Racial Equity Accelerator for Homeownership, a collaboration between Urban Institute and Federal Home Loan Bank (FHLB) of San Francisco, on Monday released a report that examines how the adoption of alternative data can benefit Black households within the mortgage lending landscape.

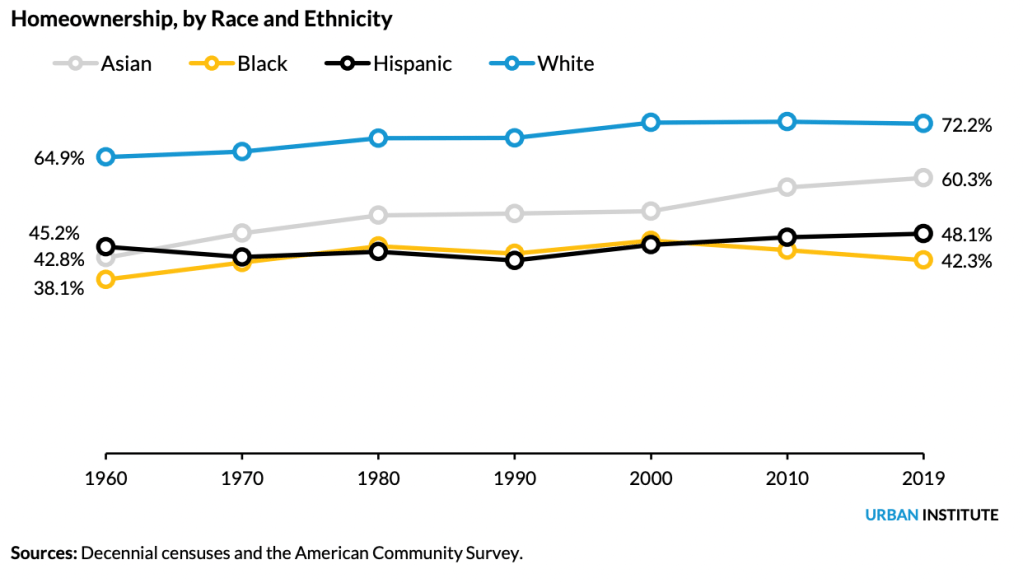

The report found a 30-percentage point gap in homeownership between Black and white households in the U.S., which is wider than it was in 1960, before the Fair Housing Act was passed and while race-based housing discrimination was still legal. The report found that Black household homeownership rates are now below rates for all racial and ethnic groups since 2010.

Research by the Urban Institute’s Laurie Goodman and Jun Zhu in 2021 projected that despite growth in the population share of people of color in the next 20 years, racial homeownership gaps will maintain at current levels if stakeholders do not design and implement comprehensive and effective combat actions.

Although alternative data could include many factors, the authors of the latest Urban Institute report say that rental payment history and cash-flow data have the greatest potential to predict future mortgage performance.

The publication notes that as a result it restricted analysis to financial data (rent, utility and telecom payments, cash-flow). It says that while this data was once regularly used to evaluate borrowers, most lenders today do not use these alternative data sources when determining mortgage eligibility.

FICO’s failures

The authors argue that the lack of alternative data sources contributes to “historically rooted systemic racism,” which has long-affected the homeownership process. Lenders’ reliance on traditional FICO score models has more significantly affected Black households who are “disproportionately likely to have no FICO scores and to have FICO scores below 620,” the authors said.

Almost 30% of Black adults did not have a FICO score in 2018, compared to just 17% of white adults, with Black consumers also comprising 34% of FICO scores below 620 (16% for white borrowers).

The report claims these numbers suggest that Black consumers are disproportionately harmed by current underwriting methods, and says “alternative data into mortgage underwriting could help many Black households obtain mortgages and get a lower price for the loan.”

As a result of this homeownership gap and historically rooted racial disparities, Black households are more likely to be renters, with renters making up the national majority of Black households.

It says due to these factors, many Black renting households stand to gain from the inclusion of rental and cash-flow data in underwriting.

On the other hand, the report notes that reporting all rental payments, including missed ones, could disproportionately harm Black households due to lower average incomes and less job security in the demographic. This led the authors to recommend the incorporation of only positive rental payments, which it says “could usher more households into homeownership without creating undue burdens.”

On-time payments

According to a rental payment study by Understanding America, about 68% of U.S. renters made 12 months of on-time rental payments between July 2020 and July 2021. It found that Black households were least likely to pay 12 months of rent on time, with only 55% doing so compared to 73% and 78% of white and Asian renters.

The report says this emphasizes that incorporating rental payment data would not automatically close the racial homeownership gap, but would result in a disproportionate benefit to borrowers of color.

Unbanked

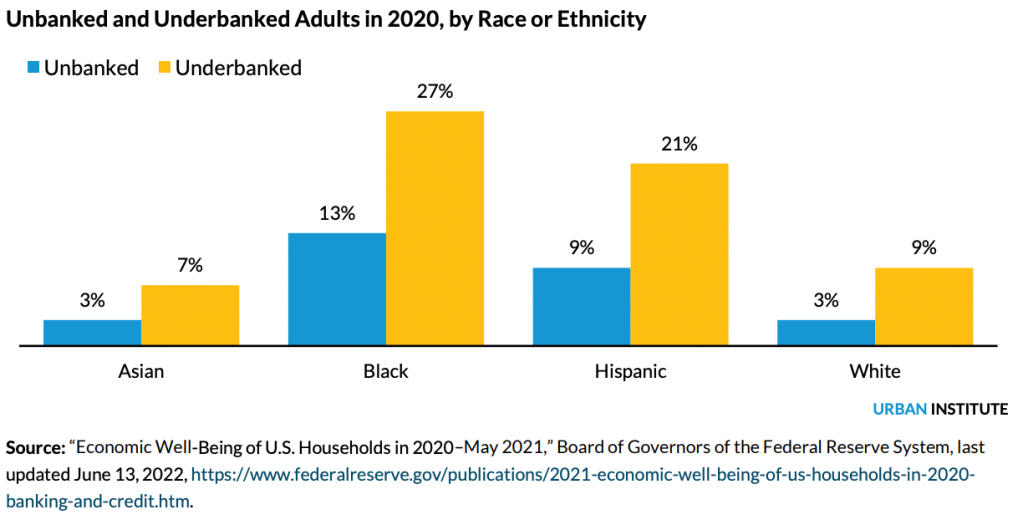

There is also a more mechanical barrier to incorporating alternative data into underwriting and mortgage lending models. Despite a continuing shift towards rent payment and cash-flow reporting, Black renters are also more likely to be unbanked, with 13% of Black adults likely to be unbanked in 2020 (compared to just 3% of white adults).

Additional issues arise when you look at the actual implementation of rental payment data. Even if mortgage underwriters begin to incorporate these payments into their credit scoring models, the report suggests it would not make a meaningful difference.

They say this is because less than 4.5% of U.S. renter households have rental payment history on file with the three major credit reporting agencies, with the most common reports that are filed being negative missed payments. This suggests that incorporating rental payment data directly into credit scores would “require a significant improvement in rent reporting.”

How does reporting rental payments affect credit scores?

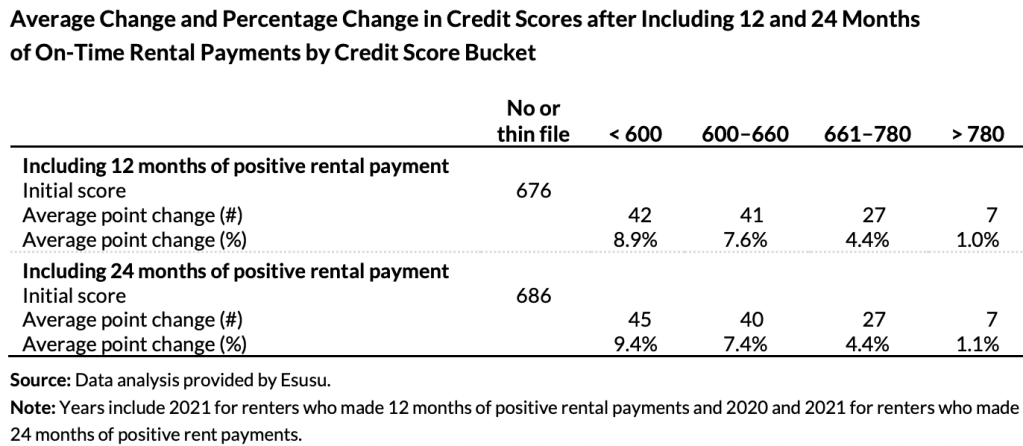

In order to better understand how rent reporting affects credit scores, the study’s authors partnered with Esusu Financial, a fintech which reports rental data, to examine the impact that 12 and 24 months of rental payments have on renters’ credit scores.

The report says this analysis, which sampled 12,492 Esusu consumers who made on-time rental payments, found that previously unscorable consumers received average VantageScores of 676 and 686, respectively, after 12 and 24 months of positive rental payments. It says these scores would enable said consumers to apply for convention loans and lower potential mortgage costs.

The analysis also found that consumers with the lowest initial scores experienced the largest increases in terms of gross and percentage credit score growth. It says this is highlighted by a 8.9% credit score increase for consumers with scores below 600, compared to a 4.4% increase for scores between 661-780 and a 7.6% increase for scores between 600 and 660.