Today’s U.S. housing market is leaving many prospective homebuyers priced out. Homes, on average, have become less affordable, and the ones that are affordable are in short supply. As a result, 55% of future homebuyers believe that homeownership is out of reach for them financially, according to recent Fannie Mae research.

However, while affordability and supply constraints have weighed on many prospective homebuyers, homeownership education has the power to help people prepare for the home-buying process and successful homeownership. As an industry, we have an opportunity to dispel mortgage qualification misconceptions that prospective homebuyers have and, at the same time, educate housing professionals about ways to better meet their needs.

In the same study, future homebuyers were asked to demonstrate their knowledge of the mortgage process and the affordable options available. Among respondents, 73% were unaware of lower down payment options that range from 3% to 5% of a home’s purchase price.

This is an important realization, considering that 31% cited not being able to come up with a down payment as one of the key challenges holding them back from homeownership. These findings align with a 2018 Fannie Mae survey in which many of the 3,000 respondents overestimated the minimum credit score and down payment necessary to qualify for a mortgage, and remained unfamiliar with low down payment programs.

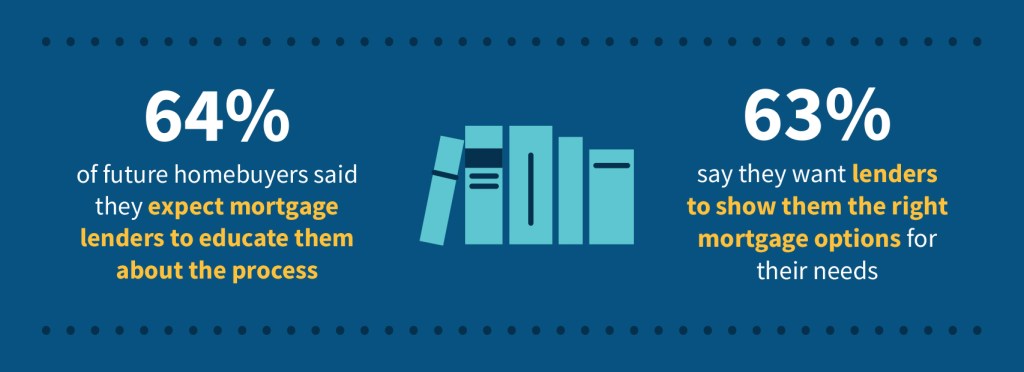

This lack of mortgage knowledge and understanding might seem bleak, but it is actually a great opportunity for our industry to provide educational resources. Fannie Mae research found that 64% of future homebuyers said that they expect mortgage lenders to educate them on the process, and 63% said they want mortgage lenders to show them the right mortgage options for their needs. This demonstrates that many of the barriers preventing more homeownership can be overcome with more outreach and deeper engagement.

Fannie Mae offers many resources to help educate homebuyers about their options to purchase a home and show them how to stay in that home if they experience financial hardship. Educational resources available through KnowYourOptions.com, the Framework homeownership education course, and HomePath.com can help homebuyers better understand the mortgage process and what’s possible within their budget.

Fanniemae.com also offers a wide range of materials for lenders and real estate professionals that can help them serve more prospective homebuyers who may need help preparing for long-term homeownership. This can help to ensure that borrowers are not only ready to purchase a home, but that they understand and are prepared to manage the responsibilities of homeownership.

The obstacles to homeownership are very real for many people. However, education is a powerful tool in helping prospective homebuyers better understand their buying power, know what options are available to them, and prepare for sustainable homeownership. Fannie Mae, along with lenders, real estate professionals, housing counselors, and others can all play a role in helping prospective homebuyers become successful homeowners.

Visit FannieMae.com/Affordable and read more about our approach to making housing more affordable.

See our Infographic to learn more about the power of borrower education.

Sources: Fannie Mae, “Future Homebuyers,” Single-Family Strategy & Insights unpublished research (November 2019). | Fannie Mae, “Manufactured Housing,” Single-Family Strategy & Insights unpublished research (December 2019). | Fannie Mae, “Builders,” Single-Family Strategy & Insights unpublished research (December 2019). | Fannie Mae, “Consumers Continue to Overestimate Mortgage Requirements,” Economic and Strategic Research (June 2019). | Hickey, “2019 State of the Nation’s Housing Report: Lack of Affordable Housing,” Habitat For Humanity (2019).