The Consumer Financial Protection Bureau (CFPB) announced on Friday that it has enhanced its previously controversial Consumer Complaint Database, providing additional information and context to new submissions. This allows reverse mortgage industry stakeholders to more clearly examine complaints specific to the product category, and to compare them with the broader figures of the data in its totality.

“The [Bureau] today announced the addition of a trends view to the Consumer Complaint Database. The trends view allows users to see information about complaints over time using a robust set of filter options,” the Bureau writes in a press release announcing the changes.

While the database has previously given users the ability to filter complaints by date, product, issue, company name or to search complaints for keywords, now the new “trends view” and “map view” options can “emphasize aggregation and analysis of information, while continuing to make all the underlying data available for closer examination,” in addition to the previous capabilities.

“These powerful new capabilities allow users to gain deeper insight into changes in the location, type, and volume of complaints over time, which provides valuable context into consumers’ experiences in the financial marketplace,” said CFPB Director Kathleen Kraninger in a press release announcing the upgrades. “I’m excited to make these additional tools available to the public as I promised last year.”

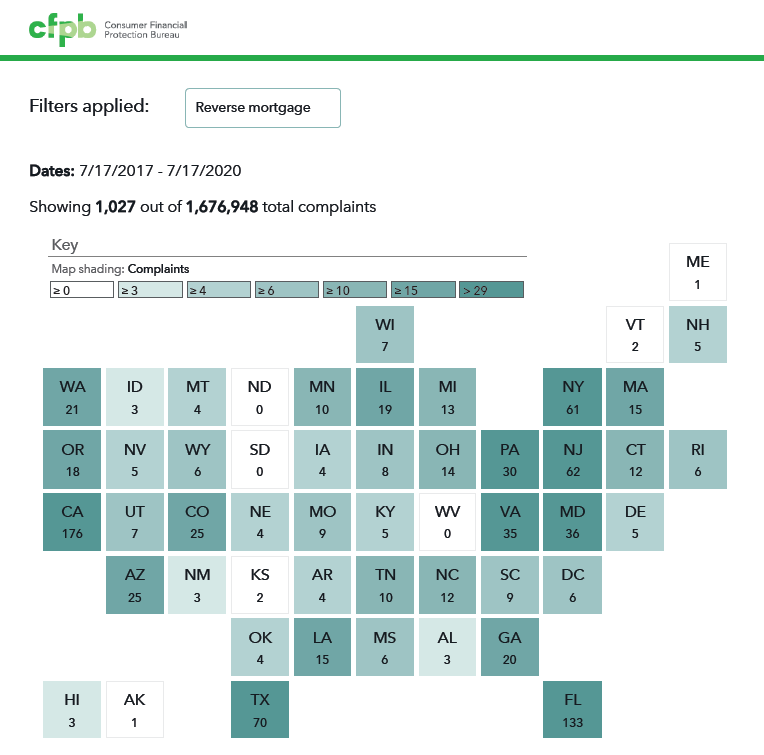

A cursory review of the new features allowed RMD to visualize the search results of a reverse mortgage-specific complaint request, revealing that in a period between mid-July 2017 and mid-July 2020, a total of 1,027 complaints related to reverse mortgages were recorded across all 50 states. This constitutes just over .06% of the total number of complaints recorded by the Bureau over the last three years, which as of mid-July stands at 1,676,948 across all industries under CFPB’s regulatory jurisdiction.

Unsurprisingly, the highest numbers of complaints were seen in states featuring the largest reverse mortgage volume: 176 in the state of California and 133 in Florida, respectively. Texas followed with 70 complaints, with New Jersey (62) and New York (61) rounding out the top 5.

The implementation of these new data aggregation tools follows upon the announcement of enhancements to the complaint database made by the Bureau last September, fulfilling the promise of “dynamic visualization tools on recent complaint data,” the Bureau said at the time.

Visit the enhanced Consumer Complaint Database at CFPB.