You know what loan officers and real estate agents love almost as much as cashing a commission check? Complaining about other loan officers and real estate agents. And they have good reasons to do so.

Talk to a top producer in either field and he or she will tell you: the biggest problem their respective industry faces is that there are far too many sloppy, inexperienced, yee-haw types who, I’m sorry, just shouldn’t be in this business! Those people harm consumers as well as industry professionals by wasting time, making mistakes and driving up acquisition costs, they’ll tell you.

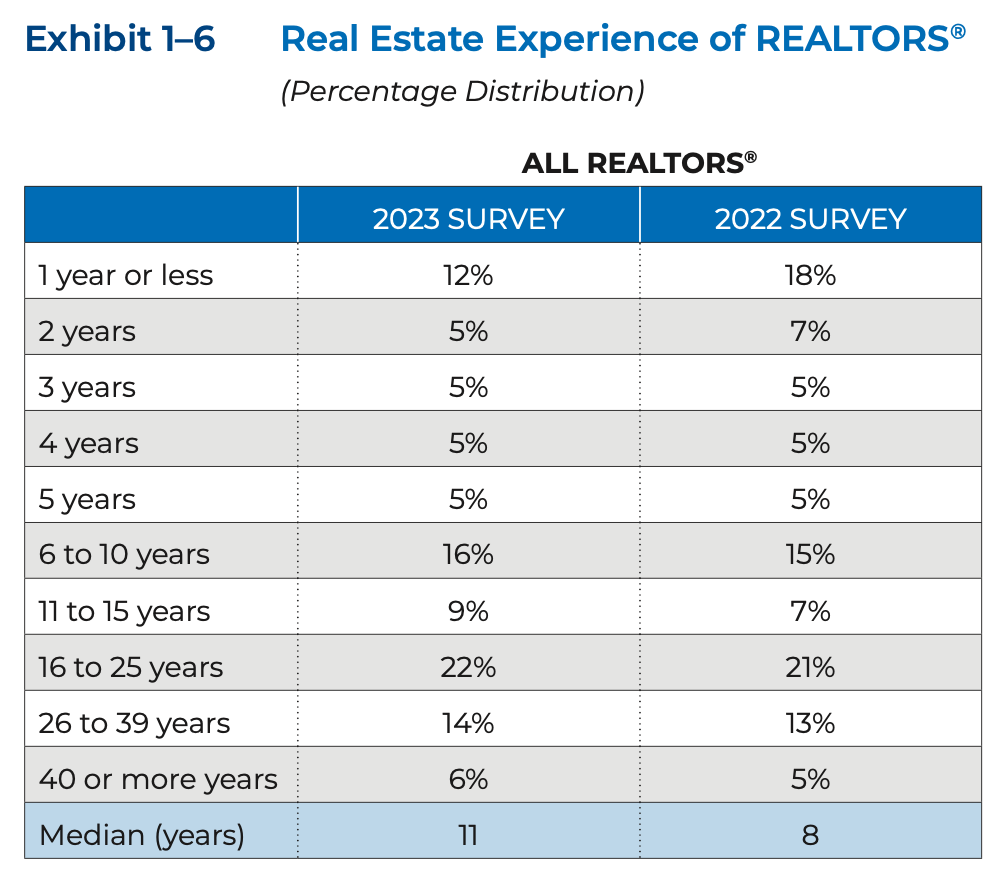

It shouldn’t surprise you that a sizable percentage of newer LOs and real estate agents are washing out in the current market. The latest statistics from the National Association of Realtors found that the percentage of agents with fewer than two years of experience fell to 17% in 2022 from 25% in 2021. Meanwhile, the number of active nonbank loan officers is about a third lower than it was during the glory days in 2021, several industry sources told HousingWire.

But at 343,000 workers in May, the mortgage LO workforce remains quite elevated for the origination volume being produced. And there are north of 1.5 million Realtors competing for about 4.2 million existing home sales.

There are compelling arguments that the housing industry should shed far more agents and LOs than it currently is. Like, a lot more. So let’s dive in a little deeper.

In March of 2021 the mortgage industry was running at a $4.4 trillion annualized pace. The industry is down about 75% from that level, at an annual pace of between $1.2 trillion and $1.4 trillion in 2023.

“That’s still nuclear winter-ish kind of volume, especially for the size of the industry. The industry has not shrunk 75%,” Brian Hale, founder and CEO of Mortgage Advisory Partners LLC, told my colleague Bill Conroy.

Looking at the productivity of the LO’s real estate agent partners is key, he said.

“The top 1.5% of real estate agents last year accounted for 68% of all sales in America. That’s a shocking number,” Hale said. “If you go up to the top 2%, you’re at about 75%. If you go to the top 10%, you’re north of 90%.”

But in many cases, LOs are still calling and looking for business from the bottom 50% of Realtors, Hale said. (The typical NAR member averaged one deal per month in 2022, according to the latest NAR Member Profile.)

This is among the market inefficiencies caused by too many unproductive agents and LOs chasing nonexistent leads. It’s no wonder that the cost to originate a mortgage is over $10,000.

Garth Graham, a senior partner at mortgage M&A shop STRATMOR Group, told Conroy that roughly 80% of the volume is done by 40% of the loan originators. He estimated that about 75% of mortgage companies lost money in the first quarter, and a big reason is they pay relatively high compensation for LOs who simply aren’t doing the volume to warrant it.

In other words, the housing industry is still carrying a lot of dead weight.

“We still don’t have enough sales, and if you want to be successful in the mortgage business, you have to do business not just with people who are in real estate, but you have to do business with people who sell real estate,” Hale told Conroy. “There is a big difference between being in real estate versus actually selling real estate. And even the big ones are finding volume difficult to get a listing on. Valuable people today are those with listings.”

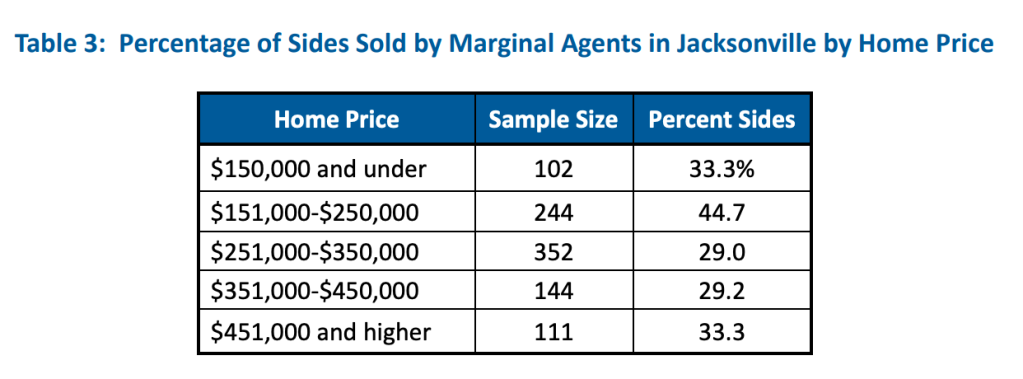

Relatedly, the Consumer Federation of America released an intriguing study this week that examined 1,000 deal sides each for home sales in Minneapolis, Jacksonville and Albuquerque during a few months in 2021 and 2022. The CFA study found that “marginal agents” – who completed five or fewer sales over the past year – took home between 25% and 30% of the overall commissions in each market. That’s not a positive.

“Industry experts have noted that this surfeit of agents creates economic inefficiencies, deprives full-time agents of needed income, frustrates both consumers and experienced agents who must deal with inexperienced agents, forces agents to spend inordinate time and money acquiring new customers, reinforces relatively high and uniform commission rates, and damages the reputation of the industry,” the trade group argued.

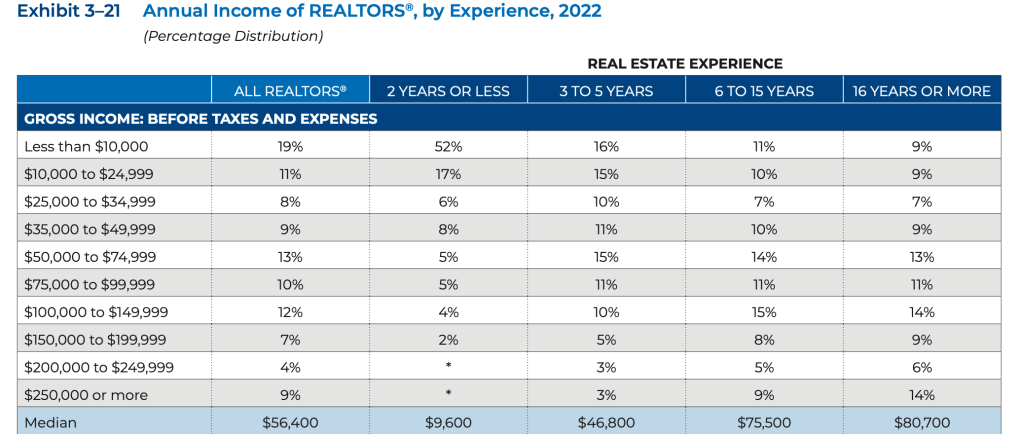

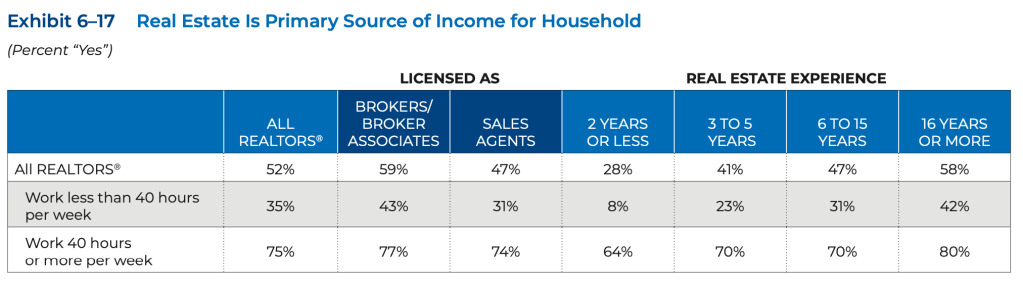

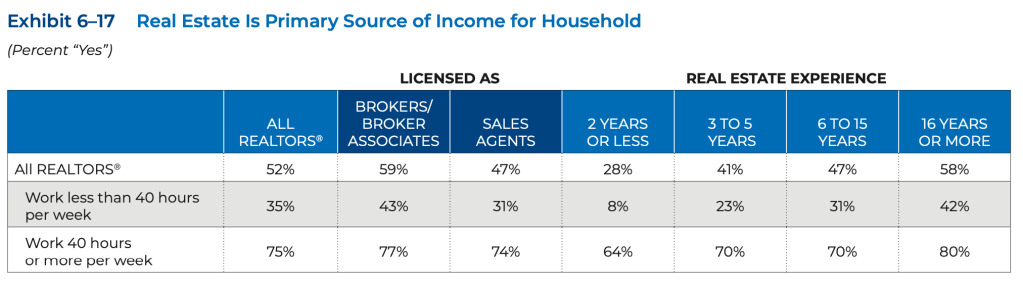

Indeed, the median real estate agent in 2022 worked just 30 hours a week, according to the NAR. And nearly 50% of agents worked fewer than 40 hours per week. You won’t be surprised to read that part-time agents aren’t very productive or able to generate much income from doing a couple deals a year – many make under $10,000 a year in commission income.

It’s not just Side Real Estate’s Guy Gal who would argue that part-time real estate agents cause more harm than good. My Aunt Betty doing a deal or two a year doesn’t benefit the industry or consumers. How many billions of dollars in commissions go to uneducated, unprofessional, mistake-prone agents and LOs? How many hours do full-time professionals waste chasing leads that go to the Aunt Bettys of the world? Residential mortgage lending and real estate brokerages are low-margin businesses; if we want a healthier housing industry, we should disincentivize part-time agents and stop paying high comp to average or below-average LOs.

One quirk that I found especially interesting in the CFA study was that those “marginal agents” were just as likely to work a deal at the highest sales category in Jacksonville, Minneapolis and Albuquerque as they were the lowest.

Anyway, what do you think about all this? Share your thoughts with me at james@hwmedia.com.

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann breaks down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email him at james@hwmedia.com.

Regarding real estate agents it has been true for decades that there are too many of us. There’s a low barrier to enter the business and large traditional companies do better when they have a lot of agents because there’s not much overhead involved with hiring an agent given they’re not employees. The more agents you hire the better chance you have a getting Aunt Betty’s 1 or 2 family transactions each year. No doubt Aunt Betty is a nice person but she’s not up to speed on most things real estate so it makes the transition a real grind and prone to errors. I’m for W-2 employee agents and much more training prior to licensure.

The mortgage industry needs more policing. Way too many borrowers are being place into loan programs (FHA, non QM,) etc by the loan officer because the loan officer can make a higher commission. That’s unacceptable and needs to stop.

Home builders that own a mortgage co are forcing buyers to use their in house lender in order to obtain a credit, while charging points and higher rates.