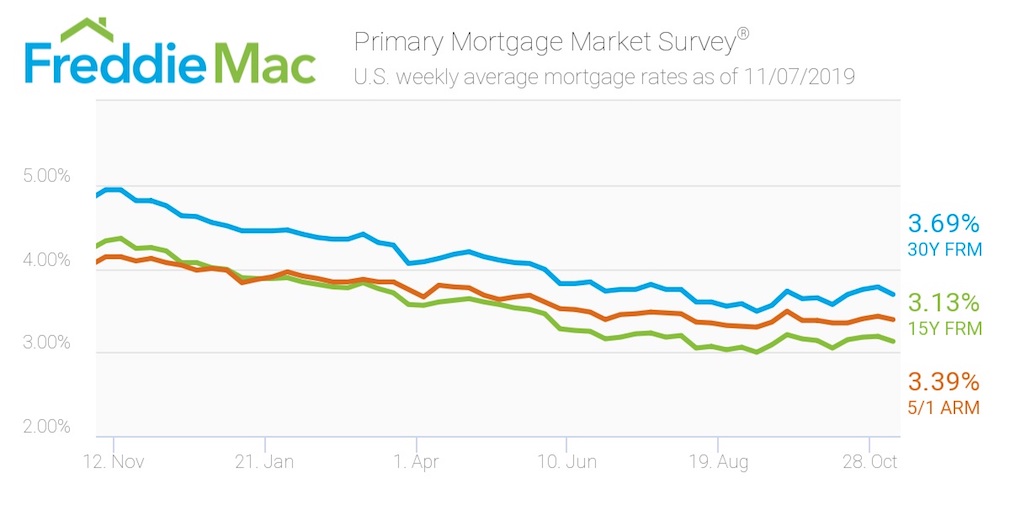

This week, the average U.S. fixed rate for a 30-year mortgage rose to 3.69%. That’s 9 basis points below last week’s 3.78% and still more than a percentage point below the 4.94% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“After a year-long slide, mortgage rates hit a cycle low in September 2019 and have risen in six out of the last nine weeks due to modestly better economic data and trade related optimism,” said Sam Khater, Freddie Mac’s chief economist. “The improvement in sentiment has been one of the main drivers behind the surge in equity prices and will provide a halo effect to consumer spending heading into the important holiday shopping season.”

The 15-year FRM averaged 3.13% this week, sliding from last week’s 3.19%. This time last year, the 15-year FRM came in at 4.33%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.39%, retreating from last week’s rate of 3.44%. The percentage remains significantly lower than its 2018 rate of 4.14%.

The image below highlights this week’s changes: