U.S. mortgage rates dropped to a 3-year low last week, driving another uptick in both purchase and refinance demand across the country. As rates continue to hover near historic lows, LendingTree indicates borrowers are reaping significant savings by comparing mortgage offers.

In order to gauge which markets offer borrowers the most savings, the company created a Mortgage Rate Competition Index that measures the basis point spread between high and low annual percentage rates offered to users through its marketplace.

LendingTree discovered borrowers using its marketplace could save an average of $44,500 over their loan’s lifetime — just by comparing offers.

“Cutting back the total interest paid over the lifetime of a loan may translate into meaningful savings on a yearly and monthly basis,” LendingTree writes. “For example, purchase borrowers could save an average of $125 a month, or about $1,499 a year, while refinance borrowers could save about $163 a month, or $1,953 a year.”

This average differs in each housing market, especially in California which boasted three of the nation’s highest cost savings, according to the index.

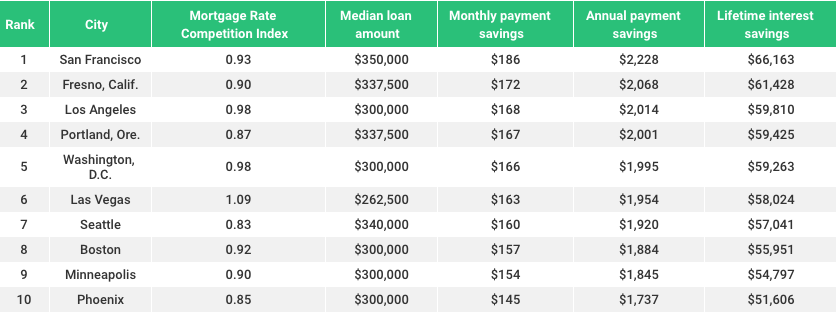

According to LendingTree, these are the top ten cities where purchase borrowers could save the most in interest payments by comparing mortgage offers:

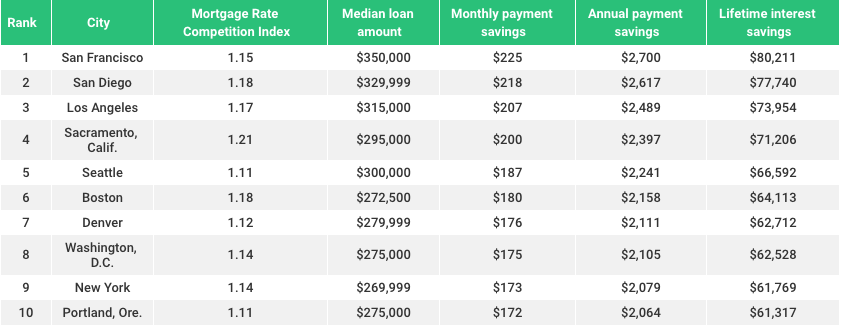

When it comes to refinancing, LendingTree also discovered borrowers could save the most when shopping around for the best rate in California.

According to the company, these were the top 10 cities where refinance borrowers could save the most in interest payments:

“Even in cities where savings aren’t as high as they are in San Francisco or Fresno, borrowers may still benefit from shopping around,” LendingTree writes. “For example, buyers in Pittsburgh (where purchase loan savings are the lowest) could still save $23,409 if they shop around for the best rates. In Detroit (where potential refinance savings are the lowest), refinancers could save $47,815 over the life of their loan.”

NOTE: The LendingTree Mortgage Rate Competition Index measures the spread in the APR of the best offers available on its website.