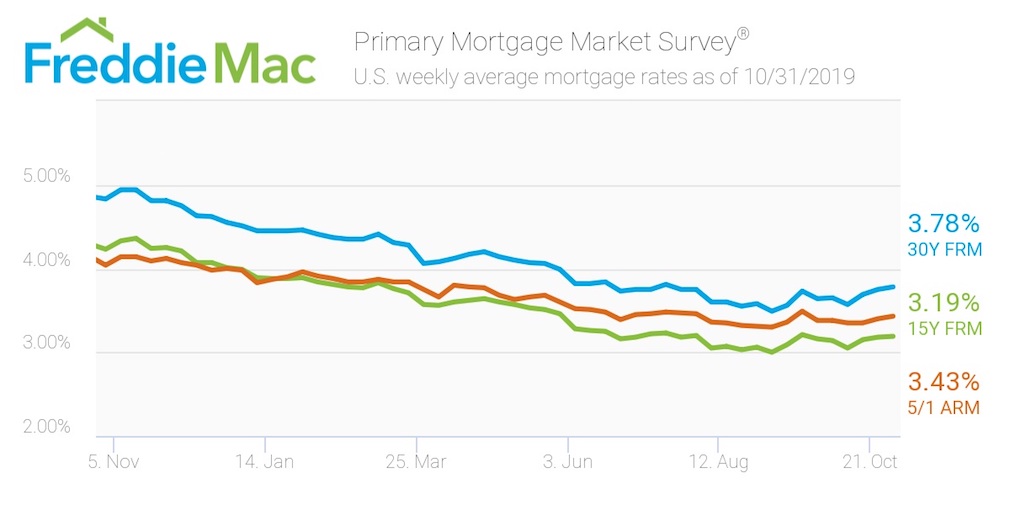

This week, the average U.S. fixed rate for a 30-year mortgage rose to 3.78%. That’s 3 basis points above last week’s 3.75% but still more than a percentage point below the 4.83% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“This week marks the third consecutive week of rate increases, which hasn’t happened since April of this year. That said, purchase activity continues to show strength, indicating obvious homebuyer demand,” said Sam Khater, Freddie Mac’s chief economist. “However, the lack of housing supply remains a major barrier to not just the housing market, but the overall economic recovery.”

The 15-year FRM averaged 3.19% this week, crawling forward from last week’s 3.18%. This time last year, the 15-year FRM came in at 4.23%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.43%, ticking up from last week’s rate of 3.4% That being said, the percentage still sits well below 2018’s rate of 4.04%.

The image below highlights this week’s changes: