Americans are more in debt than they’ve ever been, but thanks to a solid economy, the vast majority of people are still able to pay their debts on time. And that’s pushing credit scores to levels not seen since the early part of this decade.

According to new report from Experian, Americans’ average credit score is 682 as we close out 2019. That’s up 2 points from last year to the highest level since 2011.

“We’re seeing a promising trend in terms of how Americans are managing their credit as we head into a new decade with average credit scores increasing two points since 2018 to 682 – the highest we’ve seen since 2011,” said Shannon Lois, Experian’s head of analytics, consulting and operations.

Per Experian’s review of credit data, consumers’ average credit card balances and debt are up over last year, but credit utilization rates have held steady at 30%.

Beyond that, Experian noted that while people are taking on slightly more credit card, mortgage and non-mortgage debt, delinquency rates are decreasing on average.

According to Lois, this indicates that consumers are “using credit as a financial tool and managing their debts responsibly.”

The report also breaks down which states’ residents have the highest and lowest credit score.

According to Experian, here are the top five states with the highest average credit scores:

- Minnesota – 715

- Vermont – 708

- South Dakota – 707

- New Hampshire – 707

- Massachusetts – 705

On the other end of the scale, here the bottom five states with the lowest average credit scores:

- Mississippi – 652

- Louisiana – 654

- Alabama – 660

- Texas – 660

- Oklahoma – 660

Per the Experian report, the average American has $231,599 in mortgage debt, up from $208,180 in 2018 and $201,811 in 2017.

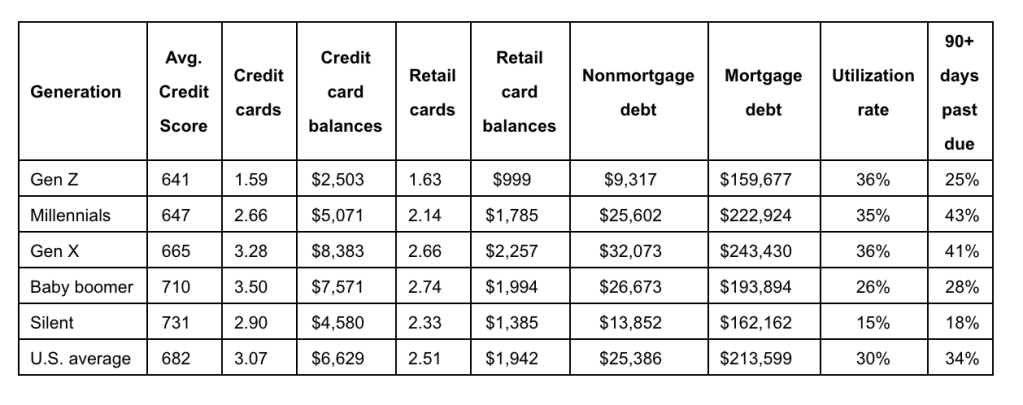

Broken out by generation, Generation X is carrying the most mortgage debt with an average of $243,430. Millennials have the second highest average mortgage debt at $222,924.

Baby Boomers carry an average mortgage debt of $193,894, the Silent generation has an average mortgage debt of $162,162, and Gen Z has an average mortgage debt of $159,677.

Younger generations also have higher credit utilization rates, indicating they’re taking on more debt to be able to afford their lives.

Each of Gen X, Millennials, and Gen Z all have credit utilization rates of 35% or higher, while the older generations have credit utilization rates of 26% for Baby Boomers and just 15% for the Silent generation.

Here, from the Experian report, is a breakdown of the credit profile of Americans, broken out by generation:

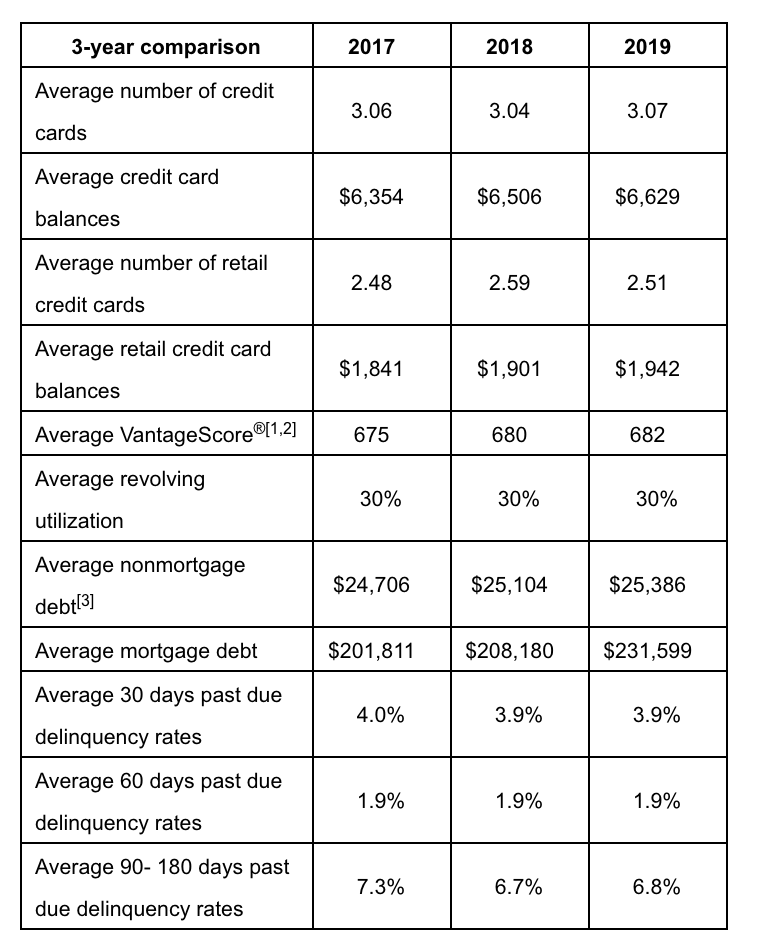

And here is a look at the average American’s credit profile over the last three years: