Last week, the share of borrowers with rates under 4.25% ticked up.

In fact, LendingTree's Mortgage Rate Competition Index indicates borrowers with rates under 4.25% increased to more than 36% for the week ending April 19, 2019.

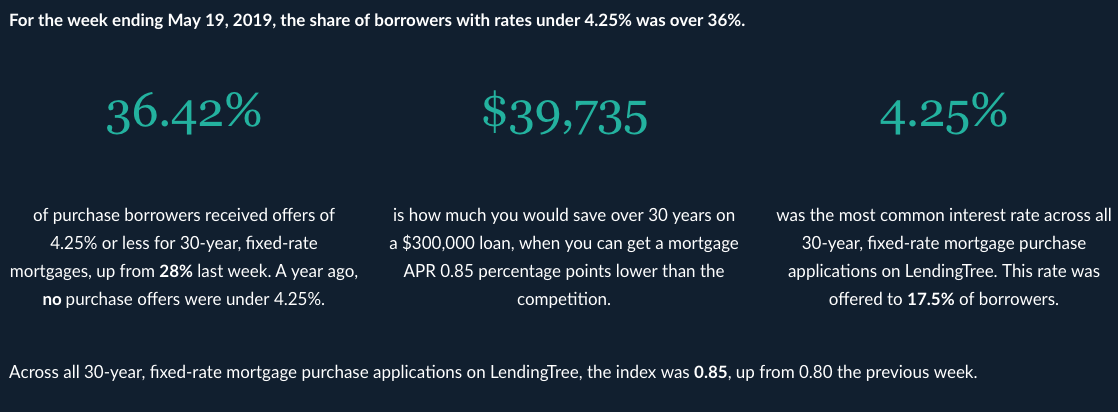

The report states that for 30-year fixed-rate mortgages, 36.42% of purchase borrowers received offers under 4.25%, rising from 28% last week. At this time last year, no purchase offers were under 4.25%

(Click to enlarge; Source: LendingTree)

Additionally, the report highlights that across all 30-year, fixed-rate mortgage purchase applications made on LendingTree’s website, 17.5% of borrowers were offered an interest rate of 4.25%, making it the most common interest rate.

When it came to 30-year fixed-rate mortgage refinance borrowers, 42.9% received offers under 4.25%, climbing from 32.3% one week prior. Once again, not a single purchase offer fell under this rate during this time in 2018.

Notably, across all 30-year, fixed-rate mortgage refinance applications, the most common interest rate was 4.25%. This rate was offered to 19.9% of borrowers, according to the report.

Lastly, LendingTree reports that across all 30-year fixed-rate mortgage purchase applications on its site, the index edged up five basis points from the previous week, coming in at 0.85. This means that over 30 years, the average borrower could save $39,735 on a $300,000 loan.

So, with a wider refinance market index of 0.96, the typical refinance borrowers could have saved $45,192 by shopping for the lowest rate.

NOTE: The LendingTree Mortgage Rate Competition Index measures the spread in the APR of the best offers available on its website.