“I’m going to lead from the front, but I’m going to lead shoulder-to-shoulder with the 10,000 folks here and the 100,000 folks in the industry,” said Freddie Mac CEO David Brickman.

Brickman takes to helm of one of the largest mortgage companies in the U.S. today, and while times at the government-sponsored enterprise are filled with uncertainty, Brickman sees nothing but excitement for the future of Freddie Mac.

Brickman takes to helm of one of the largest mortgage companies in the U.S. today, and while times at the government-sponsored enterprise are filled with uncertainty, Brickman sees nothing but excitement for the future of Freddie Mac.

Brickman is taking over for retiring CEO Donald Layton, known affectionately as Don to his colleagues, who is leaving as one era for the company sunsets, and another era begins.

Layton explained the company has gone through several eras, including just after the financial crisis, from about 2008 to 2012, which was the era of dealing with the foreclosure crisis; the era during Layton’s seven years with the company, from 2012 to 2019, which was the era of reform while in conservatorship.

And now, the former CEO explained, Freddie Mac will move into the era of coming out of conservatorship.

Back in 2012, after having already retired twice, Layton came out of retirement once again to serve as CEO of Freddie Mac.

Layton led E*Trade in 2008 and 2009. During his reign, E*Trade was a top 50 mortgage servicer, with $18 billion worth of mortgages serviced in 2009 and $23 billion in 2008.

He was brought on to the GSE to begin its reformation, and was expected to transform Freddie Mac’s practices and business model. Over the next seven years, that’s exactly what he did.

Early during Layton’s tenure, he asked the company’s acting head of single family what the servicing standards were. The answer? There is an annual survey.

While this shocked Layton, who expected to hear statistics such as, “We answer 90% of phone calls after x  number of seconds, etc.,” he had vowed not to make any changes during his first six months at the company as he watched and waited, learning everything he could.

number of seconds, etc.,” he had vowed not to make any changes during his first six months at the company as he watched and waited, learning everything he could.

Soon, it was time for the results of the one servicing standard – the annual survey.

“Who do you survey?” Layton asked.

“Freddie’s customers,” was the simple reply.

Already, this showed Layton a bias in the results. The third party conducting the survey would never hear from the people that were dissatisfied with the company and didn’t use them.

The presenter continued, showing, on each slide, bar charts. In one, Freddie Mac would be slightly above Fannie Mae, in the next, Fannie Mae beat out Freddie Mac. This dance continued, throughout the presentation – sometimes Freddie lost, sometimes it won against its GSE competitor.

“Do you do any of these surveys for the large banks or insurance companies?” Layton asked after a while.

“Yes,” the survey presenter answered.

“Where are they?” Layton braced himself for the reply.

“Oh, they’re up here,” the presenter pointed to a spot on the bar chart that put the GSEs to shame.

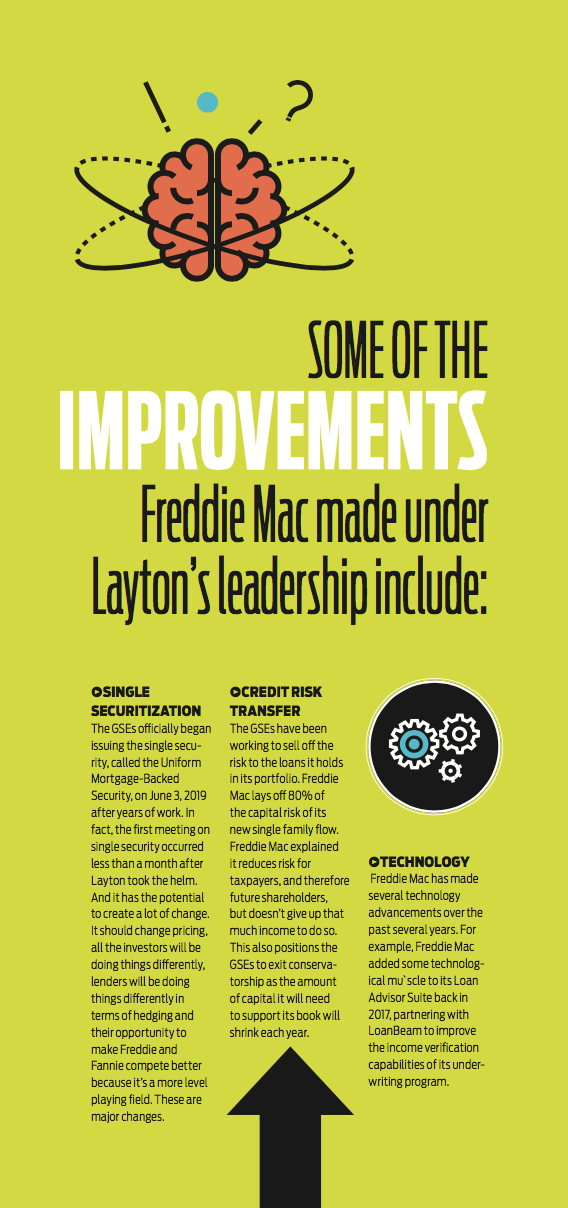

Through the shock at how far behind Freddie Mac had fallen in its quest to simply be better than Fannie, Layton let the impact of that moment steer his direction going forward. He implemented servicing standards. A six-month wait time for certain items turned into days.

