Home prices showed resilience in May as buyers took advantage of the relatively lower rates during that month, keeping the pressure on available inventory.

The S&P CoreLogic Case-Shiller home price index posted a 0.7% month-over-month increase after a seasonal adjustment in May — marking the fourth consecutive monthly increase. The 10-city composite gained 1.1% and 20-city composite posted an increase of 1%.

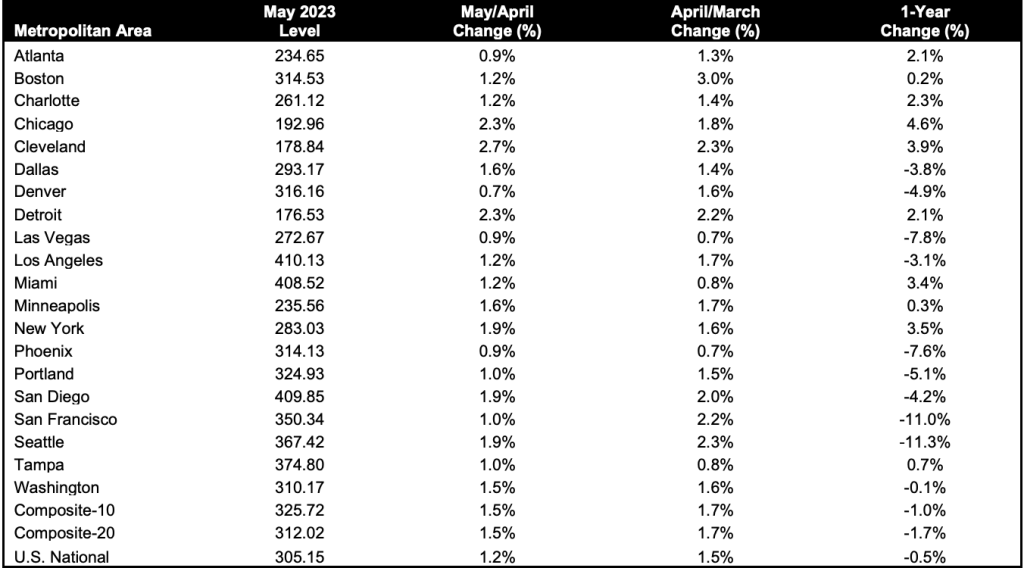

Compared to May 2022, the home price index posted a -0.5% annual decrease in May, down from a loss of -0.1% in the previous month.

“The rally in U.S. home prices continued in May 2023,” Craig Lazzara, managing director at S&P DJI. “The ongoing recovery in home prices is broadly based.”

Seasonally adjusted data showed rising prices in 19 of the 20 cities in May, repeating April’s performance.

Chicago (4.6%), Cleveland (3.9%) and New York (3.5%) posted the largest price gains.

At the other end of the scale, the worst performers were along the Pacific coast — with Seattle (-11.3%) and San Francisco (-11.0%) at the bottom.

The Midwest (+2.7%) unseated the Southeast (+2.1%) as the country’s strongest region in May and the West (-6.9%) remained the weakest.

Affordability pressures

“This month’s index data tracks prices for March, April and May, a period during which mortgage rates spanned a 0.5 percentage point range, but largely remained on the low end,” Hannah Jones, economic research analyst at Realtor.com, said.

The 30-year mortgage rates dropped to as low as 6.3% in April, according to Mortgage News Daily. Rates were 6.8% on Monday, according to HousingWire’s Mortgage Rates Center.

While slightly lower rates motivated eager buyers to enter the housing market, dwindling home supply meant that this demand kept upward pressure on prices, Jones noted.

Still-high mortgage rates mean that many homeowners feel ‘locked-in’ by their current mortgage rate and are choosing not to sell, leading to dwindling existing home inventory, and in return, existing home sales falling nearly 20% year-over-year.

Sales of existing homes dipped in June, slipping 3.3% to a pace of 4.16 million – the slowest since January, according to the National Association of Realtors (NAR).

Low inventory and surprisingly resilient housing demand have kept home prices stable or rising in many markets, but affordability will be challenged as more inventory begins to come on line later this year, Lisa Sturtevant, chief economist at Bright MLS, noted.

As a result, it’s possible that the “bottoming out” of home prices is just the first half of a “w-shaped” pattern in the market, according to Sturtevant.

“With households running through their savings, student loan payments set to resume, job growth slowing, and mortgage rates remaining above 6%, affordability is going to be a bigger factor in the months ahead,” Sturtevant said.

Where will prices go from here?

With existing homeowners feeling reluctant to give up their record-low mortgage rates, builders have been all smiles as buyers turn to new construction.

Some economists believe that multi-family and single-family construction will take some pressure off prices as inventory grows.

“Strong multi-family construction activity suggests that there may be relief on the horizon for renters as inventory grows, taking some pressure off prices. Similarly, the recent pick up in single-family construction indicated that builders are looking to fill the gap left by existing home inventory,” Jones said.

On the other hand, some buyers are more accepting of current mortgage rates which will keep upward pressure on prices during the peak summer season, George Ratiu, chief economist at Keeping Current Matters, a real estate insights and analytics company, noted.

“As homebuyers, buoyed by a solid job market and rising wages, accept current mortgage rates as the new normal, even a moderate pace of transactions will keep upward pressure on prices during the peak summer season. We can expect prices to show a typical return to historical patterns as we move into the second half of the year,” Ratiu said.

The second half of 2023 will still depend on the actions of the Federal Reserve and response in economic activity, Ratiu projected.

The central bank is most likely to raise interest rates by 25 basis points on Wednesday, continuing its monetary policy tightening.

“The last four months’ price gains could be truncated by increases in mortgage rates or by general economic weakness. But the breadth and strength of May’s report are consistent with an optimistic view of future months,” Lazzara added.