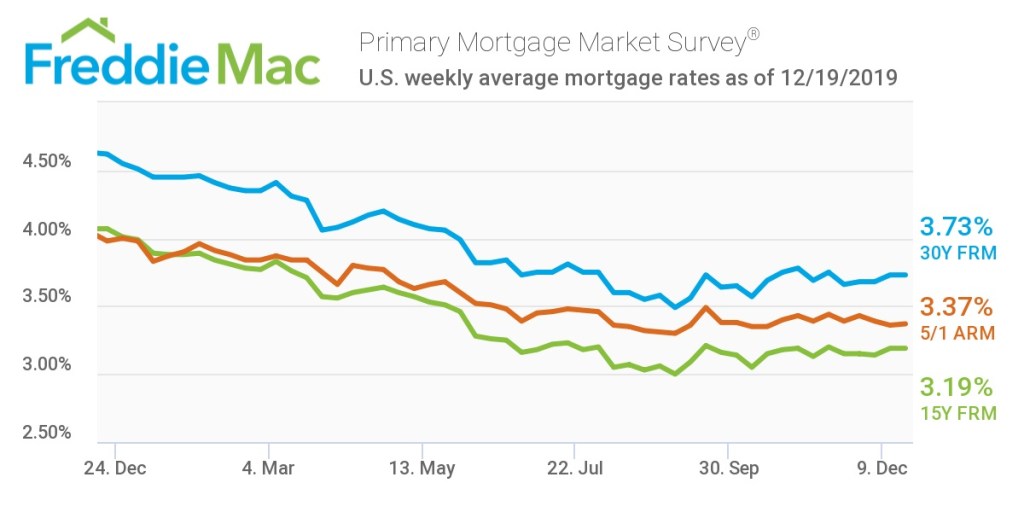

This week, the average U.S. fixed rate for a 30-year mortgage held steady at 3.73%. Although this rate remains the same as last week’s percentage, it’s still more than a percentage point below the 4.55% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

The 15-year FRM averaged 3.19% this week, remaining unchanged from last week’s rate. This time last year, the 15-year FRM came in at 4.01%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.37%, inching forward from last week’s rate of 3.36%. Last year, the 5-year ARM sat much higher at 4%.

Although rates continue to hover near historic lows, Sam Khater, Freddie Mac’s Chief Economist, warns a lack of housing supply is likely to dampen home sales moving into 2020.

“The economy continued to pick up momentum with a solid increase in residential construction, improvement in industrial output in our nation’s factories and a rise in job openings,” Khater said. “While the economy is in a sweet spot, improvements in housing market sales volumes will be modest heading into next year simply due to the lack of available inventory.”

The image below highlights this week’s changes: