New home construction exploded early in the pandemic as soaring home demand squeezed existing inventory nationwide, giving homebuilders a much bigger share of a shrinking pie.

However, as mortgage rates hit multi-decade highs, cooling demand and shrinking the pool of qualified buyers for new homes, homebuilders slowed their pace of construction, which settled at a plateau that is still well above pre-pandemic levels.

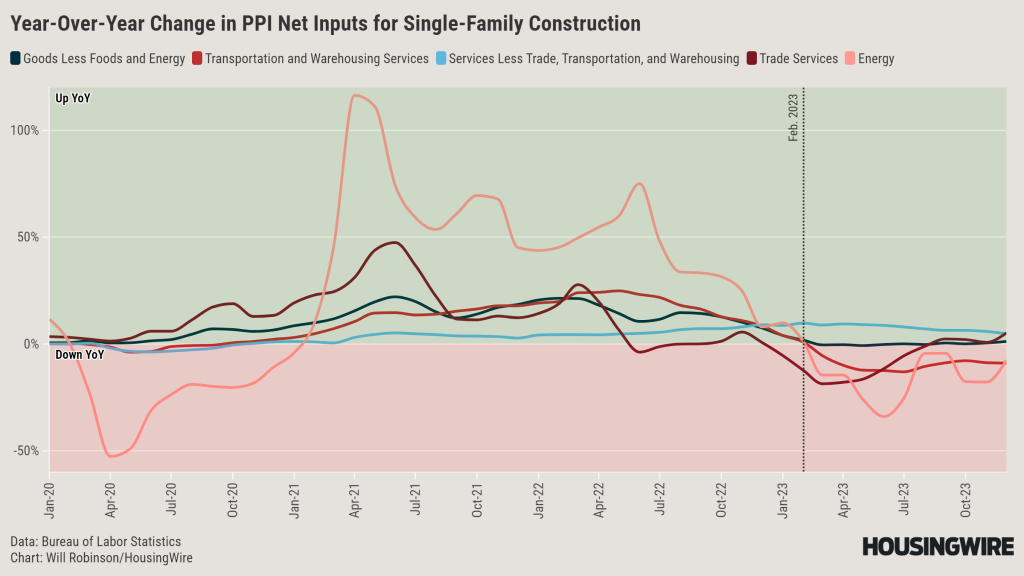

New data on prices of materials and labor needed for homebuilding suggests supply constraints have eased, and homebuilders have a relatively clear path to keep cranking out units if demand holds and their own economic incentives line up.

Supply shocks soothed

Among the pandemic’s many ripple effects, two hit hard on homebuilders’ costs: a sudden increase in homebuyer demand and supply chain shocks due to lockdowns and capacity cuts by producers who had anticipated economic slowdowns.

High mortgage rates and home prices quelled the surge in buyer demand, and time seems to have moderated the supply chain shocks. As a result, homebuilders’ costs are plateauing or falling, according to the Bureau of Labor Statistics‘ latest Producer Price Index.

The index measures average changes in prices received by domestic producers for their output and pegs a value of 100 to June 1986. Index values for December published last week.

Index values for most construction inputs are down from 2022 but remain above pre-pandemic levels.

Trade services spiked to 174 on the index in June 2021, then spiked again to 182 in March of last year. But it fell to about 150 in July 2022 and has remained around that mark ever since, hitting 153 last December.

Energy, residential homebuilders’ most volatile net input, nosedived to 49.5 after the initial lockdowns in 2020 before rocketing to almost 206 in June 2022. Energy’s index value has fallen in four consecutive months and now stands at 121, as of December.

Transportation and warehousing services peaked around 150 in May of 2022 and has fallen slightly in most proceeding moths, landing at 130 last December.

Association of Builders and Contractors Chief Economist Anirban Basu noted that “most [construction] input prices were tame in 2023’s final month,” which he called “a fitting end to a year during which aggregate input prices increased just 1.2% and many individual commodity prices actually fell.”

However, Basu notes supply chains are already facing new pressures in 2024.

“Despite continued materials price moderation and other positive developments regarding inflation, the outlook is not without risks,” he wrote. “Piracy in the Red Sea and the resulting diversion of ships from the Suez Canal around the Cape of Good Hope has caused global freight rates to nearly double in the first two weeks of 2024, according to the Freightos Baltic Index. All else equal, rising shipping costs will put upward pressure on certain inputs.”

Demand uncertainty

Homebuilders ended 2023 on a sour note with increased uses of incentives and price cuts to close deals and homebuilder sentiment falling for four consecutive months (although the streak broke in December).

Builders like D.R. Horton have said in earnings presentations that they still expect to rely on price cuts and incentives in 2024, while mixed forecasts from housing experts generally expect higher new home sales but not higher home starts.

That could set the backdrop for a slower pace of construction.

However, those forecasts and statements were made prior to December’s meeting of the Federal Reserve Open Market Committee, which sparked market anticipation of several cuts in the federal funds rate this year. Mortgage rates fell precipitously that week, although they remain above 6.5%.

If rates hold or even drop further, homebuilders’ calculations would obviously be different and would lean towards bringing more units to market. Supply costs – at least as they are trending through December – would not stand in the way.