The American financial sector is concerned about the potential actions of the Consumer Financial Protection Bureau (CFPB) in 2021, owing to changes that the incoming administration could make to the agency’s regulatory posture particularly as it pertains to the Bureau’s use of its enforcement authority. This is according to reporting at Bloomberg.

“Banks should be prepared for more aggressive enforcement and an expansion of the CFPB’s authority through its rulemakings,” said Rachel Rodman, former CFPB lawyer and partner at law firm Cadwalader, Wickersham & Taft LLP in Washington, D.C., where she represents banks. “[The agency will be] more likely to bring an enforcement action, pursue novel legal theories and [is] more likely to demand higher penalties,” she tells Bloomberg.

Consumer advocates see a lot of the dormant power the CFPB wields as a potentially useful tool to combat some of the economic distress being felt by many American workers in the midst of the pandemic, according to Linda Jun, senior policy counsel at consumer advocacy group Americans for Financial Reform.

“The CFPB has so many tools that it isn’t using right now,” Jun told Bloomberg. “If you get the right leadership in place, there is a lot that can be turned around.”

To date, the most prominent settlement undertaken by the CFPB under the administration of President Trump is a $500 million enforcement action against Wells Fargo for allegedly overcharging some of its auto loan and mortgage customers. That settlement was made in 2018 under the leadership of acting CFPB director Mick Mulvaney.

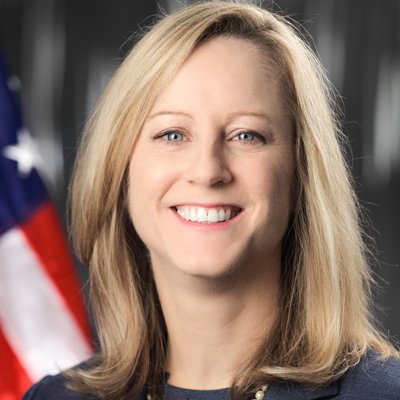

Recently, U.S. House Rep. Maxine Waters (D-Calif.), chair of the Financial Services Committee, submitted a letter to President-elect Joe Biden asking him to take certain steps to reverse the Trump administration’s consumer protections course. At the top of the consumer protection priority list laid out by Waters was the request to “fire [CFPB] Director Kathy Kraninger.”

A recent decision by the United States Supreme Court, sought by Trump administration officials and endorsed by incumbent Director Kraninger, will give the incoming president the power to dismiss the CFPB director at-will and replace her with an appointment of his own choosing. An acting director could be appointed immediately, while a permanent director would require confirmation by the U.S. Senate.

The CFPB maintains regulatory enforcement authority over the reverse mortgage industry at the national level. Since the onset of the COVID-19 coronavirus pandemic, reverse mortgage-related complaints to the Bureau have slowed. Enforcement actions have also recently risen to their highest levels in five years, though Democrats in Congress have repeatedly lamented what they perceive to be a softer approach to the agency’s regulatory posture since President Trump took office in 2017.

Read the article at Bloomberg.