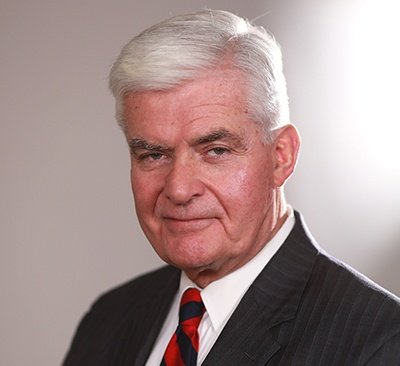

The leadership team at Harbor Mortgage Solutions — including George Downey, Chris Downey and Brett Kirkpatrick — have made the move to Chicago-based Federal Savings Bank and are now operating Harbor as Federal’s newest branch.

The move comes as the bank sets its sights on scaling the reverse mortgage business.

Aligned interests

“The Federal Savings Bank is proud to welcome the Harbor Mortgage Solutions Team,” the bank said in an announcement Wednesday. “This not only strengthens the bank’s capabilities in both conventional and Home Equity Conversion Mortgages (HECMs) across the United States but also extends local operations and face-to-face consultations in Massachusetts.”

The Harbor team’s expertise in reverse, jumbo and conventional will “further [enhance] the Federal Savings Bank’s capacity to cater to diverse financial needs nationwide,” the company said.

Downey said this move had been in the works for nearly a year.

“As we read the tea leaves and saw the changing markets, the mortgage industry obviously has changed dramatically,” Downey said. “They’re particularly interested in developing their reverse mortgage offerings, and it is a pretty robust organization. They have a very, very broad portfolio of loan offerings, with a keen interest in developing within the reverse mortgage space.”

Downey said the additional resources from the bank will allow the Harbor team to move beyond its broker status — and the geographic area of Massachusetts and Rhode Island.

“In addition to having the resources that they have, it enables us to extend our marketing to all 50 states,” he said.

Market evolution and education

Because of headwinds in the traditional mortgage space, reverse mortgages have become more attractive to lending institutions, Downey said. Given the leaders’ specialty expertise and connections, including the National Reverse Mortgage Lenders Association (NRMLA) and lawmakers in the midst of state lobbying efforts, the fit seemed natural, he said.

Downey is a former member of the NRMLA board, a role now held by his son Chris. The shift was announced at the association’s annual meeting for George.

There are potential educational benefits with the new partnership as well, Downey said. Considering the increase in resources now available to the Harbor team, and the bank’s willingness to expand its reverse mortgage capabilities, educating consumers is at the front of Downey’s mind.

“What is less well-known is the planning capabilities that reverse mortgages bring,” he said. “I would now consider this to be a really offensive opportunity to work with the financial planners, which we do for the most part. We want to work in educating them to see the planning potential of the reverse mortgage.”

The point is sharpened by what home price appreciation has done over the past few years, according to Downey.

“As we stand back and look at housing, wealth, it is a significant, if not the most significant single asset that people have,” he said. “It has never been an integral part of the financial planning process, but it could be.”

What the industry should know

Downey is conscious of what the move to Federal Savings Bank may accomplish for the reverse mortgage industry. While his team has been accustomed to doing things in “[their] own way” for the past 30 years, it will also allow them to deploy more marketing and recruiting resources while working to expand the reverse mortgage business.

“They have resources and expertise that will enable us to fast forward that activity,” he said.

At the end of the day, Downey said product education will remain key, and with additional resources, he looks forward to continuing to work toward his goal of expanding the reach of the reverse mortgage business.

“The people are just not aware of [the product],” he said. “And so, they will hopefully give us the full board that we’ll be able to use to not only increase our business, but increase awareness. So I think that would be my takeaway, and to perhaps encourage other people that are in the business to do likewise.”