Morningstar Credit Ratings announced today that it has entered into an agreement to acquire DBRS – the fourth-largest credit ratings agency in the world – in a $669 million deal.

Morningstar said the merger will expand its global asset coverage and provide its investors with an enhanced platform for fixed-income analysis and research. Combined, the two companies will become the largest ratings agency for U.S. mortgage bonds.

DBRS rates more than 2,400 issuer families and nearly 50,000 securities across Europe, the U.S. and Canada, and it promises to provide a serious boost to Morningstar’s business. Morningstar said if it owned DBRS from the start of the year, it would have already enhanced its total annual revenue by 17%.

“The chance to empower investors with the independent research and opinions they need across a multitude of securities first drove our decision to enter the credit ratings business,” said Morningstar CEO Kunal Kapoor.

“DBRS and Morningstar share research-centric cultures committed to rigor and independence,” Kapoor continued. “Together, we believe we can elevate the industry with the world’s first fintech ratings agency backed by state-of-the-art models, modern technology, and expert research teams that issuers and investors can count on to deliver transparent and independent ratings.”

Morningstar first began publishing credit ratings on public companies that were not part of the Nationally Recognized Statistical Rating Organization (or NRSRO) in 2009, and in 2010 it built its NRSRO portfolio, added a specialty in commercial mortgage-backed securities, with the acquisition of Realpoint.

Since then, it has expanded its credit ratings to include residential mortgage-backed securities, agency risk transfers, single-family rentals, asset-backed securities, collateralized loan obligations corporate securities, financial institutions and real estate investment trusts, according to the company.

In a letter to employees, Kapoor said the acquisition of DBRS will round out its fixed-income product portfolio in the U.S. market by bringing to the table its leadership in asset-backed securities and financial institution ratings.

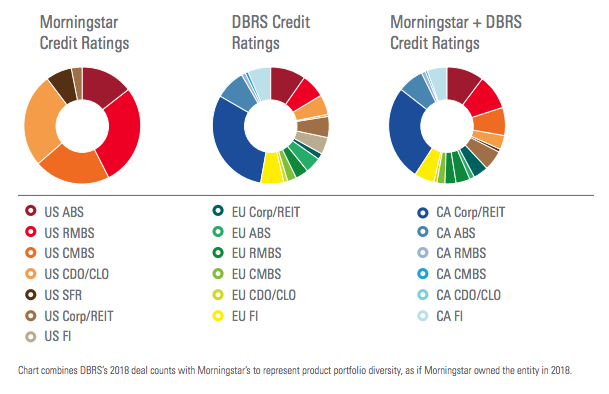

"The combination represents minimal product overlap in only four U.S. categories: commercial mortgage-backed securities (CMBS) single-asset/single-borrower; CMBS conduit; residential mortgage-backed securities (RMBS) agency; and RMBS non-qualified mortgage (Non-QM)," Kapoor said in his letter, which included the chart below illustrating how the acquisition would diversify Morningstar's business (click to enlarge).

"DBRS’s more than 40 years of experience and success coupled with Morningstar’s proven capabilities will offer an even stronger global alternative to larger ratings agencies," added DBRS CEO Stephen Joynt. "Both DBRS and Morningstar are driven by similar core values that aim to bring more clarity, diversity, transparency, and responsiveness to the ratings process, which makes Morningstar a perfect fit for us."

"DBRS’s more than 40 years of experience and success coupled with Morningstar’s proven capabilities will offer an even stronger global alternative to larger ratings agencies," added DBRS CEO Stephen Joynt. "Both DBRS and Morningstar are driven by similar core values that aim to bring more clarity, diversity, transparency, and responsiveness to the ratings process, which makes Morningstar a perfect fit for us."

Under the new deal, DBRS’s 500+ employees working seven locations and will continue to operate under its existing management team. Morningstar the companies will work together on their integration and that it plans to appoint a leader of the combined businesses by the time the deal closes.

Morningstar said it plans to fund the deal with a mix of cash and debt, which will include the placement of a new credit facility at closing. The deal expected to close pending regulatory approval in the third quarter of 2019.