Reverse mortgage professionals across the country are being inundated with a constantly-evolving situation related to the COVID-19 coronavirus pandemic. For some seniors whose retirement plans have been affected, looking at reverse mortgages has become a way to access needed cash.

This is according to outreach conducted by RMD, and results of a recent Pulse Survey of RMD readership conducted between March 24 and April 1. That survey includes responses among 127 professionals who are in the business of originating reverse mortgages.

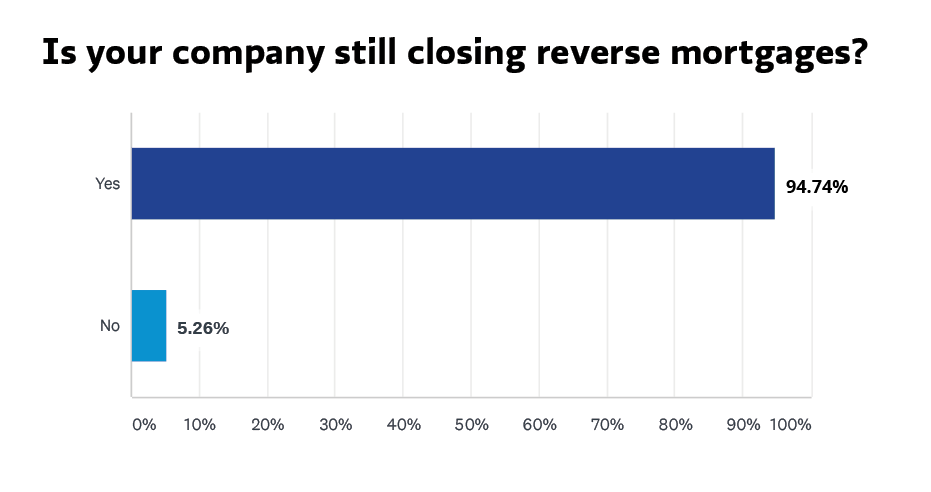

Closings are still taking place

For many reverse mortgage originators, closings themselves have not been hampered by the ongoing effects of the pandemic. In Northern California, closings have yet to be inordinately affected by the virus, according to Rich Pinnell, branch manager at Primary Residential Mortgage Inc. in Redding, Calif.

“On the reverse mortgage side, I don’t think we’ll see many problems in closing loans as the title companies are still doing signings in their offices,” Pinnell tells RMD. “I use mobile notaries on about half of my closings, [but I anticipate] appraisals may slow things down.”

According to the survey results, nearly 95% of respondents reported that companies are still able to close reverse mortgages in light of all of the preventive and mitigating measures that have been taken by local, state and federal authorities to try and slow the spread of the coronavirus. However, in some cases closings have taken different forms.

“In light of the chaos we’ve stopped closing loans in house and now are just underwriting through our investors,” says Laurie MacNaughton of Atlantic Coast Mortgage outside Washington, D.C.

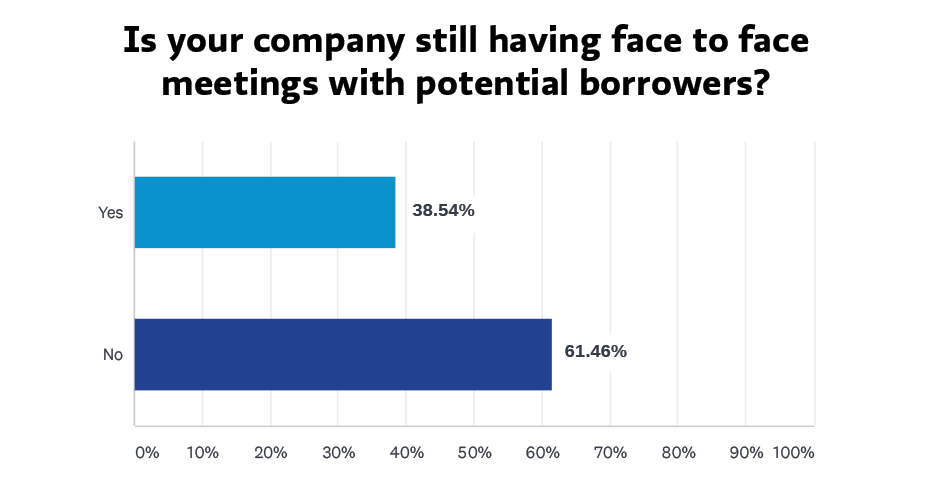

In-person meetings have slowed, but not disappeared

The impact of state and national stay-at-home orders is absolutely manifesting by changing the ways that some reverse mortgage loan officers are taking meetings with prospective clients. This is true in multiple parts of the country, where the effects of the virus are not uniform across regions.

