Millennial homebuyers are less likely to take extraordinary measures to be able to afford their mortgage payments in 2019, according to a recent study from Redfin.

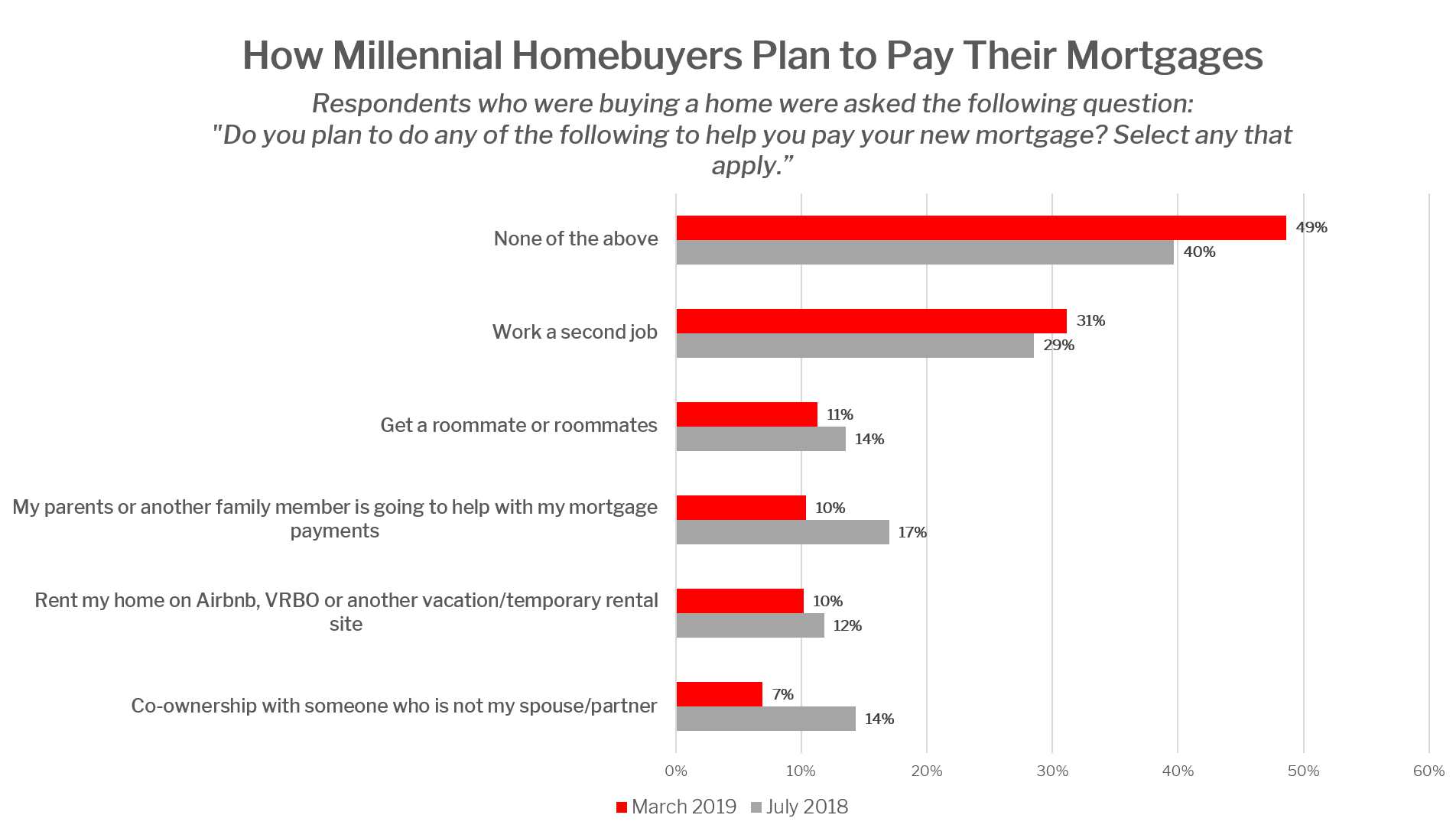

Only 10% of the 1,000 Millennials surveyed said they planned on seeking financial assistance from their parents to pay their mortgage – a notable 7% drop from last year.

“Over the last couple years, Millennial household incomes have been rising, and America’s youngest professionals now earn more than previous generations did at this age. As a result, they’re needing less and less help from family members to buy a home,” said Redfin Chief Economist Daryl Fairweather.

“A lot of that increase in Millennial household earnings has been driven by Millennial women, who are working more and earning more than women of previous generations," Fairweather added. "Millennials may have postponed getting married, having children and buying a home while they got their careers on track, but now that they are more established in their careers and earning more, I expect to see more Millennials buying homes and checking off those major life milestones.”

According to the survey, 31% said they planned on paying off their mortgage with a second job – a 2% rise from last year. And, only 11% said they would opt to get a roommate to help pay the bills, an option that declined 3% from 2018. (See chart from Redfin to the left; click to enlarge.)

According to the survey, 31% said they planned on paying off their mortgage with a second job – a 2% rise from last year. And, only 11% said they would opt to get a roommate to help pay the bills, an option that declined 3% from 2018. (See chart from Redfin to the left; click to enlarge.)

Fewer Millennials also said they would rent their space on Airbnb, VRBO or another home rental site, with only 10% selecting this preference compared with the 12% who said this was an option in 2018.

The number of Millennials this year who said they would co-own with someone who isn’t a partner or spouse declined by half, falling from 14% in 2018 to 7% this year.

Notably, 51% of those surveyed said they would actually turn to one of these strategies to help pay their mortgage – a considerable decline from the 60% who embraced these options as a possibility last year.