Freddie Mac reported net income of $1.5 billion in the second quarter of 2019, down from $2.5 billion in the year-ago period. The government-sponsored enterprise said it expects to submit $1.8 billion to the U.S. Treasury by September, a payment known as a “profit sweep.” That will bring its total payments to the government to $119.7 billion, exceeding its original draw during the financial crisis by about $48.1 billion.

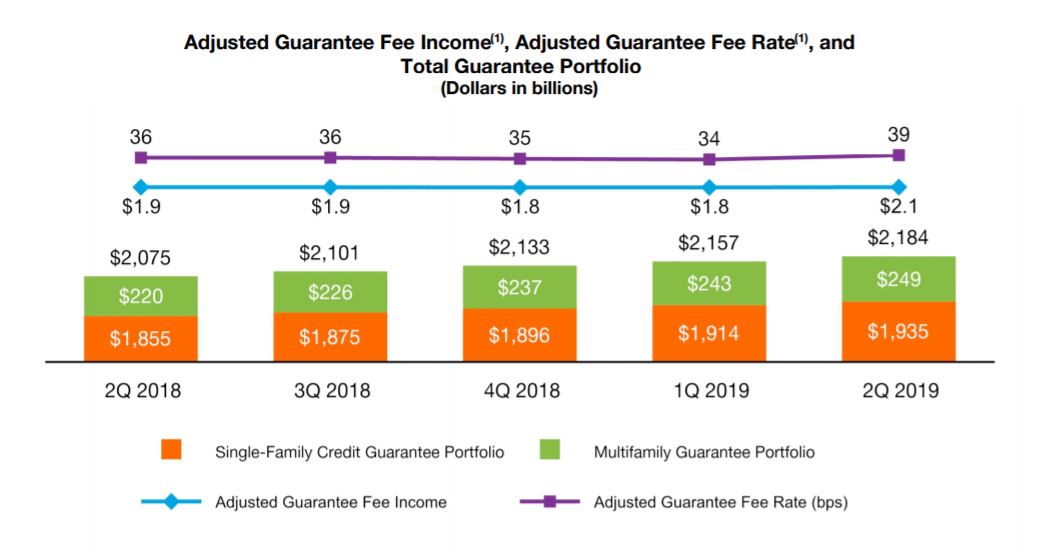

Freddie’s portfolio of single-family guaranteed mortgages totaled $1.94 trillion in the second quarter, up 4.3% from the $1.86 trillion a year earlier. Its portfolio of multifamily guaranteed loans rose 13% to $249 billion. The serious delinquency rate for guaranteed single-family mortgages, meaning loans with payments more than 90 days overdue, declined to 0.63%, while the multifamily rate was near zero, at 0.03%.

“Freddie Mac’s second quarter continued our growing track record of strong returns, solid risk management and an unwavering commitment to our mission,” said David Brickman, who became CEO in July. “Once again, we made home possible for hundreds of thousands of families across the country.”

Guaranteed fee income was $2.1 billion, up from $1.9 billion a year earlier. The average guarantee fee was 39 basis points, up from 36 basis points. The so-called g-fee is intended to cover the credit risk and other costs that Freddie Mac incurs when it backs mortgages from lenders and it results in higher mortgage rates for borrowers.

The company posted net interest income of $2.9 billion in the second quarter, compared with $3 billion a year earlier.

Its mortgage-related investments portfolio was $219 billion, down 7% from the prior year. That’s below the $225 billion limit imposed by the Federal Housing Finance Agency.

Administrative expenses, including salaries, rose to $619 million from $558 million a year earlier.