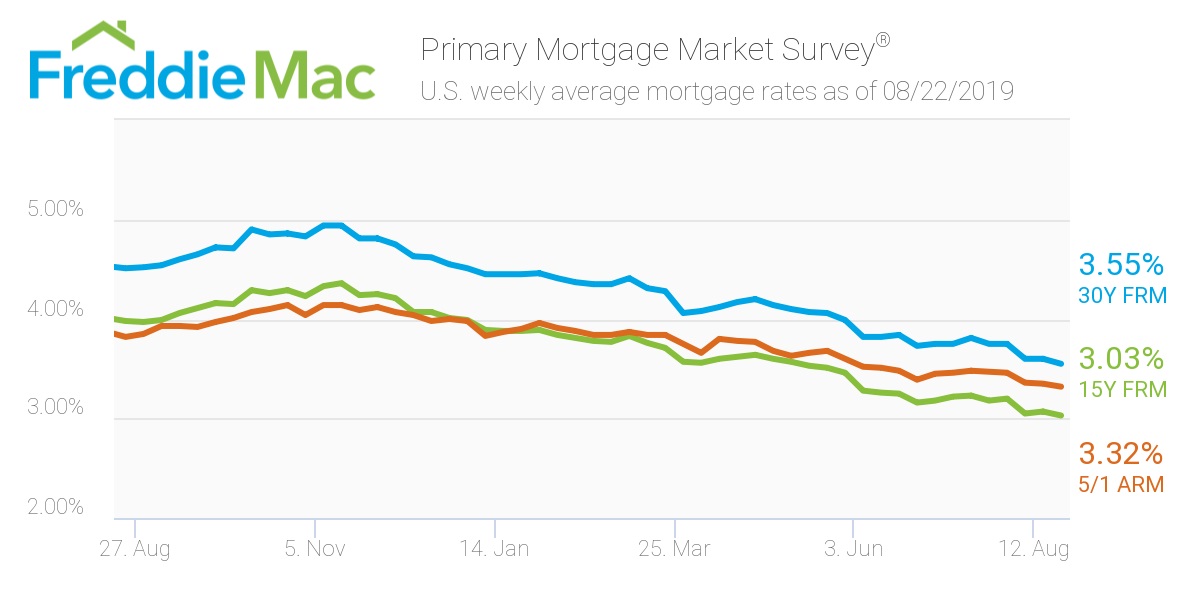

The average U.S. rate for a 30-year fixed mortgage fell to another three-year low this week, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the company’s data, the 30-year fixed-rate mortgage averaged 3.55% for the week ending August 22, 2019, down from last week’s rate of 3.6%. That’s almost a percentage point lower than its 2018 average of 4.53%.

Freddie Mac Chief Economist Sam Khater said the drop in mortgage rates continues to stimulate the real estate market and the economy.

“Home purchase demand is up 5% from a year ago and has noticeably strengthened since the early summer months, while refinances surged to their highest share in three and a half years,” Khater said. “Households that refinanced in the second quarter of 2019 will save an average of $1,700 a year, which is equivalent to about $140 each month.”

“The benefit of lower mortgage rates is not only shoring up home sales, but also providing support to homeowner balance sheets via higher monthly cash flow and steadily rising home equity,” Khater said.

The 15-year FRM averaged 3.03% this week, retreating from last week’s 3.07%. This time last year, the 15-year FRM came in at 3.98%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.32%, falling from last week’s rate of 3.35%. This rate sits much lower than the same week in 2018 when it averaged 3.82%.

The image below highlights this week’s changes: