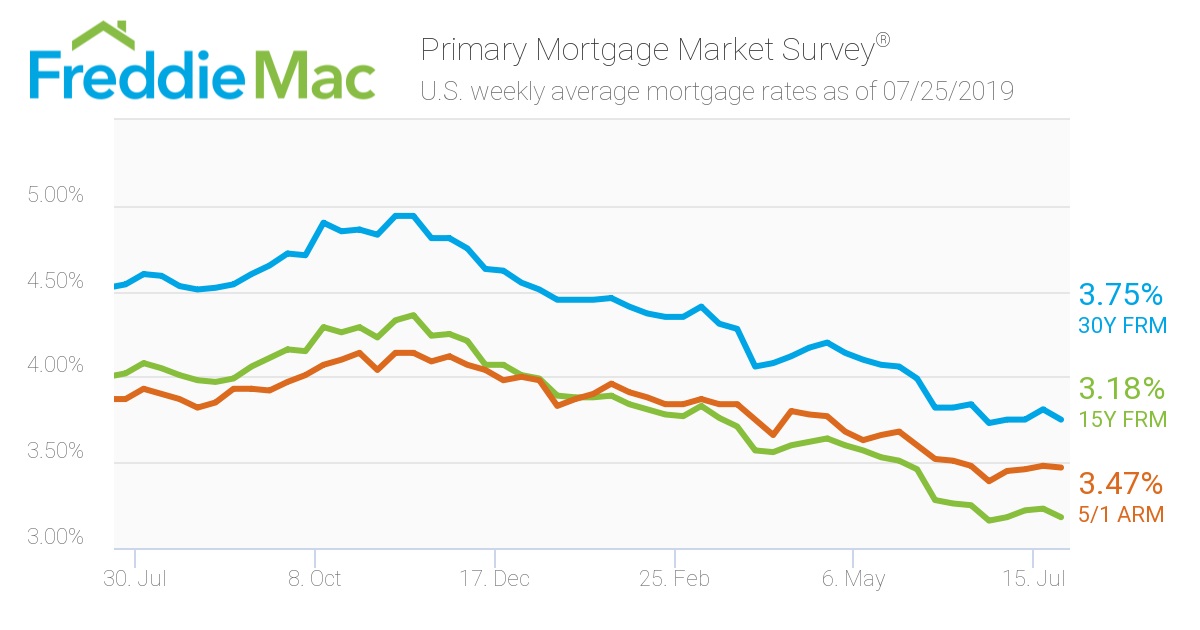

This week, the 30-year, fixed-rate mortgage averaged 3.75%, falling from last week’s 3.81%. A year ago, the rate averaged 4.54%, according to the Freddie Mac Primary Mortgage Market Survey.

“Mortgage rates continued to hover near three-year lows and purchase application demand has responded, rising steadily over the last two months to the highest year-over-year change since the fall of 2017,” Freddie Mac Chief Economist Sam Khater said. “While the improvement has yet to impact home sales, there’s a clear firming of purchase demand that should translate into higher home sales in the second half of this year.”

The 15-year FRM averaged 3.18% this week, retreating from last week’s 3.23%. This time last year, the 15-year FRM came in at 4.02%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.47%, inching backward from last week’s rate of 3.48%. This rate is lower than the same week in 2018 when it averaged 3.87%.

The image below highlights this week's changes: