American Advisors Group (AAG) is the largest reverse mortgage lender in the industry, and one of the reasons that is the case is likely due in no small part to its ubiquity in advertising. By employing a well-recognized spokesman to tell consumers about reverse mortgage options, fielding inbound calls or generating word-of-mouth is something the company has equipped itself well for.

However, no one is spared from the tumultuous economic environment that the United States currently finds itself in, which ripples out into the global economy. These are some of the additional topics that were discussed with Ed Robinson, president of AAG, and Kimberly Smith, the company’s SVP of wholesale during the National Reverse Mortgage Lenders Association (NRMLA) Western Regional Meeting in Irvine, Calif.

The evolving economy

One of the most direct ways that the current economic environment will affect AAG’s posture in terms of connecting with borrowers is in listening to the economic impacts seniors are feeling, and adjusting messaging accordingly, Robinson explains.

“So it’s interesting, it goes back to what I was talking about with the ‘delight the customer project,’” Robinson said, referring to an ongoing priority for customer experience. “There’s an element of what do we do digitally, or from a marketing perspective upfront? What do we do to hear more directly from our customers and from broad consumers about how they learn about the product, and how they identify the need?”

This has led to something of an evolution of the way the company is approaching its marketing goals and practices, Robinson explains.

“We are really at the early stage of morphing our marketing schemas to make sure that we overlay the learnings we’re having in the ‘delight the customer’ project,” he says. “To make sure we have a better way to reach out more to them, and to the influencers, such as the adult children, and folks in the financial advisor community.”

That will likely come with more digitization in the next couple of years, he explains, as well as the establishment of additional partnerships that can help fulfill the company’s outreach priorities.

“I do believe you’re going to see a lot more partnerships evolve in both the for- and not-for-profit communities, especially when it comes to the types of organizations that ensure people maintain homeownership,” he says. “Especially given what you’ve seen with COVID, where more people are working from home and want to stay there; they don’t want to move to a nursing or assisted living facility. I think you’re going to see more of those partnerships evolve, and therefore, the way that we market with and through them as well as to consumers will actually continue to evolve quite a bit.”

Reach will continue to be important across both the retail and wholesale channels, which illustrates how much room there is to grow, adds Smith.

“We can only reach so many people on the retail side,” she says. “So that’s why we’re really leaning into wholesale, because that reach is expansive. Around 20,000-ish mortgage brokers are out there and 400 of them are doing reverse. That’s how the adoption problem for reverse mortgages is going to be changed, is in those individual mortgage brokers. Office people that know where they can help people understand the product and how much it can help them.”

Television, other digital advertising

When asked about whether or not there could be any changes to the television advertising approach currently being taken by the company, Robinson said that AAG remains very happy with the output and performance of its current strategies.

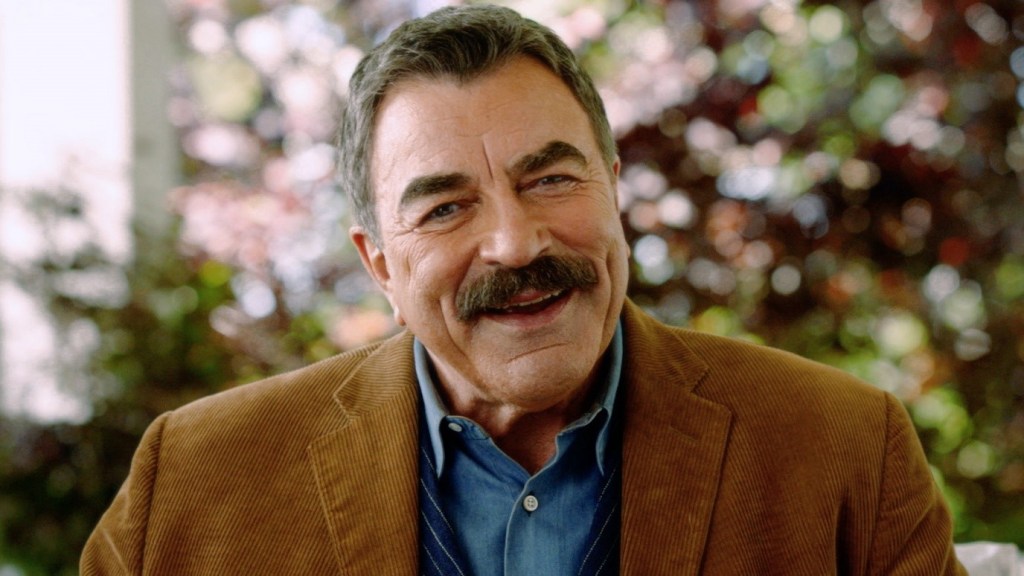

“No changes right now,” he says. “I would say we are still a multimedia advertising-approached firm. Tom Selleck is still working with us. We’re happy about the image that he brings to the industry. There’s a level of comfort that consumers find with somebody that they can trust and somebody that is a known face, name and persona.”

Robinson also references Selleck’s cross-generational appeal, since many may have seen him as the lead performer in Magnum P.I. during the 1980s, as a memorable guest star on Friends in the 1990s or those who are tuning into Blue Bloods today, where he has a featured role.

“He’s just somebody that’s been a part of people’s lives for decades,” Robinson says. “And so having someone there that continues to be a trusted figure is always a good thing. At this point, I would say that nothing has changed significantly insofar as our TV approach. We still intend to advertise on TV.”

Echoing previous comments, though, Robinson does want to emphasize that AAG is exploring how best to leverage digital media for its marketing goals, he explains.

“As consumers evolve digitally and in this internet age, whether it’s a kid, adult or senior, we have to be able to evolve with that,” he says. “And so that’s what you will see. I wouldn’t say that we’re going to go full-scale one way or the other, it’s going to be a multimedia approach, just like we have had for a number of years.”

It’s also difficult to ignore the recognition that AAG is often met with from clients because of the ads featuring Selleck, Smith adds.

“We have wholesale clients who specifically say that they tell their borrowers, ‘your loan is going to the Tom Selleck company,’” she says. “It just brings that trust. It’s used across the industry.”

Read part one of RMD’s interview with Robinson and Smith.