For years broker channel evangelists told me that a down market would give them an edge on their retail brethren. Well, it’s certainly been a down market. How has the broker channel fared in the wake of the Fed rate hikes?

We asked the good folks at mortgage data technology firm InGenius to run the numbers, comparing the first six months of 2022 to the first six months of this year. Take a look.

“From the first six months of 2022 to first six months of 2023, brokers have increased their percentage from 23% to 28% while retail has decreased by that same percentage,” Jeff Walton, CEO and co-founder of InGenius, said. “There’s definitely a shift and while we know there is a lot of movement going on with people losing jobs because of mergers or closures, a certain percentage are moving to brokerage instead of another retail company.”

It shouldn’t come as a great surprise that wholesale has gained market share as refi activity has slowed. A significant number of retail lenders were purpose-built to pump out huge refi volumes with a call center model. Broadly speaking, the broker space tends to be more relationship focused, which lends itself better to a purchase environment.

Though virtually every mortgage lender is down because of the high-rate environment (excepting homebuilder-affiliated mortgage firms, of course), purchase volumes are still above 2019 levels. It’s refinancings that have fallen off a cliff, and they are unlikely to return in force in 2024. Should current market conditions remain, I expect the broker channel to gain a couple more points of market share over the next year (even after several notable lenders exited the channel and United Wholesale Mortgage exerts its dominance).

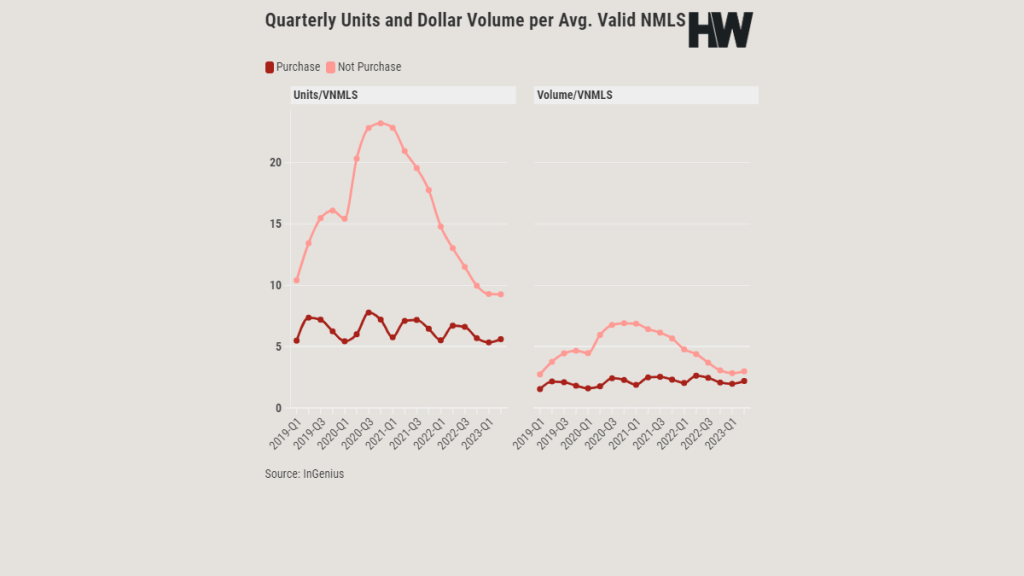

Setting channel side, where are we in terms of the overall LO landscape? Let’s look at InGenius’ data on the number of loan officers and corresponding production levels.

The InGenius data dating back to Q1 2019 points to some sobering trends. In Q2 2023, the number of valid LOs fell to 89,094. That’s well below the high of 181,656 achieved in Q3 2021 and even the average of about 146,000 since early 2019.

Since Q1 2019, the average LO has pumped out just under 16 loans per quarter at $4.8 million in origination volume. At the height of the boom, in Q1 2021, the average LO originated nearly $6.9 million. But in Q2 2023, the average LO generated just 9 loans worth $2.9 million. It’s a big drop.

If you’re looking for a silver lining, it’s undoubtedly that purchase volume per LO has remained consistent. The average LO achieved $2.2 million in purchase volume in Q2 2023, besting the average since Q1 2019.

It’s not crazy to think that the LOs who haven’t been able to generate enough purchase business have already washed out. About 20,000 LOs have dropped out per quarter since Q2 2022, per InGenius data. How many more are just hanging on?

While the next year will likely continue to be a relative struggle for even high producers (many of the industry’s best are down 50% year-over-year), the opportunities for purchase-tested LOs when the market rebounds could be fantastic. All they have to do is survive.

In our weekly DataDigest newsletter, HW Media Managing Editor James Kleimann and Data Journalist Will Robinson break down the biggest stories in housing through a data lens. Sign up here! Have a subject in mind? Email James at james@hwmedia.com.