Most Americans have seen their disposable income spike thanks to 2017’s Tax Cuts and Jobs Act, and this could provide a sizable boost to homeownership, researchers say.

Last year, the savings amounted to renters paying $2,716 less in taxes, and homeowners paying $1,508 less, according to researchers at John Burns Real Estate Consulting.

How might this affect housing?

The researchers say that the savings will drive some renters toward ownership, spurring more entry-level home buying across the country.

“Renters who have been saving to purchase have gotten some help with their endeavor, and we will see more of them purchase homes in 2019 and beyond,” they say, noting that this will spur more activity in the entry-level home market.

“Many of our home builder clients have already pivoted to offering more attainable price points to meet pent-up demand,” they add. “Homeowners buying at these prices points haven’t benefited from housing tax policy in years.”

Of course, not all homeowners have been equally affected by the new tax laws.

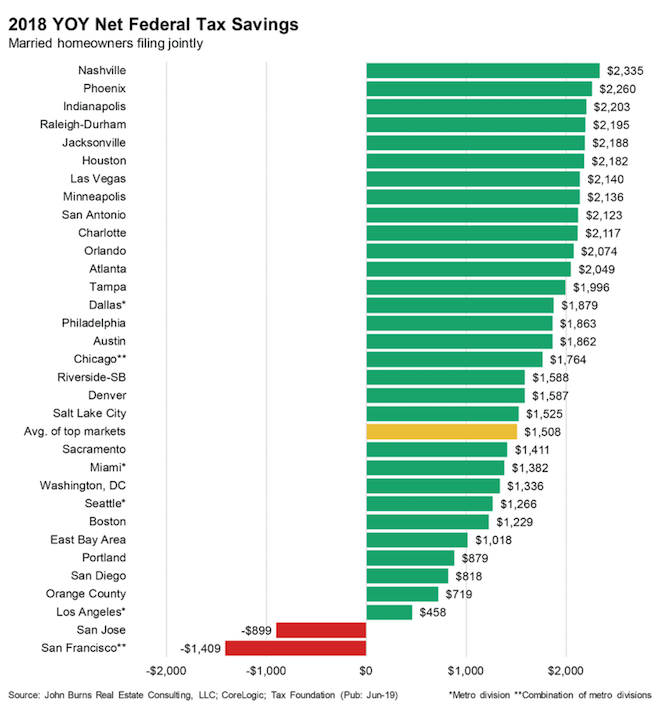

Consistent with reports that luxury markets have suffered negative consequences from the tax laws, the researchers' analysis shows that those living in more expensive markets, like San Jose and San Francisco, are actually paying more in taxes.

And, in other parts of the country, like Nashville, some homeowners are reaping more savings, paying an average of $2,335 less in taxes.

The researchers say that the laws could encourage people to move South and settle in these less expensive markets.

“More homeowners in expensive areas who were considering renting or moving to more affordable areas are more likely to do so now,” they state. “Low-tax states should continue to see in-migration and strong housing demand while outmigration accelerates in California, New York, New Jersey and Illinois. The TCJA did not create these trends but has amplified them.”

Here’s where married homeowners filing jointly saved the most:

(Image courtesy of John Burns Real Estate Consulting; click to enlarge.)