Millennial homebuyers are projected to purchase at least 10 million homes within the next 10 years. But how will this debt-heavy generation afford housing in a market that’s already priced out the wealthiest?

Real estate brokerage company Redfin claims it’ll be the old-fashioned way.

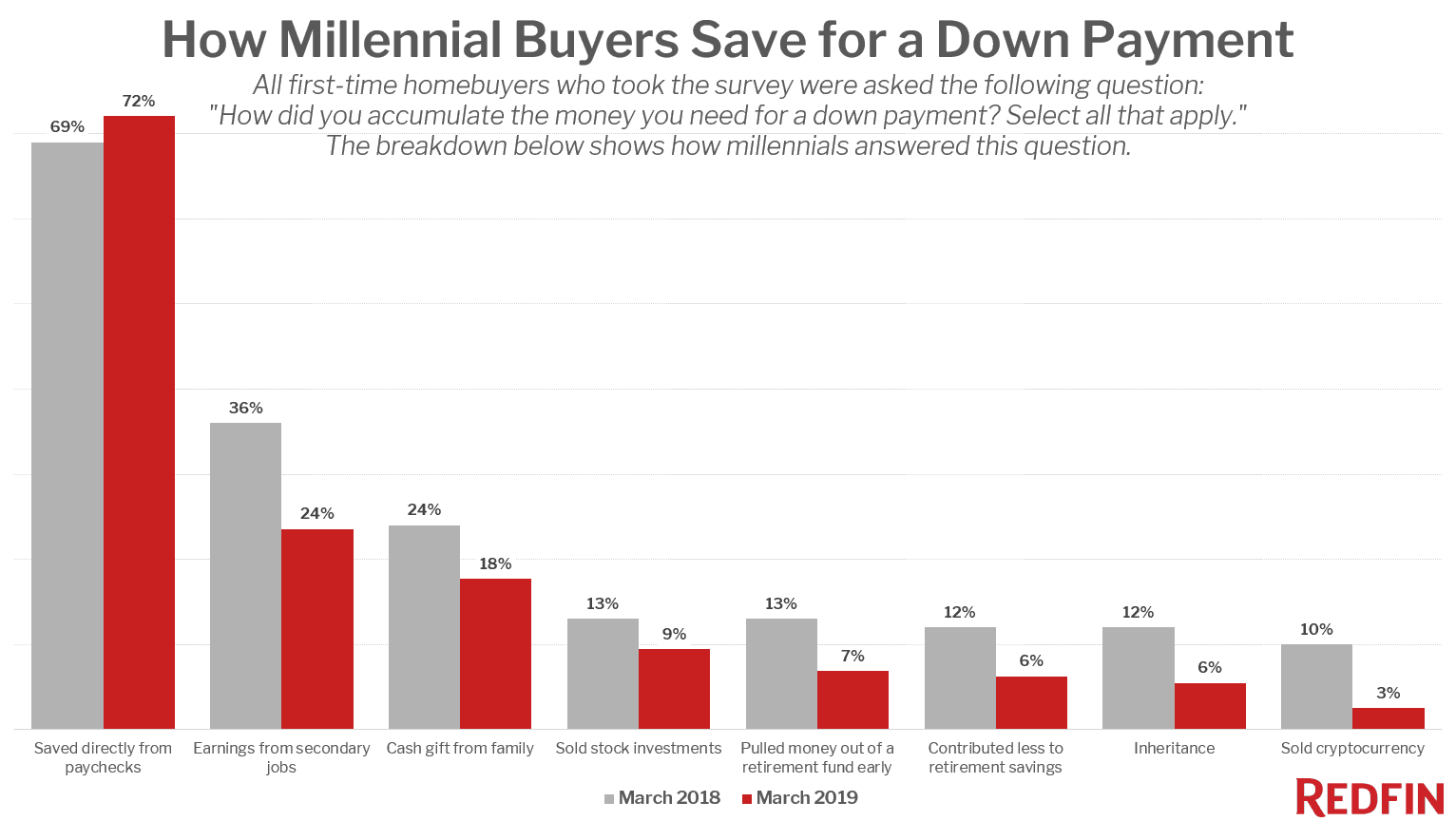

According to the company’s recent survey, 72% of Millennial homebuyers say they are funding home down payments with money saved from their paychecks.

This is because the generation’s buying power has strengthened as their income levels have risen, according to Redfin.

“The combination of strong wages and the housing market stalling late last year means that more buyers are able to save for their down payment using their primary income alone,” Redfin writes.

And the company is right as the most recent Employment Situation Summary report indicated that America’s average hourly earnings have risen by 3.2% over the last year.

Additionally, the latest Gross Domestic Product report revealed real GDP rose at an annual rate of 3.2% in the first quarter of 2019, demonstrating America’s economic vigor.

“Unemployment is at its lowest point since 2000,” Redfin Chief Economist Daryl Fairweather said. “Millennials have never worked in an economy this strong before and are now finally making enough from their paychecks to save for a home. The fact that they are less often needing to rely on family members or sacrificing retirement savings to fund a home purchase is another sign that Millennials are finally gaining their financial footing.”

Interestingly, Redfin’s survey also determined that although saving is the most common payment plan, 3% of Millennials have used cryptocurrency to fund their down payments. Not only has this percentage fallen from last year’s 10%, but it also sits behind the 24% of Millennials that have taken second jobs to fit the bill.

The image below highlights the different ways Millennials save for down payments:

NOTE: Redfin’s report is based on the survey responses of more than 500 Millennial respondents.