“Significant untapped growth potential,” touts a slide in an Offerpad Solutions Inc. presentation to investors in the blank-check SPAC that took the company public in 2020.

Offerpad is an instant buyer, or iBuyer, a company that gives sellers cash offers for their homes and attempts to resell the homes for a profit, sometimes after making renovations.

The slide, presented in March 2021, forecasted that Offerpad would sell nearly 15,000 homes in 2023. In reality, Offerpad has sold fewer than 3,000 homes through the first three quarters of the year, about a fifth of its projection for the entire year, the company reported last week.

“The largest, undisrupted market in the U.S.,” reads an Opendoor Technology Inc. presentation slide for investors in the SPAC that took it public, also in 2020.

The Opendoor presentation projected sales of more than 37,500 homes in 2023. The actual results for the first three quarters of 2023: about 16,500 homes, less than half of its projection for the year, according to its earnings report last week.

Opendoor set out on its disruptive journey in 2014, and Offerpad followed soon after in 2015. In 2018, Zillow and Redfin joined the fray with their own iBuying business segments.

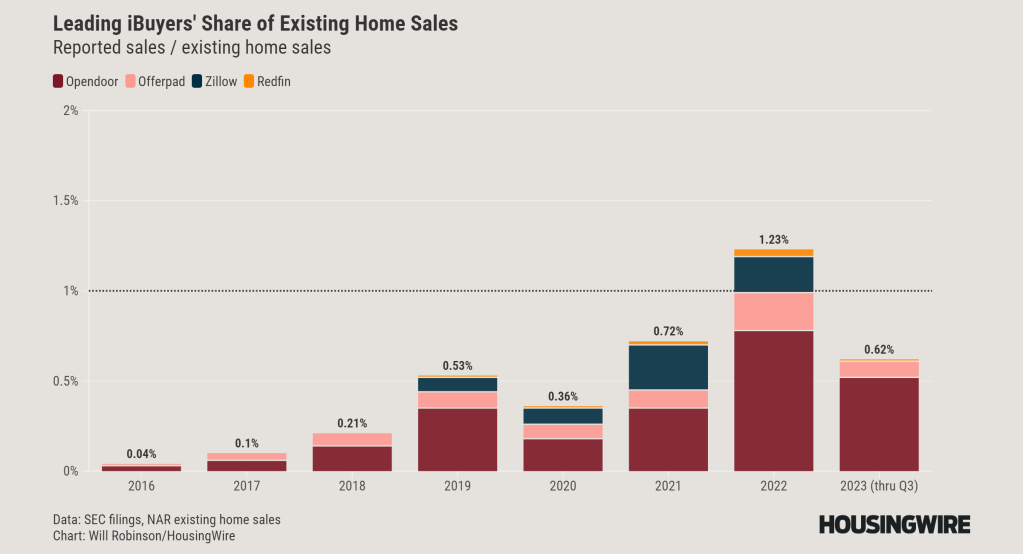

In the years that followed, Zillow and Redfin shuttered their iBuying divisions, and the two remaining iBuyers accounted for a mere 0.61% of existing home sales through the first nine months of the year, based on the companies’ reported home sales and unadjusted existing home sales data published by the National Association of Realtors.

While home sales are down nationwide in 2023’s high-mortgage-rate environment, sales data suggests the aspiring disruptors are losing ground to industry stalwarts.

Shrinking share, continuing losses

The leading iBuyers have accounted for more than 1% of existing sales in only one year: when Zillow was clearing its books of the ill-fated Zillow Offers’ inventory.

The share of existing sales transacted by Opendoor and Offerpad appears to have shrunk so far this year, based on the first nine months of the companies’ reported sales and NAR’s existing home sales data.

iBuyers have consistently produced steep losses as the companies seek to establish national footprints. Zillow Offers’ last full year of home sales netted a loss of $881 million. Opendoor lost about $1.4 billion last year.