Seven years later, Freddie Mac’s bar chart now competes with the big banks.

Foreclosure crisis era

On September 7, 2008, the housing system as we know it changed forever. Then President George W. Bush signed a bailout for Fannie Mae and Freddie Mac after the housing system crashed, placing them into conservatorship under the Federal Housing Finance Agency.

Originally, the U.S. Department of the Treasury bailed out Freddie Mac for $71.3 billion and Fannie Mae for $116.1 billion. Since then, the government-sponsored enterprises have more than paid back their debts to American taxpayers – as of the fourth quarter of 2018, Freddie Mac has paid $116.5 billion back to the Treasury, and Fannie Mae paid made payments totaling $175.8 billion.

But the bailout was just the beginning. In the years that followed, homeowners were either forced to stay in their homes after the values plummeted, or were foreclosed on, starting what is now referred to as the foreclosure crisis.

What’s more, during this time, employees from Freddie Mac lived in uncertainty, not knowing if the company could survive the crash.

“It’s almost like we were an athlete that had a major car accident,” Brickman, who has been with Freddie Mac for more than 20 years, explained. “We were injured, we were rushed to the emergency room and we were in the intensive care unit. It was not clear whether we were going to make it or not.”

“[It] was very much a period of just stabilizing the patient and ensuring that we were able to survive and continue to do some of the basic functions we had,” Brickman said of the foreclosure crisis era.

Transformation era

But the company did make it through. In fact, after it stabilized from the fall, it began to transform.

Brickman explained that when Layton came on the scene, he started retraining the company and transforming it into the Freddie Mac that we see today.

Brickman explained that when Layton came on the scene, he started retraining the company and transforming it into the Freddie Mac that we see today.

“It was really training to be a different kind of institution to transform who we are and become more commercial, focus on running the business in ways that had been less of a focus in the past,” Brickman said.

“You really can’t understate the tremendous impact that Don has had on Freddie Mac,” he said. “He was…the perfect leader for Freddie Mac. He has had such a singular focus transforming the company, making us better, changing, or helping contribute to change in the housing finance system, and he has been dogged about that.”

Layton explained that it is important that while a company is getting bigger, that it also continues to improve, and get better with each expansion. That was his goal at Freddie Mac – to make the company better.

When he began his tenure as CEO, Layton began making sweeping changes throughout the company. He currently has 10 divisions under him as the company is structured. Of those, eight of the leaders were outside hires since he began at the company.

Layton was searching for a competitive edge. Leaders that drove change and innovation. When he didn’t find it, he found someone else who could.

“You can’t do a great job unless you have great people,” Layton said.

In order to be a great leader, Layton explained you have to have a thorough knowledge of your field, you have to be competitive and you have to have a vision.

“I had a vision,” he said. “And the vision was a well-managed FI…and it means competitive and aggressive with the customers you do business and high service standards and technology, you upgrade the technology.

But now, Layton is leaving the transformed company, and retiring for a third (and final?) time.

From here, he will stay busy and involved in the housing industry by engaging in nonprofits, corporate boards and a think tank. Through the think tank he will write and speak about topics in housing finance.

“One of the problems I’ve noticed in conservatorship, there’s a giant knowledge gap between what we in the conservatorship know is going on and the changes made and how things work and the outside world’s knowledge,” Layton said. “I’m not quite sure why, but it just doesn’t seem to get out there adequately, so people are just unaware of what changes have been made and how things work because the communication is not there.”

But Layton intends on changing that, saying starting July 1st, he will have no more rules on what he can and can’t say.

“I don’t think people, even in the housing system, understand how the housing system really works in terms of not the theory but the real- what’s efficient, what’s not, where the subsidies are, where they’re not,” he said.

Leaving conservatorship era

As the sun sets on Layton and his transformation era at Freddie Mac, a new dawn is beginning for Brickman as he sets new goals for the company’s next era: leaving conservatorship.

Brickman is not new to the company, serving there more than 20 years and even consulting for Freddie Mac before he was employed there, which gave him an in-depth perspective of many areas of the company.

Brickman started his career at Freddie Mac as a senior economist in the financial research area. He has worked his way through the organization, through the different levels, different sets of responsibilities and even different parts of the organization.

For the past few years since the Great Recession , Brickman has run the GSE’s multifamily business.

, Brickman has run the GSE’s multifamily business.

While the rest of the leaders at Freddie Mac focused on improving various parts of Freddie Mac’s single-family business, Brickman quietly worked on the multifamily business with much less restrictions from the FHFA.

