With a homeownership rate of 64.2%, it’s safe to say the American dream of homeownership is alive and well. However, lackluster growth in the sector suggests the market might be turning, especially as affordability remains a top concern.

In a recent analysis, LendingTree surveyed 2,095 American homeowners aged 22 and older about their perceptions of owning a property versus renting.

According to the company’s study, 67% of American homeowners believe owning a home is a better option than renting. However, LendingTree discovered that for many American homeowners, renting is still a viable option.

“About 15% of homeowners believe renting is easier than owning a home, and another 18% are neutral on the topic,” LendingTree writes. “Just 13% of homeowners across all ages wish they could go back to renting, but when broken down by age, 1 out of every 5 homeowners ages 22 to 37 say they miss renting.”

Interestingly, LendingTree says this breakdown is highly dependent on the number of years a homeowner has lived in their home.

“In most cases, the longer that survey respondents have been in their homes, the more likely they are to believe owning is easier,” LendingTree writes. “That changes for those who have owned for a decade or longer. Nearly 72% of homeowners who have spent seven to nine years in their home agree with the statement, compared with 65% of those with at least 10 years in their home.”

Additionally, the report found that age also plays a major role in homeowner satisfaction.

According to the study, 23% of Gen Xers claimed to be dissatisfied with their home purchases, this was followed by 21% of Millennials who expressed the same sentiment.

When it came to Baby Boomers and those aged 73 and older, LendingTree reports that only 14% and 3% held the same regrets, respectively.

Overall, the study revealed that homeownership tenure is a tremendous indication of whether or not a person is likely to return to the rental market.

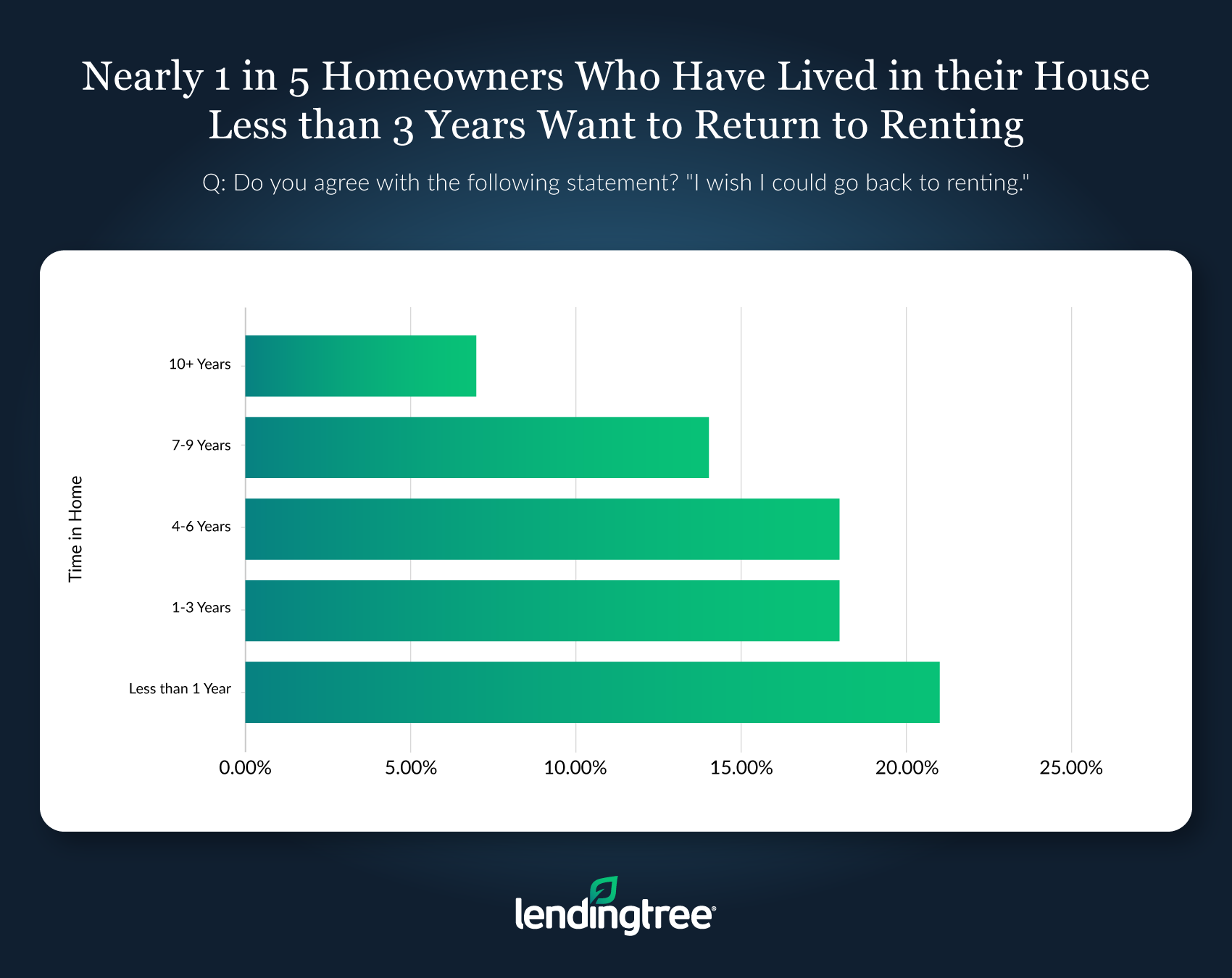

“Our survey found that the longer you own your home, the less likely you’ll want to rent again,” LendingTree writes. “Only 7% of respondents who have owned their home for at least 10 years wish they could go back to renting, compared with 19% of those who have owned for three years or less.”

The image below highlights the percentage of Americans who wish to return to renting after owning a home:

(Click to enlarge)

Note: LendingTree commissioned Qualtrics to collect the responses of 2,095 American homeowners aged 22 and older from the dates of March 22-27, 2019.