Rob Bonta, the attorney general for the state of California, issued an alert this week to encourage more of the state’s residents to avail themselves of the California Mortgage Relief Program that includes assistance for forward and reverse mortgage borrowers who have been financially impacted by the economic effects of the COVID-19 coronavirus pandemic.

Implemented at the end of 2021 and funded by a federal $10 billion Homeowners Assistance Fund distributed through the American Rescue Plan Act, the program uses $1 billion in federal funds to provide financial assistance to low-to-moderate income homeowners who are behind on their housing payments due to the pandemic.

The program, which is free to California state residents, covers past due forward mortgage payments or reverse mortgage arrearages in full as a one-time grant, which will be submitted as a direct payment to either the homeowners’ lender or mortgage servicer.

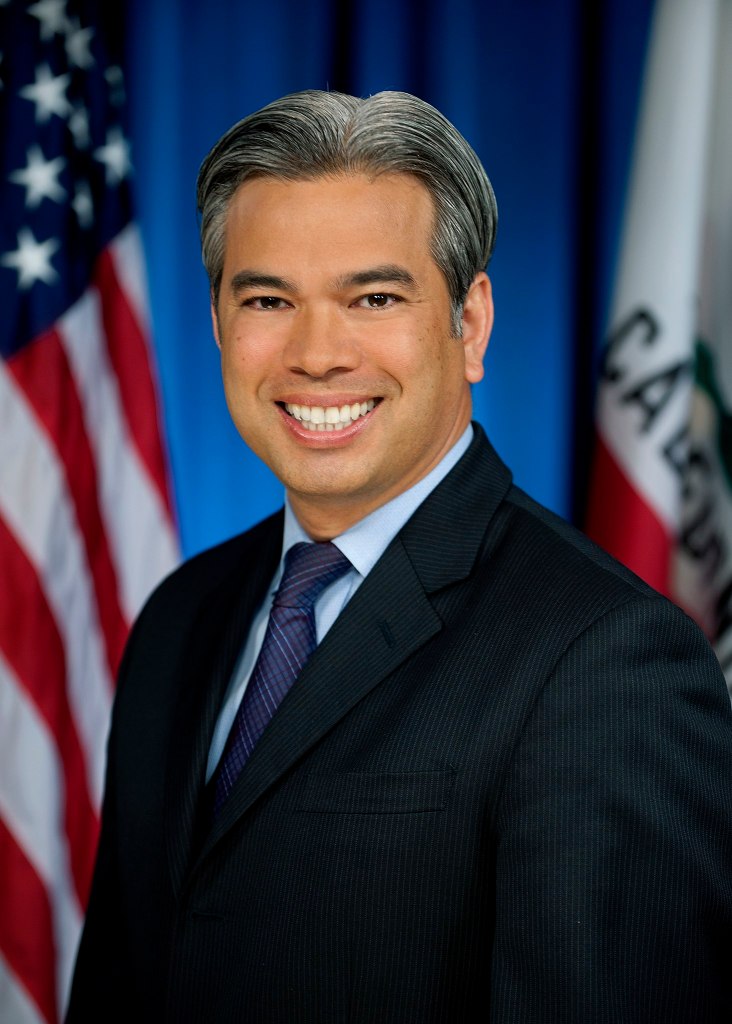

“What makes the California Mortgage Relief Program so unique, is that the financial assistance provided through this program is completely free and does not need to be paid back,” said Attorney General Bonta in a statement. “This is an important opportunity for struggling homeowners to receive federal grants of up to $80,000 per household that will help them get caught up on their housing payments. It is crucial that homeowners check to see if they qualify for this free financial assistance, and apply as soon as possible so that they can get the help that they need to keep their home.”

When the program was launched, the state of California estimated that 20,000 to 40,000 struggling homeowners would be assisted by it, with funds reserved for homeowners in socially disadvantaged and underserved communities often hit hardest by the pandemic. According to origination data from the U.S. Department of Housing and Urban Development (HUD), the region including California is typically the highest-volume area in the country for the reverse mortgage industry.

“The California Mortgage Relief Program gives qualified homeowners who were most impacted by the pandemic a chance to regain their footing financially,” said Rebecca Franklin, President of CalHFA Homeowner Relief Corporation. “The program is open to homeowners, even if they have already received government COVID-19 assistance.”

On the heels of a February 2022 Mortgagee Letter clarifying certain components of federal reverse mortgage assistance in the pandemic era, National Consumer Law Center (NCLC) Attorney Sarah Bolling Mancini explained to RMD that there could still be some kinks to work out for the affected homeowners.

“We have been asking that [FHA] allow for — and really require — a pause in any foreclosure activity when someone has applied for the Homeowner Assistance Fund program, which is just now getting up and running in all 50 states and territories, as well,” she told RMD in February. “$10 billion was allocated by Treasury to the states, but the programs are just opening. In fact, I think only 15 states are currently open for applications. And that program can help reverse mortgage borrowers cure a default on property charges, and certain other home-related defaults.”

Some professionals assisting borrowers in different parts of the country have criticized the speed at which these programs came online. Shortly after the Texas state program was activated, an attorney who oversees the Foreclosure Prevention Project at the nonprofit organization Lone Star Legal Aid cited a pandemic-impacted reverse mortgage borrower he’s attempting to assist as a key example.

“If this money had been rolled out at any point in 2021, I could have saved the house,” Amir Befroui told the Texas Tribune. The Texas program was activated last month, while the American Rescue Plan Act was signed into law by President Biden in March of 2021.

California residents can seek more information about the state’s program through its dedicated website.