In November 2021, about four years after its first home sale, Zillow decided to close its iBuying division. By the time it sold its final home in September 2022, the division had lost more than $1.5 billion.

In a letter to shareholders in 2021, executives cited unexpected market conditions – “a global pandemic, a temporary freezing of the housing market, and then a supply-demand imbalance that led to a rise in home prices at an unprecedented rate” – as a major factor in closing Zillow Offers. The volatility and unprecedented nature of the market, weakened Zillow’s price forecasting, crippling its ability to buy low and sell high.

But additionally, executives noted, customers did not seem happy with the iBuying experience.

“A final factor in the wind-down decision is that, to date, we have been able to convert only about 10% of the serious sellers who ask for a Zillow Offer, and have tended to disappoint the roughly 90% who didn’t sell to us,” the letter read.

The executives further expressed their belief that there are “better, broader, less risky, more brand-aligned ways of enabling all of our customers who want to move” than iBuying.

Redfin, too, threw in the towel on iBuying, completing their winddown of RedfinNow in June 2023. Redfin only began reporting the net loss attributable specifically to its iBuying segment in recent years, making its total losses less clear. However, the company lost more than $65 million in RedfinNow’s final six quarters.

Although they didn’t exit iBuying like Zillow and Redfin, both Opendoor and Offerpad as well as non-public iBuyers like Knock, Ribbon, Flyhomes and Homeward have also made significant job cuts in recent years.

Growth prospects

At the end of September 2022, Opendoor had 16,873 homes in inventory. For the same period this year, the company has 4,007. That is a 76% drop in inventory, despite the fact that Opendoor expanded to two new markets in the past year.

The company purchased about 5,000 fewer homes in the third quarter than the same period a year ago, although it noted in its shareholder letter that purchases increased 17% on a quarter-to-quarter basis.

With fewer homes to sell, Opendoor offered fourth quarter revenue guidance of $800-$850 million. At $850 million, that would be a decline of 70% year-to-year, or 13% quarter-to-quarter.

Despite the cuts to inventory and home purchases an annual basis, CEO Carrie Wheeler touted the company’s market share growth in the company’s earnings presentation.

She pointed out that Opendoor bought more homes quarter-to-quarter despite an 8% drop in the number of homes for sale in Opendoor’s markets. Thus, the company’s share of the available inventory increased on a quarterly basis.

Wheeler also noted the company netted a positive “contribution margin” in the third quarter for the first time in several quarters. Contribution margin is a non-GAAP, supplemental measure used “to assess Opendoor’s ability to generate returns on homes sold during a reporting period after considering home purchase costs, renovation and repair costs, holding costs and selling costs,” the company’s filings state.

“We feel like we’ve done the hard work to be well-positioned for next year, which is about growing our volumes, getting back to cash flow positive, leveraging the partnership channels we’ve been expanding all year and just continuing to manage our balance sheet appropriately,” Wheeler told HousingWire.

The company forecasts an adjusted EBITDA loss of $95-$105 million for the fourth quarter.

Similarly, Offerpad acquired half the homes in the third quarter as it did in the same period a year ago and is forecasting an adjusted EBITDA loss of $10 million or potentially breaking even. CEO Brian Bair offered investors an upbeat attitude about the company’s future.

“We have proven we can perform in a difficult market, and we have exciting opportunities ahead of us,” he said in a statement accompanying the company’s earnings materials. “We are well positioned for further solid performance in 2024 as we take the friction out of real estate.”

Offerpad recently announced it is partnering with real estate conglomerate Anywhere to expand its services nationwide. Opendoor, too, recently announced a partnership with eXp Realty.

Investors seem skeptical of the companies’ growth and opportunities in 2024.

Opendoor’s stock closed at $2.09 on Nov. 3, the day after the company’s earnings presentation. That is down 80% from when the company went public in June 2020 and down 94% from its all-time high.

Offerpad’s stock closed at $8.48 the same day, down 94% from when it went public in December 2020 and down 97% from its all-time high.