“We are doing a lot more business over the phone for both our safety and the borrowers’ safety,” says Tim Nelson of VIP Mortgage in Scottsdale, Ariz. “They appreciate us giving them the options of working over the phone or meeting face-to-face.”

However, for some originators, face-to-face meetings with borrowers still appear to be taking place.

The results of the Pulse Survey indicate that while a majority of respondents are no longer conducting face-to-face meetings with prospective clients, a surprisingly high figure – nearly 39% – indicated that face-to-face meetings were still taking place. However, it’s necessary to mention that the guidance from authorities regarding stay-at-home orders notably shifted while this survey was still in effect, and has increased significantly in the past few days alone.

Between the week of March 23 and March 30, the amount of stay-at-home orders active across the country increased from 9 orders to 30 orders according to the New York Times. Between April 1 and April 3, the District of Columbia, Florida, Georgia, Maine, Mississippi, Nevada and Pennsylvania have put their own statewide orders to remain home in place based on guidance from the Centers for Disease Control and Prevention (CDC).

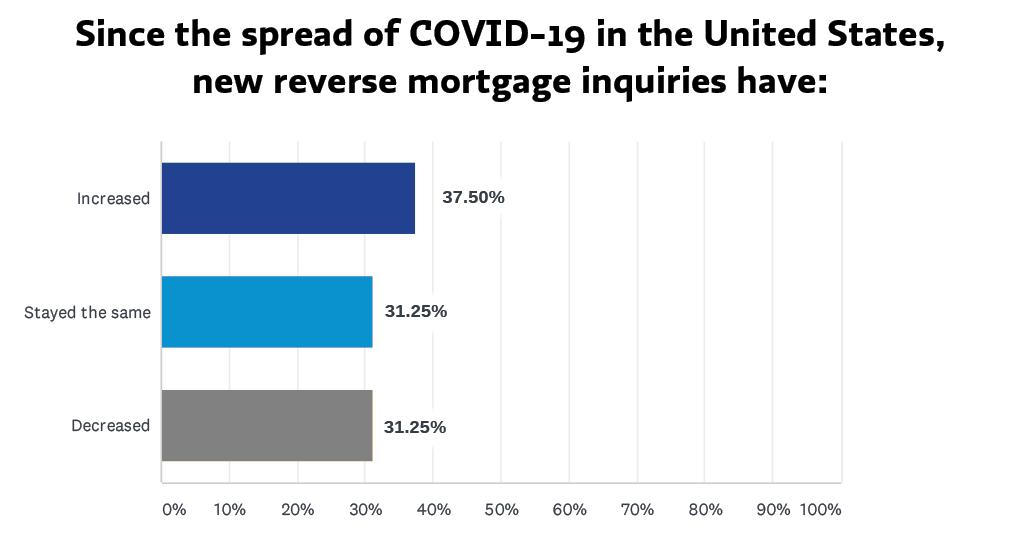

Incoming inquiries: maintained, and increased

Based on more recent conversations, reverse mortgage originators report that product inquiries have either remained stable or have increased since the onset of the coronavirus crisis. American Advisors Group (AAG) tells RMD that from their perspective, product inquiries remain strong.

“We continue to see a strong flow of applications as seniors across the nation are utilizing their home equity to help bridge the financial gap created by this market downturn,” according to an AAG spokesperson.

Based on the results of RMD’s Pulse Survey, a combined figure of 68.75% of respondents shared that reverse mortgage product inquiries have either stayed the same or increased, with the share of increasing inquiries edging out the figure of professionals reporting that they have stayed the same. Demand also appears to be strong from the perspective of Finance of America Reverse (FAR) according to Jonathan Scarpati, VP of wholesale lending.

“From our vantage point, consumer demand is very strong as seen in the increase in applications and submissions FAR received in March,” Scarpati tells RMD.

However, while applications have gone up, the realities of actually taking them may now be more complicated.

“So far the most inconvenient aspect of the new reality is taking applications over the phone,” MacNaughton tells RMD. “If clients have a hearing deficit it can take a couple of hours, and if they don’t have a computer and they miss a signature, my assistant has to overnight documents back to them.”