As 2023 draws to a close, housing professionals hope for relief from the high mortgage rates, terrible inventory levels and slow sales that characterized the year.

They may find that relief for mortgage rates next year, according to forecasts from various industry experts compiled by HousingWire.

Sales, however, may see only mild improvement in the year ahead, while prices will remain more or less historically high, the forecasters believe. Home starts forecasts, meanwhile, don’t offer much certainty about the pace of construction next year.

Among all the experts’ forecasts for 2024, there is no number more tightly watched than mortgage rates, as those rates will undoubtedly impact sales, prices and construction as well.

Mortgage rates

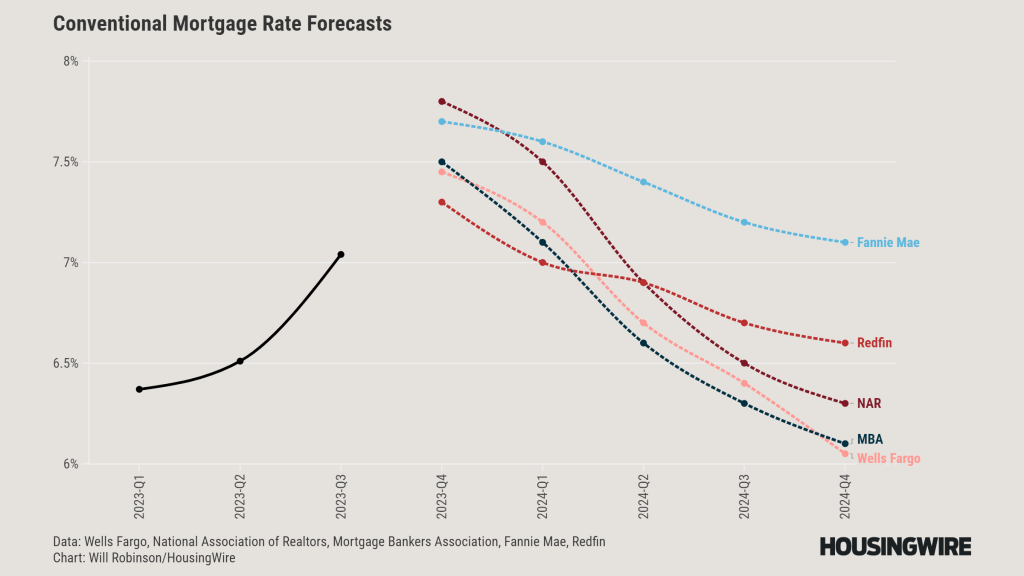

The experts unanimously foresee lower mortgage rates in 2024, although none expect rates to fall below 6%. Expectations for the first quarter of the year range from 7% to 7.6%, and expectations for the final quarter of the year range from 7.1% to 6.05%.

The average of expectations from Fannie Mae, Redfin, the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA) and Wells Fargo were:

- Q1: 7.28%

- Q2: 6.9%

- Q3: 6.62%

- Q4: 6.43%

If mortgage rates fall within these expectations next year, they would not be within shouting distance of 3.2% rates seen as recently as January 2022, before the Federal Reserve began raising interest rates in March 2022 to combat inflation.

The Federal Reserve ultimately hiked rates 11 times for a total increase of 5.25 percentage points, the fastest pace of hikes in four decades. Mortgage rates rose in tandem with interest rates; they briefly crossed the 8% mark this October but currently hover around 7%.

Lawrence Yun, NAR’s chief economist, believes data showing easing inflation will motivate the Fed to reverse course next year.

“I think that the Federal Reserve will cut interest rates four times in 2024,” Yun told HousingWire. “Inflation will be much calmer, [and] the abnormal spread between mortgage rates and the 10-year treasury [yield] will begin to normalize or narrow.”

High mortgage rates have had a doubly adverse impact on home sales. The higher borrowing costs have deterred would-be buyers by making homes less affordable, and the higher rates have made homeowners loathe to sell their current homes given that their mortgage rates are far lower than the market rate, keeping inventories tight and prices high.

“With lower mortgage rates, buyers will come back,” Yun said. “I think that some sellers will give up on their low interest rate because of life events, such as a new child, retirement, marriages, divorces, etc. Mortgage rates going down will be a clear positive sign.”

Home sales

Forecasters universally predicted home sales rising throughout 2024, but opinions were divided as to whether home sales would exceed the levels seen in the first half of 2023.

Fannie Mae was the least optimistic forecaster for both existing home sales and new home sales, while NAR was the most optimistic for both. Expectations for existing home sales ranged from a seasonally adjusted annual rate of 4.21 million to 5.07 million by the end of 2024, and a range of 680,000 to 840,000 for the rate of new home sales.

Netting higher home sales than 2023 is not exactly a high bar for 2024.

“2023 was probably the worst year in origination volume and in home sales that we have seen in a long time,” MBA Chief Economist Michael Fratantoni told HousingWire. “2023 was an extraordinarily slow year; 2024 will just be a little bit better.”

Forecasts are rosier for new home sales than existing home sales as new home sales have become a higher share of total home sales amid tight inventories of existing homes and as homebuilders have more levers to pull to incentivize sales.

Home prices

Record-breaking home prices continue to inch higher month after month, with the S&P CoreLogic Case-Shiller Home Price Index hitting another all-time high in September.

Forecasters believe homebuyers will see only modest relief next year, if any. Of three quarterly forecasts for existing home sales next year, one predicts a small increase in prices by year end, another predicts home prices to start and end the year at the same level and one predicts a modest decline.

Homebuilders are more likely to net price gains over the course of the year, the forecasters prognosticate.

Home starts

The experts appear more divided on home starts in 2024, although most expect builders to continue to build at a higher rate than they did pre-pandemic.

NAR anticipates a steady quarterly increase throughout 2024, while Wells Fargo, MBA and Fannie predict a dip in the first half of the year.

Will Robinson is a data journalist at HousingWire. Sarah Marx is a general assignment reporter at HousingWire.