it is time to beef it up. Consolidating programs and clearly assigning authorities can create accountability.

Today, when asked what’s causing the continued failure to meet the desires of so many families to own a home, the standard reply is, “It’s a lot of things.” When there is no accountability and limited or defused leadership on the subject, there is no one who feels accountable or capable to move the ball forward and execute.

This conundrum cannot be solved by a tax credit or some new mortgage product. This conundrum requires focus and leadership. And the inability to gain ground on this will only continue producing pockets of social unrest and continued divisions in this country.

While these things will always exist, meaningful work can be done to change the cycle of inopportunity that is pervasive along class and color boundaries in homeownership in this nation.

This article was pulled from the HousingWire Magazine May issue. To read the the rest of the issue, go here.