“The whole housing finance policy tends to be on single family, and he [Brickman] went and did it on his own as a different business model in multifamily starting four years earlier than I did, before I got here,” Layton said. “Multifamily was sort of left alone by the policy conservatorship stuff, so he could actually change the business model in very forward looking ways without being interfered unduly.”

Multifamily saw significant growth under Brickman’s watch.

“We were able to watch that transformation which also accompanied, not coincidently, significant growth from about 300-some odd people when I’d just joined to over 1,000 people in that line of business today,” he said.

But now, Brickman will use his time running multifamily as a guide to steer him as he takes the helm in this new era.

And while Brickman doesn’t think the rest of Freddie Mac will need the same level of transformation that he oversaw in the multifamily division, he hopes to utilize his experience managing through change.

As Freddie Mac enters the end of conservatorship era, it comes with a lot of uncertainty surrounding the future of the company, but Brickman is ready for the challenge.

“I think that’s what makes it exciting and makes it a great time to be at the helm of Freddie Mac,” he said. “I think there’s a lot of people who can get concerned and worried about what the outcome of the process might be and I’m going to reassure them.”

Brickman said it is important during this time to focus on the company’s role functionally and economically, and less in terms of organizationally or what the corporate structure is.

“It’s an exciting opportunity to help demonstrate that we are a transformed company,” Brickman said. “There’s nothing that the employees of Freddie Mac would like better than to be able to compete and be able to innovate in a less constrained manner and to return to private ownership and the ability to be judged by the markets in terms of our actual performance.”

Brickman is prepared to turn uncertainty into opportunity. To push competitiveness in the company. To, as Brickman said, be judged by the market.

Brickman is prepared to turn uncertainty into opportunity. To push competitiveness in the company. To, as Brickman said, be judged by the market.

“We think we’re ready for it, we think we’re up for the challenge,” he said.

And the opportunity to prove themselves could be coming sooner rather than later.

FHFA Director Mark Calabria continues to drive talks on housing finance reform, saying the status quo isn’t an option.

At the Mortgage Bankers Association Secondary conference in New York City at the end of May, Calabria emphasized that the time for housing finance reform was now, while the economy and the housing market are strong. Calabria said he is awaiting a report from President Donald Trump, which will help him develop a roadmap for reform.

He said he anticipates collaborating with the Treasury Department and working with Congress, but, “the centerpiece of this plan has to be a strategy to end conservatorship of Fannie and Freddie. I want to move to a new reform structure, one that’s more competitive and works for taxpayers and supports financial stability.”

“I just hope they build on the positive change and keep it going, rather than starting differently and making new mistakes,” Layton said.

New leader, new focus

Not only is Freddie Mac entering a new era, but a new leader is also taking the helm. And Brickman brings his own views, values and mission to the company.

Brickman notes that one of the key changes he will look to instill is greater efficiency.

“We’re a large company, we touch trillions of dollars, but I hold out the hope that perhaps there is opportunity and perhaps changes that might occur in terms of our structure might enable us,” the new CEO stated. “That we could focus a little more on execution, on driving change a little faster.”

“I don’t know that we’re ever going to be Silicon Valley and a tech firm that’s spinning new products out every week, but I’d like to see us be a little more agile in terms of our ability to do new things and drive change and bring new ideas to market,” he continued.

Brickman also said he would like to place more focus on the affordable housing market and perhaps more in the rental housing market.

“I think there are even more challenges on the affordable housing side,” he said. “So rental housing does tend to be where more low- and moderate-income Americans reside and where they look to for housing, and if that’s where the problem is most acute, then there’s probably more opportunity for us to contribute.”

Currently, the FHFA puts loan production caps on each of the GSE’s multifamily business to further the goal of maintaining multifamily activities while not impeding on the participation of private capital.

However, the FHFA designed exclusions from the cap to support affordable and underserved multifamily segments of the multifamily market, saying these segments are not being adequately served by the private sector.

Even outside of conservatorship, Fred die Mac could continue to serve this sector as it fills the gaps not being served already.

die Mac could continue to serve this sector as it fills the gaps not being served already.

While there are many changes coming, Brickman also pointed out there are things about the company that he loves and hopes to maintain during his tenure. After 20 years at the company, he saw many ups and downs, many leadership changes, entering conservatorship and now, perhaps soon, exiting it, but through it all there he said the essence of the company has remained the same.

“We have great culture,” he said. “It drives it from our mission, a little bit. We are focused on serving the housing market, we’re focused on driving innovation, we’re focused on being thoughtful about what we do.”

“It’s a powerful thing as a business when you know there is no other market I can go into,” he said. “There’s no credit card trading or auto loans or foreign exchange or money management, we’re just in housing, not going anywhere, so we’ve got to be good at that.”

Freddie Mac will continue to innovate, transform and adopt to its coming changes as housing finance reform looks to become a real possibility in the near future. And as it continues on its journey, Brickman is ready, saying it’s an exciting time to be at the helm.