Reverse mortgage market leader American Advisors Group (AAG) has unveiled a new public relations initiative aimed at illuminating the stories of its customers enjoying the benefits of their reverse mortgage loans.

Introduced this week, AAG’s “Borrower Stories” relates the life stories of specific people who have benefitted from the incorporation of a reverse mortgage into their financial plans in retirement, forming a new initiative that began as a way to check in with the performance of reverse mortgage processes during a time of nearly-universal stress for people across the country.

Finding the voices of borrowers

Spinning out of an initiative aimed at making sure that all of the mechanisms of reverse mortgages like document signings and appraisals were functioning well in the midst of the COVID-19 coronavirus pandemic, it quickly became apparent to AAG that the enthusiasm for the reverse mortgage product as shared by the borrowers the company would reach out to had become an opportunity to tell stories about how reverse mortgages were meeting the needs of clients.

“So much of the focus in this industry is on the products, and we wanted to shed more light on the everyday Americans that are using them,” an AAG company spokesperson told RMD about the new initiative. “This campaign has helped us put a face on the modern day borrower and show how they are utilizing their home equity to better their retirement.”

When reaching out to borrowers to check on how their time with a reverse mortgage was playing out, a unique opportunity emerged to hear those borrowers’ stories, and how they had been permitted to make new plans for themselves because of the financial instrument they had been using. Reaching out to people also made clear to AAG that in many cases, borrowers were thrilled to share the ways in which they have been positively impacted by their reverse mortgages.

“Many of our borrowers are excited to share their stories with our loan officers and some showed interest in sharing their stories to a broader audience,” the company spokesperson said.

The first story, financial savviness

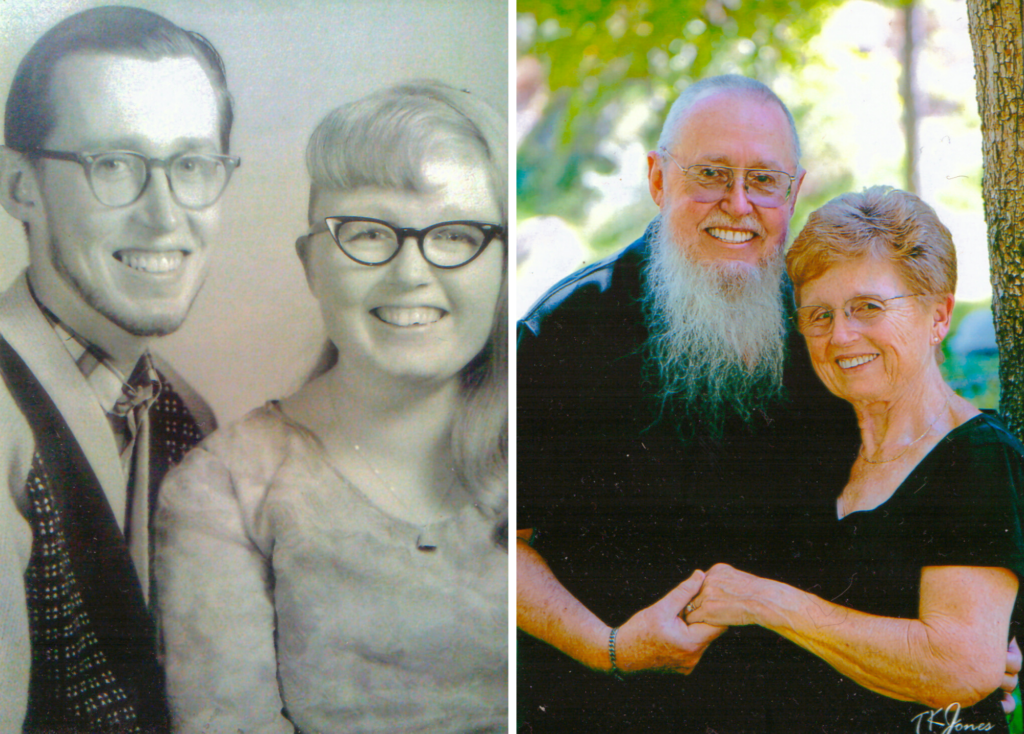

The first released story focuses on a couple — Tom and Patti Petry — who successfully utilized a reverse mortgage to expand their retirement options when they were in their mid-70s.

“Now both 74, they had two primary goals for the next stage of their eventful and purpose-driven lives,” their story reads in part. “They wanted to continue living in the beautiful home that they have lovingly maintained for 47 years, including an extensive remodel, and wished to create a small safety net so that it would complement their modest savings and allow them to maintain their current lifestyle.”

With both of them having to retire early due to different circumstances, they found a financial path forward through the employment of a reverse mortgage, according to the story. In this instance, it was the borrowers’ adult son who recommended the exploration of a reverse mortgage, and they began the process of educating themselves about what the product would be able to do for them.

This proved to reveal a trend the company would come to notice when asking borrowers to tell their stories related to their use of reverse mortgages: the borrowers themselves had done a significant amount of research into the ways that the products have changed over the years, and how those changes would affect them if they engaged in a reverse mortgage transaction.

When the time came for Tom and Patti to meet with a reverse mortgage counselor, that counselor found a savvy couple who was very well-informed about the product category and how it applied to their own financial situation.

“The counselor said she was amazed that we already knew so much,” Patti related in the story.

More to come

Tom and Patti’s story is only the first of additional borrower stories that AAG plans to roll out in the future, according to the company.

“We have already interviewed more AAG borrowers and plan to share their stories in the coming weeks,” the company spokesperson tells RMD.

In addition to being available to AAG’s employees internally, the stories are being made available publicly on the company website and will be distributed widely via its social media presence.

Read the story of Tom and Patti at AAG.