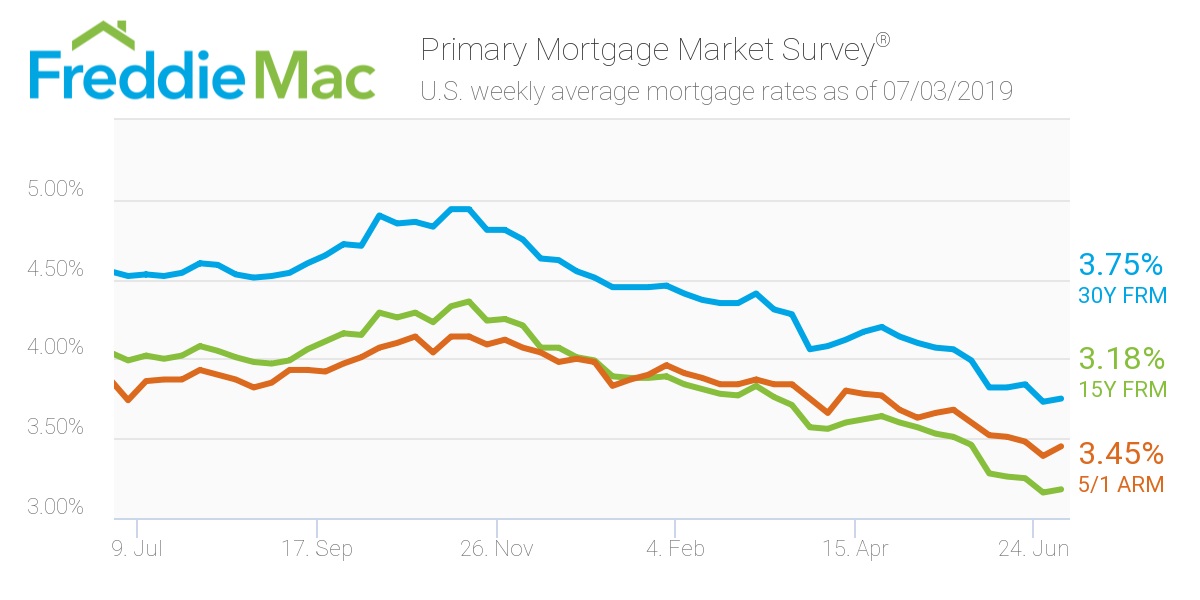

This week, the 30-year fixed-rate mortgage averaged 3.75%, slightly rising from last week’s 3-year low of 3.73%, according to the Freddie Mac Primary Mortgage Market Survey.

Despite this week’s increase, the rate is more than three-quarters of a percentage point lower than a year ago when it averaged 4.52%.

Freddie Mac Chief Economist Sam Khater said the country is experiencing a tug of war as the fixed income market flashes warning signs while the equities market continues to march higher with optimism.

“The data suggests the economy is weakening but is still on very solid ground with high consumer confidence and strong labor market,” Khater said. "Closer to home, the housing market continues to slowly improve and gain momentum as we head into the second half of the year, which is good news and should keep the economy growing.”

The 15-year FRM averaged 3.18% this week, crawling forward from last week’s 3.16%. This time last year, the 15-year FRM came in at 3.99%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.45%, rising from last week’s rate of 3.39%. Once again, this rate is lower than the same time period in 2018 when it averaged 3.74%.

The image below highlights this week's changes: