As the U.S. rushes to inoculate the current global health crisis, the real estate and mortgage finance industries are facing their second wave of significant industry headwinds in little over a decade.

Though the pandemic is causing pain throughout the housing sector, it also creates an opportunity to enact common-sense industry reforms that address the root causes of the affordable housing crisis that has beset the market for over a decade — even amid a period of strong economic expansion.

We simply cannot overlook the reality that there are not enough homes in the United States to house every American. Regrettably, that gap has only widened since the global financial crisis. Every year since 2007, the rate of household formations outstripped the number of housing completions, despite relative strength in both the overall housing market and U.S. consumer spending.

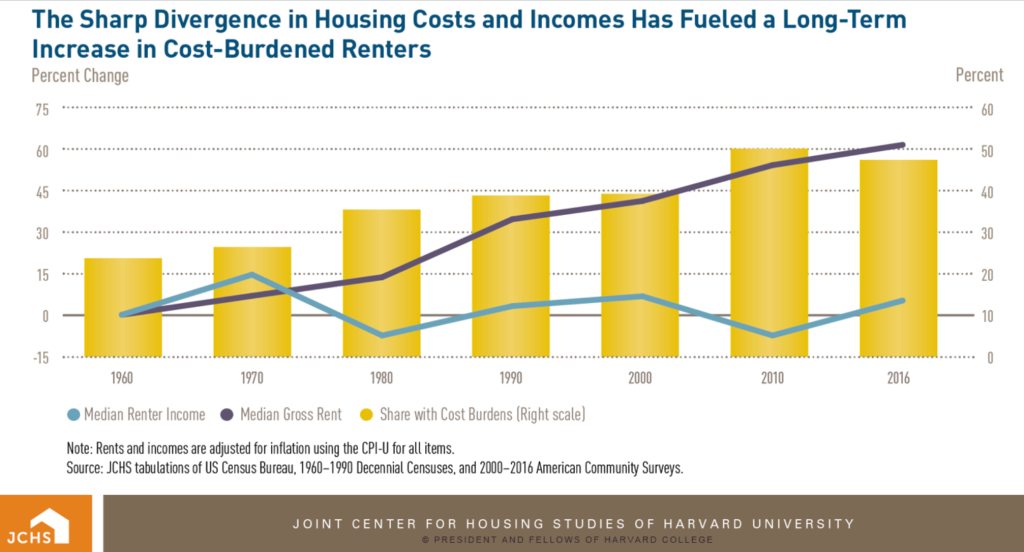

At the same time, rents have increased faster than incomes, to the point where some 18 million Americans are spending more than half their income on housing expenses.

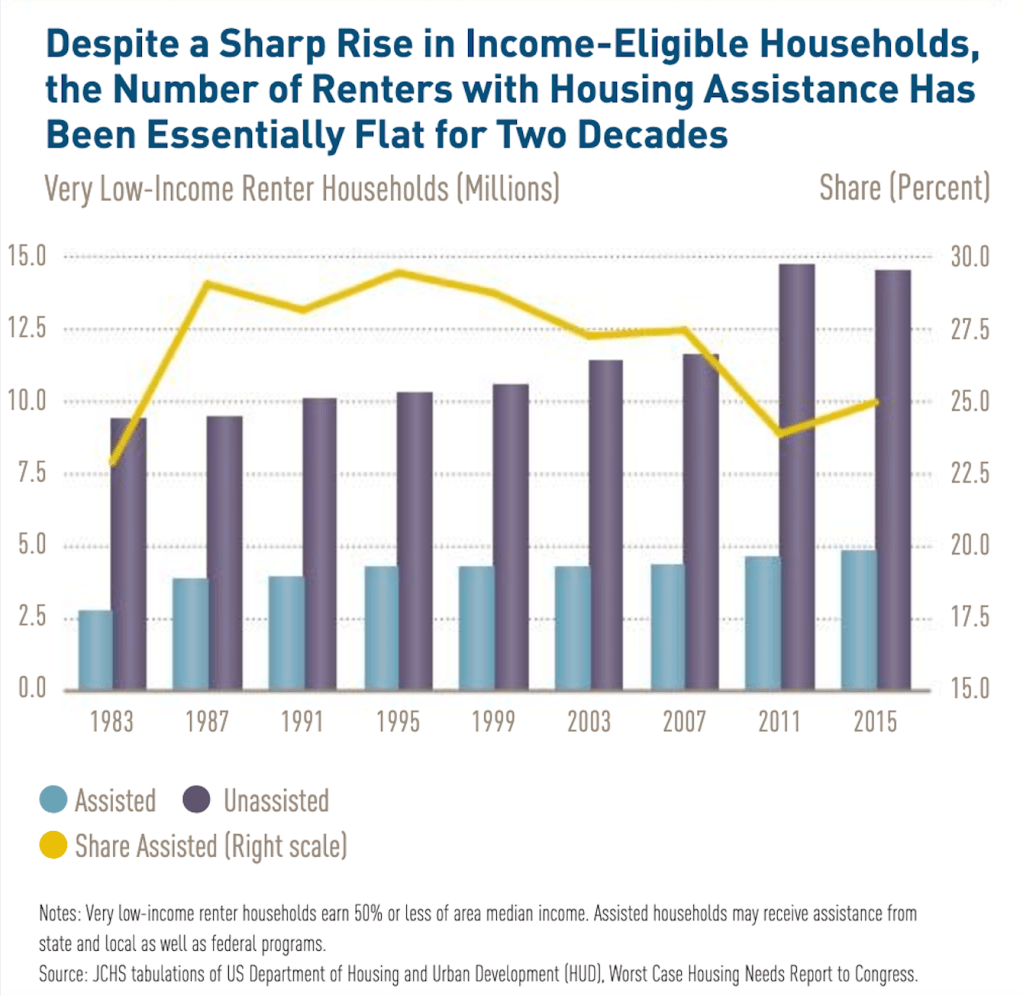

The U.S. has a shortage of 7 million affordable rental units for families with incomes at or below the poverty line and the number of very-low income households with housing assistance has remained flat for decades, while the number of income-eligible households has sharply increased.

Prioritize affordable housing…really

In essence, the U.S. has failed to expand access to affordable housing at every level following the financial crisis, which is particularly ironic given that crisis originated in the housing sector.

Given the economic magnitude of the pandemic and lingering uncertainty surrounding when and how it will be contained, the housing sector is poised for change — particularly if eviction and foreclosure moratoriums continue to strain industry participants. We have seen market cycles like this play out before, and we must not let past mistakes mask the opportunity a crisis creates to truly prioritize and address affordable housing.

If the housing industry is forced to undergo another overhaul, we need to think about the type of industry we want to build and how we can use this crisis as an opportunity to expand access to the American dream. If we truly want to prioritize affordable housing in this country, I believe there are three common-sense initiatives that could immediately enable the industry to better address this issue.

Standardize and digitize

First, we need to standardize and digitize the regulatory infrastructure the entire industry relies upon. It’s no revelation that we all work in an antiquated system, but the coronavirus has brought into focus just how dependent the industry is on paper documents, the postal service and person-to-person contact. Further complicating the issue is the fact that the process differs across each locality, and that means some have been able to continue closing deals during stay-at-home conditions while others have not.

The real estate industry is wholly dependent on a patchwork of manual review processes that could very easily be standardized and digitized. The existing system creates unnecessary market frictions that significantly increase transaction costs, yet benefit no one. Other countries, including England, have developed digital national systems for processing and recording mortgage and property transactions. It’s time for the U.S. to do the same.

A public, searchable system of digital property records can only serve to lower transaction costs and improve outcomes for all market participants.

Reform zoning laws

The second reality we must address is that the physical space needed to build additional housing stock is limited, and therefore expensive. Since we cannot create more land, the only alternative is to increase housing density. Here again, the decentralized network of municipal law has handicapped the industry’s ability to respond to the pressing need for more affordable housing.

Across the country, local zoning ordinances have consistently been designed to inhibit the development of medium and high density-housing. In some areas, zoning boards have restricted homeowners from even building a carriage house on their property, citing increased density. These regulations artificially inflate property values. If zoning regulation and approval were administered at the state, rather than local level, long-term housing policies could be developed specifically targeting the areas hardest hit by the affordable housing crisis.

This would be decried by some as an invasion of local authority and a boon to the housing industry at the expense of existing property owners, but the cold truth is that the economics of affordable housing do not work if zoning laws artificially inflate property values.

Incentivize entrepreneurs

Finally, we need to renovate our existing housing stock. Real estate is one of the few remaining avenues for wealth creation open to those without advanced education or specialized skills. We need to harness the entrepreneurial spirit of our industry and incentivize small contractors, property owners and developers to renovate, rehab and repurpose existing housing to better reflect the changing demographics and preferences of the housing market.

We can achieve this both through policy and access to capital. A serious effort to renovate America’s aging housing stock in the aftermath of the coronavirus crisis would spur economic activity, create jobs, increase tax revenue and provide safe, healthy neighborhoods in both urban and rural areas across the U.S.

It has been incredibly heartening to see this industry band together with innovative responses to this unprecedented crisis. We have seen lenders and borrowers, landlords and tenants, and trade associations and regulators working together to preserve the market ecosystem. But no matter what results from the current crisis, the housing sector only stands to benefit from a more inclusive future.

If we can collectively act as one industry to respond to a pandemic, we can also band together to advocate for an expansion of the American dream. Through coordination, smart policy choices and partnership with every level of government, the U.S. housing industry can grow and prosper as it expands access to affordable housing from coast to coast.

But if we continue to ignore the affordable housing crisis, we will be guilty of failing to learn from past mistakes. And as an industry, we will be guilty of fixing one crisis while watching another one worsen.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

John Beacham at jbeacham@toorakcapital.com

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com