With the 2020 presidential election in full swing, the field of Democratic candidates has narrowed considerably since the first debates in 2019 while primary challengers for the Republican nomination have largely fallen by the wayside due to the party’s support of the current President of the United States. Whoever is elevated to the highest office of the land in November will have significant control over the destiny of reverse mortgages in general and the Home Equity Conversion Mortgage (HECM) program specifically.

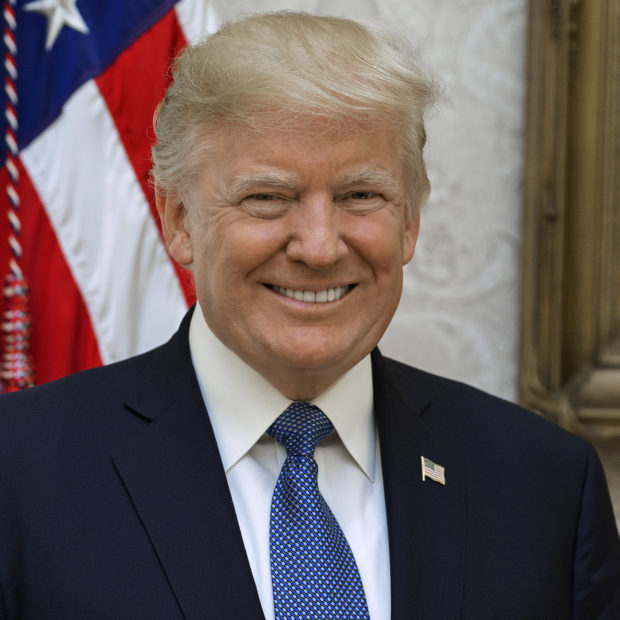

In our second of two looks at the field of prominent presidential candidates and their perspectives that may inform how they view the reverse mortgage industry, RMD takes a look at current Democratic Party front-runner Senator Bernie Sanders of Vermont, and incumbent President of the United States Donald J. Trump.

It’s hard to find two more ideologically-opposed candidates, but some of the perspectives shared by Sanders and some of the policies put into place by Trump seem to indicate shared support for seniors to age in place.

Bernie Sanders: aging in place proponent, reverse mortgage skeptic

Vermont Senator Bernie Sanders is technically independent in terms of his party affiliation, but has recently become the front-runner for the Democratic presidential nomination based on a recent poll conducted by ABC News and the Washington Post. While Sanders has not spoken specifically about reverse mortgages on the record, a few instances of interaction with the reverse mortgage product concept paint a picture of what his perspective may be concerning them.

On his official Senate website, Sanders has posted articles related to the reverse mortgage industry in a section called “must-reads.” One such posting from 2008 came from the New York Times, detailing a reverse mortgage borrower who told the outlet that she was maneuvered into applying her loan’s proceeds to a number of complex investments, minimizing the amount of cash she was able to take. While the story mentions that many surveyed borrowers had a high level of satisfaction, it focuses on unscrupulous tactics.

However, a 2016 story in The Atlantic highlighted in the “must-reads” section of Sanders’ Senate website also describes an increasing number of poor seniors in America, and reverse mortgages are illustrated as a possible solution, albeit one that should be among a senior’s final considerations.

Sanders was in the Senate at the time the Reverse Mortgage Stabilization Act of 2013 was passed, voting with his colleagues to approve it via unanimous consent. Its previous passage in the House allowed it to go to the desk of then-President Barack Obama, who signed it into law on August 9, 2013. Passage via unanimous consent can only take place if there is no single Senator wishing to present any objections.

In 2018, Sanders voted against the nomination of Brian D. Montgomery as Commissioner of the Federal Housing Administration, though Montgomery was ultimately confirmed by the full body. Montgomery’s nomination received support from prominent members of the reverse mortgage industry, up to and including the then-president of the National Reverse Mortgage Lenders Association (NRMLA).

Sanders ran unsuccessfully for the 2016 Democratic presidential nomination, and began his campaign for the 2020 nomination in February of last year. In late summer of 2019, Sanders tweeted a story from the Washington Post detailing an “elder boom” in the state of Maine, and detailed his support for seniors to be able to age in place.

“No senior should have to sell their belongings or spend their life savings just to be able to age in place,” Sanders said. “Under the Medicare for All, long-term, home-based care will be guaranteed as a right to every senior and person with a disability in America.”

Donald Trump: HECM track record, reform proposals

As the incumbent President of the United States, Donald Trump’s administration has had a notable impact on the reverse mortgage industry since coming into office in January of 2017. That August, newly-installed HUD Secretary Dr. Ben Carson announced that the department planned to increase premiums and tighten lending limits on reverse mortgages due to concerns about the strength of the program and taxpayer losses to the Mutual Mortgage Insurance Fund (MMIF).

“Given the losses we’re seeing in the program, we have a responsibility to make changes that balance our mission with our responsibility to protect taxpayers,” HUD secretary Ben Carson said in a statement emailed to RMD at the time. “Fairness dictates that future HECM loans do not adversely impact the overall health of FHA’s insurance fund, which supports the financing needs of younger, mostly first-time homeowners with traditional FHA mortgages.”

The impacts of the changes, which went into effect that October 2, are still being felt today. It was followed in 2018 by the institution of a collateral risk assessment, which sometimes results in the requirement of a second property appraisal. These changes largely resulted in a demonstrable atrophy of the reverse mortgage industry, though Trump Administration officials have contended recently that the changes instituted are now having their intended effects on the health of the HECM program.

“The HECM portfolio shows dramatic improvement due to program changes, along with the health of the economy and housing market,” said FHA Commissioner Montgomery in November 2019.

The Trump Administration has also proposed further reforms to the HECM program, including administrative proposals that would not require congressional approval: the development of new HECM servicing standards and the elimination of HECM-to-HECM refinancing. A legislative proposal the plan makes is to revise the loan limit structure in the HECM program to reflect variation in local housing markets, as opposed to operating off of one national HECM lending limit as is currently the case.

The currently turbulent political climate in Washington, D.C. may not result in any substantive reverse mortgage changes until after the conclusion of the 2020 presidential election, in which President Trump is running for a second term. HUD Secretary Carson has stated, however, that he will likely not remain in his post should the president be re-elected.