The majority of middle-income seniors will not have enough money to cover essential living and medical expenses a decade from now, according to a recent study by researchers at the University of Chicago.

This group, which will soar to 14.4 million by 2029, desperately needs policy solutions to help them navigate expenses as they age, the study states.

But for some, home equity could alleviate the stress, researchers found.

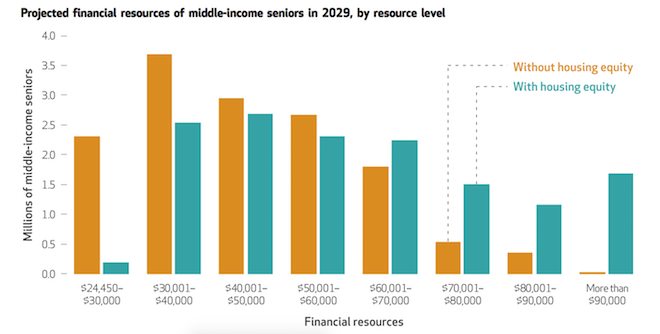

The researchers found that 81% of middle-income seniors will have an annual income – which includes annuitized assets – of $60,000 or less. This is below the $62,000 the researchers project will be needed to pay for assisted living rent and out-of-pocket medical expenses 10 years from now.

But, if seniors were to draw upon their home equity to supplement existing income, only 54% of this same group would fall short of the threshold. (See the chart below for a breakdown of financial resources for those with and without home equity.)

But the researchers note a general reluctance among the older generation to tap into their home equity, even though it might alleviate their financial struggle.

“Many seniors treat housing equity differently from other financial resources and attempt to liquidate other income and assets before liquidating the equity,” the study notes. “Such housing equity may be the family home that some older adults keep as a nest egg to protect against future, unexpected financial hardship or wish to preserve for their children.”

And, as they point out, more than half of middle-income seniors would still not have enough to cover expenses even if they did utilize their equity.

“As our results show, a large and growing cohort of middle-income seniors will have a gap between their housing and care needs and the financial resources to meet those needs, given today’s seniors housing options,” the study states.

“Creating and financing those solutions will require innovation from public and private stakeholders to bring more affordable seniors housing options to the market and to enable people at all income levels to access the care they need and want as they age,” they concluded.

Bob Kramer, founder of the National Investment Center for Seniors Housing & Care, which helped finance the study, said the findings are a wake-up call.

“We still have a lot to learn about what the emerging ‘middle market’ wants from housing and personal care, but we know they don’t want to be forced to spend down into poverty, and we know that America cannot currently meet their needs,” said Kramer. “The future requires developing affordable housing and care options for middle-income seniors. This is a wake-up call to policymakers, real estate operators and investors.”